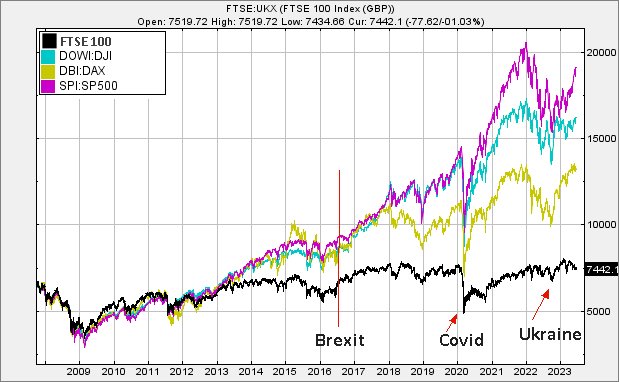

#Stoxx50 #Japan Wednesday proved a day of revelations, featuring The Spice Girls and Jean Claude Van Damme! Firstly, there was the realisation The Spice Girls were responsible for the FTSE’s lack of performance since 2012. If they hadn’t performed at the London Olympics, goodness knows how different the world would be. But the chart shows the damage enacted by the superbly talented girl group, the country failing to recover from the brief recession which caused so much damage in 2012.

Our reason for the chart was a little less interesting. People keep searching for blame to account for the UK markets terrible performance, Brexit obviously being one of the popular candidates. Unfortunately, the writing was on the wall long before this point in history and to be concise, the UK failed produce any form of lasting recovery from the financial crash of 2009. The situation now appears to be; no matter what is thrown at the UK, the markets fail to respond, instead remaining in a cycle of misery more suited to a TV soap such as East Enders. When viewed against the performance of Wall St, Germany, or the S&P 500, the FTSE becomes a positive embarrassment – neatly reminding us of The Spice Girls doing the Olympics.

As for Jean Claude Van Damme (JCVD), the discovery he was hired to act the role of “Predator” in the film of the same name gave an excuse to review a share we glanced at just a few weeks ago. JCVD abandoned the roll of being a 7 foot tall kick boxing monster, when he discovered he was required to wear stilts, risking very real damage to his person. He left the job, the studio finding someone who was actually the correct height to fit the suit, and the rest is history. In our opinion, it was a fun action movie and JCVD even got to make a cameo appearance in the closing scene, flying a helicopter to the rescue.

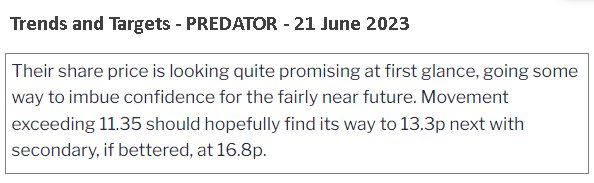

Predator’ share price managed to achieve our secondary target, even exceeding it slightly to 16.87p. More importantly, it also closed a session above 15.5p, creating a situation where we should be optimistic for further gains in the future. For no reason other than a wish for things to be tied up in a pretty bow, we wish the share price had closed above 15.5p on the same day it so precisely achieved our target of 16.8p. Instead, it closed at 13.85p and we cannot logically spot a reason for this.

Instead, in an effort to fall down a rabbit hole of numbers, the situation now exists where our software demands the share price close above 16.6p before it will be impressed, triggering further oomph toward 21p with secondary, if beaten, at 23.6p and a new all time high. If attempting to measure immediate strength, intraday traffic near term above 16.9p should trigger an attempt at 19 and if this is exceeded, there’s a strong possibility movement of strength is under way.

If things intend go wrong for Predator, below 13p looks capable of ringing alarm bells, suggesting a drip down to an initial 10p and a need for us to revisit all the numbers!

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 11:14:51PM | BRENT | 7646 | ‘cess | ||||||||

| 11:21:36PM | GOLD | 1917.12 | Shambles | ||||||||

| 11:27:46PM | FTSE | 7437.7 | Success | ||||||||

| 11:43:34PM | STOX50 | 4345.5 | 4341 | 4323 | 4291 | 4365 | 4384 | 4388 | 4404 | 4355 | Success |

| 11:45:38PM | GERMANY | 15907.7 | Success | ||||||||

| 11:48:13PM | US500 | 4444.1 | ‘cess | ||||||||

| 11:52:08PM | DOW | 34251 | Success | ||||||||

| 11:54:25PM | NASDAQ | 15195.3 | ‘cess | ||||||||

| 11:57:24PM | JAPAN | 33062 | 32910 | 32832 | 32502 | 33155 | 33381 | 33499 | 33671 | 33204 |

5/07/2023 FTSE Closed at 7442 points. Change of -1.02%. Total value traded through LSE was: £ 5,170,439,166 a change of 50.69%

4/07/2023 FTSE Closed at 7519 points. Change of -0.11%. Total value traded through LSE was: £ 3,431,263,448 a change of -36.49%

3/07/2023 FTSE Closed at 7527 points. Change of -0.05%. Total value traded through LSE was: £ 5,402,403,715 a change of 3.4%

30/06/2023 FTSE Closed at 7531 points. Change of 0.8%. Total value traded through LSE was: £ 5,224,612,707 a change of -11.43%

29/06/2023 FTSE Closed at 7471 points. Change of -0.39%. Total value traded through LSE was: £ 5,898,729,234 a change of 13.7%

28/06/2023 FTSE Closed at 7500 points. Change of 0.52%. Total value traded through LSE was: £ 5,188,003,612 a change of 2.29%

27/06/2023 FTSE Closed at 7461 points. Change of 0.11%. Total value traded through LSE was: £ 5,071,918,393 a change of 6.71%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:CCL Carnival** **LSE:ECO ECO (Atlantic) O & G** **LSE:IGG IG Group** **LSE:OCDO Ocado Plc** **LSE:TERN Tern Plc** **

********

Updated charts published on : Carnival, ECO (Atlantic) O & G, IG Group, Ocado Plc, Tern Plc,

LSE:CCL Carnival. Close Mid-Price: 1351.5 Percentage Change: + 0.00% Day High: 1376.5 Day Low: 1313

In the event of Carnival enjoying further trades beyond 1376.5, the share ……..

</p

View Previous Carnival & Big Picture ***

LSE:ECO ECO (Atlantic) O & G. Close Mid-Price: 14.5 Percentage Change: + 0.69% Day High: 15.38 Day Low: 14.12

It’s now the case of below 13.75 suggesting the potential of reversal to a ……..

</p

View Previous ECO (Atlantic) O & G & Big Picture ***

LSE:IGG IG Group Close Mid-Price: 652.5 Percentage Change: -1.88% Day High: 663 Day Low: 652.5

Continued weakness against IGG taking the price below 652.5 calculates as ……..

</p

View Previous IG Group & Big Picture ***

LSE:OCDO Ocado Plc Close Mid-Price: 573.4 Percentage Change: -6.79% Day High: 609 Day Low: 570.8

This is slightly interesting as the share seems to have the potential for ……..

</p

View Previous Ocado Plc & Big Picture ***

LSE:TERN Tern Plc. Close Mid-Price: 4 Percentage Change: + 0.00% Day High: 4 Day Low: 3.75

Now below 3.75 indicates the potential of a visit to 3p next with secondar ……..

</p

View Previous Tern Plc & Big Picture ***