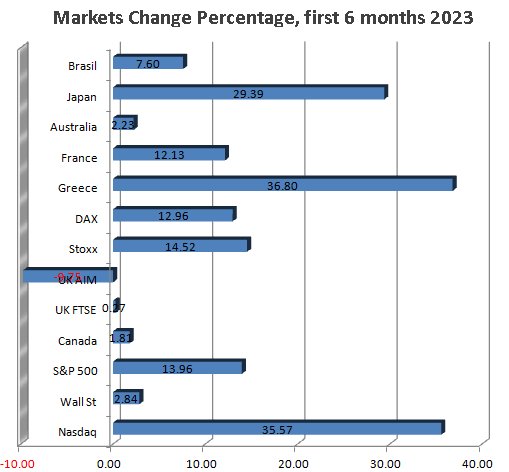

#FTSE #GOLD Historically, we’re always a little grouchy about the FTSE, suspecting it’s a 3 legged donkey competing in a thoroughbred horse race. As the first six months of the year are upon us, it seemed worthwhile to compare the UK to other major world markets. With just a single session to go before the end of June, the FTSE is up just 0.27% this year, making it the worst performing of the major indices. We include the UK AIM market (down 9.75%), just because we can…

As for the FTSE near term, we’ve just about grown out of any optimistic tendencies as the UK is literally proving it’s as bad as it gets. With the index continuing to explore the depths below the Blue downtrend since 2018, our inclination is to anticipate further reversals in the period ahead, hopefully with the index eventually discovering a bottom around 7200 points and a meeting with the uptrend since 2020. In the event a serious reversal is coming near term, below 7406 points looks capable of triggering reversal to an initial 4379 points with our secondary, if the initial breaks, calculating down at 7326 points and a possible bounce (of sorts).

If triggered, the tightest stop loss position looks like a reasonable 7446 points.

Our converse scenario, if the final trading day intends produce wine and roses, allows above 7516 points to make a leap in the direction of 7554 points. Our secondary, should such a price level be exceeded, works out at 7587 points and some possible hesitation.

Have a good weekend and enjoy the Grand Prix.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:01:13PM | BRENT | 74.42 | 73.56 | 72.92 | 74.55 | 75.14 | 75.62 | 74.2 | Success | ||

| 10:03:40PM | GOLD | 1907.66 | 1892 | 1856 | 1913 | 1913 | 1919 | 1905 | |||

| 10:07:00PM | FTSE | 7485.6 | 7458 | 7445 | 7484 | 7514 | 7537 | 7482 | ‘cess | ||

| 10:09:35PM | STOX50 | 4359.8 | 4339 | 4329 | 4352 | 4371 | 4376 | 4349 | |||

| 10:12:34PM | GERMANY | 15957.5 | 15918 | 15894 | 15965 | 15999 | 16047 | 15931 | |||

| 10:14:29PM | US500 | 4396.9 | 4369 | 4363 | 4389 | 4399 | 4411 | 4369 | |||

| 10:16:48PM | DOW | 34093.5 | 33811 | 33688 | 33983 | 34130 | 34154 | 34012 | ‘cess | ||

| 10:18:58PM | NASDAQ | 14949.9 | 14869 | 14836 | 14942 | 15000 | 15037 | 14949 | |||

| 10:21:18PM | JAPAN | 33157 | 33096 | 32970 | 33232 | 33396 | 33438 | 33229 | ‘cess |

29/06/2023 FTSE Closed at 7471 points. Change of -0.39%. Total value traded through LSE was: £ 5,898,729,234 a change of 13.7%

28/06/2023 FTSE Closed at 7500 points. Change of 0.52%. Total value traded through LSE was: £ 5,188,003,612 a change of 2.29%

27/06/2023 FTSE Closed at 7461 points. Change of 0.11%. Total value traded through LSE was: £ 5,071,918,393 a change of 6.71%

26/06/2023 FTSE Closed at 7453 points. Change of -0.11%. Total value traded through LSE was: £ 4,753,007,649 a change of 17.78%

23/06/2023 FTSE Closed at 7461 points. Change of -0.55%. Total value traded through LSE was: £ 4,035,557,775 a change of -15.52%

22/06/2023 FTSE Closed at 7502 points. Change of -0.75%. Total value traded through LSE was: £ 4,777,191,347 a change of 6.91%

21/06/2023 FTSE Closed at 7559 points. Change of -0.13%. Total value traded through LSE was: £ 4,468,515,731 a change of -18.02%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AFC AFC Energy** **LSE:CBX Cellular Goods** **LSE:CCL Carnival** **LSE:CEY Centamin** **LSE:ECO ECO (Atlantic) O & G** **LSE:EME Empyrean** **LSE:FRES Fresnillo** **LSE:GKP Gulf Keystone** **LSE:NG. National Glib** **LSE:QED Quadrise** **LSE:SPT Spirent Comms** **LSE:SRP Serco** **

********

Updated charts published on : AFC Energy, Cellular Goods, Carnival, Centamin, ECO (Atlantic) O & G, Empyrean, Fresnillo, Gulf Keystone, National Glib, Quadrise, Spirent Comms, Serco,

LSE:AFC AFC Energy Close Mid-Price: 12.74 Percentage Change: -2.00% Day High: 13.38 Day Low: 12.66

Target met. In the event AFC Energy experiences weakness below 12.66 it c ……..

</p

View Previous AFC Energy & Big Picture ***

LSE:CBX Cellular Goods Close Mid-Price: 0.8 Percentage Change: -3.03% Day High: 0.82 Day Low: 0.8

In the event Cellular Goods experiences weakness below 0.8 it calculates ……..

</p

View Previous Cellular Goods & Big Picture ***

LSE:CCL Carnival. Close Mid-Price: 1228 Percentage Change: + 0.74% Day High: 1258 Day Low: 1198

In the event of Carnival enjoying further trades beyond 1258, the share s ……..

</p

View Previous Carnival & Big Picture ***

LSE:CEY Centamin. Close Mid-Price: 89.55 Percentage Change: + 0.56% Day High: 89.65 Day Low: 87.6

If Centamin experiences continued weakness below 87.6, it will invariably ……..

</p

View Previous Centamin & Big Picture ***

LSE:ECO ECO (Atlantic) O & G Close Mid-Price: 14.5 Percentage Change: -5.84% Day High: 15.25 Day Low: 14.5

Weakness on ECO (Atlantic) O & G below 14.5 will invariably lead to 9.6p ……..

</p

View Previous ECO (Atlantic) O & G & Big Picture ***

LSE:EME Empyrean Close Mid-Price: 0.76 Percentage Change: -1.92% Day High: 0.78 Day Low: 0.74

Continued weakness against EME taking the price below 0.74 calculates as ……..

</p

View Previous Empyrean & Big Picture ***

LSE:FRES Fresnillo Close Mid-Price: 597.4 Percentage Change: -0.60% Day High: 606.6 Day Low: 589.6

Target met. Continued weakness against FRES taking the price below 589.6 ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:GKP Gulf Keystone Close Mid-Price: 114.7 Percentage Change: -1.29% Day High: 119.3 Day Low: 111.8

If Gulf Keystone experiences continued weakness below 111.8, it will inva ……..

</p

View Previous Gulf Keystone & Big Picture ***

LSE:NG. National Glib Close Mid-Price: 1038 Percentage Change: -0.91% Day High: 1050.5 Day Low: 1027.5

If National Glib experiences continued weakness below 1027.5, it will inv ……..

</p

View Previous National Glib & Big Picture ***

LSE:QED Quadrise. Close Mid-Price: 2.15 Percentage Change: + 1.18% Day High: 2.3 Day Low: 2.1

Target met. In the event of Quadrise enjoying further trades beyond 2.3, ……..

</p

View Previous Quadrise & Big Picture ***

LSE:SPT Spirent Comms Close Mid-Price: 162.7 Percentage Change: -2.57% Day High: 168.2 Day Low: 162.6

Continued weakness against SPT taking the price below 162.6 calculates as ……..

</p

View Previous Spirent Comms & Big Picture ***

LSE:SRP Serco. Close Mid-Price: 154.5 Percentage Change: + 8.57% Day High: 160.7 Day Low: 148

Continued trades against SRP with a mid-price ABOVE 160.7 should improve ……..

</p

View Previous Serco & Big Picture ***