#Gold #US500 With the sometimes superb Austrian Grand Prix just a few days away, it’d be churlish not to spend some time reviewing Astons share price. Their race time is probably only doing half as well as it should, the car driven by a major Aston Martin investor’s son (Lance Stroll) only achieving 1/3 of the race points gained by his team-mate. However, despite Stroll Jnr often looking like he should be practicing in an empty supermarket car park, the team are placed 3rd in the Constructors championship and would almost certainly be 2nd, if Stroll would remember the need to actually finish a race. Ideally, behind his team-mate who’s in an identical car!

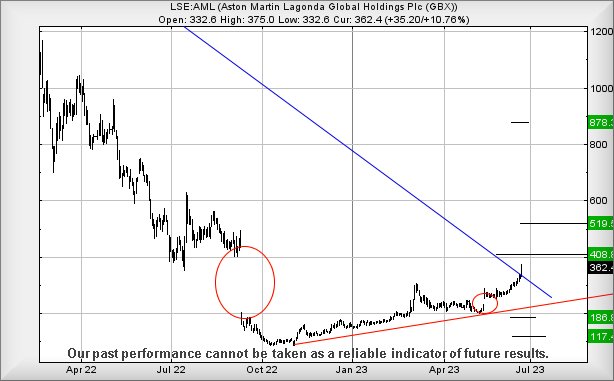

The company share price has suffered a complicated time since 2021 and is finally showing some attempts to break free upwards yet again. One of our favourite indicators for the potential of strong gains is the classic GaGa, a Gap Down and a Gap Up. To our amazement, AML are exhibiting such a phenomena but we’re not inclined to take it very seriously. The gap down of nearly £3 last September isn’t in any way matched by the gap up last month in May. Both movements are circled on the chart below. A 50 pence boost fails to provide any form of real balance but we’ll pretend some optimism is possible.

Now above 375p should make an attempt at an initial 408p with our secondary, if bettered, at a critical 519p. This secondary is, from our perspective, seriously important. Share price closure at or above this level should be game changing for the longer term, making substantial price improvement a distinct possibility. Who knows, maybe the boss’s son shall finally discover how to drive successfully this weekend in Austria, providing a needed boost for the share value.

Visually, if things intend go wrong, below Red at 227p presently will provide sufficient warning to cancel your order for a pretty Aston Martin SUV and instead, go for that Suzuki you always wanted!

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:41:20PM | BRENT | 74.48 | |||||||||

| 9:42:57PM | GOLD | 1922.82 | 1921 | 1916 | 1911 | 1929 | 1933 | 1938 | 1945 | 1923 | |

| 9:46:22PM | FTSE | 7463.6 | Success | ||||||||

| 9:50:47PM | STOX50 | 4282.2 | ‘cess | ||||||||

| 9:53:12PM | GERMANY | 15816.9 | |||||||||

| 9:55:21PM | US500 | 4332.9 | 4327 | 4322 | 4309 | 4344 | 4361 | 4373 | 4388 | 4338 | |

| 9:57:34PM | DOW | 33747.5 | |||||||||

| 9:59:03PM | NASDAQ | 14707.9 | |||||||||

| 10:01:25PM | JAPAN | 32589 |

26/06/2023 FTSE Closed at 7453 points. Change of -0.11%. Total value traded through LSE was: £ 4,753,007,649 a change of 17.78%

23/06/2023 FTSE Closed at 7461 points. Change of -0.55%. Total value traded through LSE was: £ 4,035,557,775 a change of -15.52%

22/06/2023 FTSE Closed at 7502 points. Change of -0.75%. Total value traded through LSE was: £ 4,777,191,347 a change of 6.91%

21/06/2023 FTSE Closed at 7559 points. Change of -0.13%. Total value traded through LSE was: £ 4,468,515,731 a change of -18.02%

20/06/2023 FTSE Closed at 7569 points. Change of -0.25%. Total value traded through LSE was: £ 5,450,485,635 a change of 18.02%

19/06/2023 FTSE Closed at 7588 points. Change of -0.71%. Total value traded through LSE was: £ 4,618,439,635 a change of -67.02%

16/06/2023 FTSE Closed at 7642 points. Change of 0.18%. Total value traded through LSE was: £ 14,002,242,699 a change of 107.37%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AFC AFC Energy** **LSE:AML Aston Martin** **LSE:BARC Barclays** **LSE:BBY BALFOUR BEATTY** **LSE:BDEV Barrett Devs** **LSE:BT.A British Telecom** **LSE:CCL Carnival** **LSE:FRES Fresnillo** **LSE:GRG Greggs** **LSE:ITV ITV** **LSE:LLOY Lloyds Grp.** **LSE:NWG Natwest** **LSE:PHP Primary Health** **LSE:SCLP Scancell** **LSE:SPX Spirax** **LSE:SRP Serco** **LSE:TRN The Trainline** **LSE:VOD Vodafone** **

********

Updated charts published on : AFC Energy, Aston Martin, Barclays, BALFOUR BEATTY, Barrett Devs, British Telecom, Carnival, Fresnillo, Greggs, ITV, Lloyds Grp., Natwest, Primary Health, Scancell, Spirax, Serco, The Trainline, Vodafone,

LSE:AFC AFC Energy Close Mid-Price: 13.66 Percentage Change: -4.21% Day High: 14.8 Day Low: 13.52

If AFC Energy experiences continued weakness below 13.52, it will invaria ……..

</p

View Previous AFC Energy & Big Picture ***

LSE:AML Aston Martin. Close Mid-Price: 362.4 Percentage Change: + 10.76% Day High: 375 Day Low: 332.6

Further movement against Aston Martin ABOVE 375 should improve accelerati ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:BARC Barclays Close Mid-Price: 144.92 Percentage Change: -0.21% Day High: 145.62 Day Low: 141.44

Weakness on Barclays below 141.44 will invariably lead to 134 next with s ……..

</p

View Previous Barclays & Big Picture ***

LSE:BBY BALFOUR BEATTY. Close Mid-Price: 340.8 Percentage Change: + 0.24% Day High: 342.6 Day Low: 332

If BALFOUR BEATTY experiences continued weakness below 332, it will invar ……..

</p

View Previous BALFOUR BEATTY & Big Picture ***

LSE:BDEV Barrett Devs. Close Mid-Price: 413.1 Percentage Change: + 1.40% Day High: 415.1 Day Low: 403.1

Continued weakness against BDEV taking the price below 403.1 calculates a ……..

</p

View Previous Barrett Devs & Big Picture ***

LSE:BT.A British Telecom. Close Mid-Price: 127.65 Percentage Change: + 0.12% Day High: 128.05 Day Low: 125.55

Weakness on British Telecom below 125.55 will invariably lead to 120 with ……..

</p

View Previous British Telecom & Big Picture ***

LSE:CCL Carnival Close Mid-Price: 974.8 Percentage Change: -12.10% Day High: 1154 Day Low: 974.8

Further movement against Carnival ABOVE 1154 should improve acceleration ……..

</p

View Previous Carnival & Big Picture ***

LSE:FRES Fresnillo. Close Mid-Price: 611.6 Percentage Change: + 0.33% Day High: 613.4 Day Low: 603.8

If Fresnillo experiences continued weakness below 603.8, it will invariab ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:GRG Greggs. Close Mid-Price: 2516 Percentage Change: + 0.00% Day High: 2574 Day Low: 2480

Continued weakness against GRG taking the price below 2480 calculates as ……..

</p

View Previous Greggs & Big Picture ***

LSE:ITV ITV. Close Mid-Price: 66.96 Percentage Change: + 0.39% Day High: 67.44 Day Low: 65.82

Weakness on ITV below 65.82 will invariably lead to 64p with secondary (i ……..

</p

View Previous ITV & Big Picture ***

LSE:LLOY Lloyds Grp. Close Mid-Price: 41.96 Percentage Change: -0.85% Day High: 42.19 Day Low: 41.24

Target met. If Lloyds Grp. experiences continued weakness below 41.24, it ……..

</p

View Previous Lloyds Grp. & Big Picture ***

LSE:NWG Natwest. Close Mid-Price: 231.6 Percentage Change: + 1.05% Day High: 231.3 Day Low: 225.7

Continued weakness against NWG taking the price below 225.7 calculates as ……..

</p

View Previous Natwest & Big Picture ***

LSE:PHP Primary Health. Close Mid-Price: 92.75 Percentage Change: + 1.42% Day High: 93.2 Day Low: 90.5

Continued weakness against PHP taking the price below 90.5 calculates as ……..

</p

View Previous Primary Health & Big Picture ***

LSE:SCLP Scancell Close Mid-Price: 13 Percentage Change: -2.99% Day High: 13.25 Day Low: 12.75

Weakness on Scancell below 12.75 will invariably lead to 12 next with sec ……..

</p

View Previous Scancell & Big Picture ***

LSE:SPX Spirax Close Mid-Price: 10130 Percentage Change: -0.39% Day High: 10195 Day Low: 10045

Weakness on Spirax below 10045 will invariably lead to 10019p with second ……..

</p

View Previous Spirax & Big Picture ***

LSE:SRP Serco Close Mid-Price: 136.9 Percentage Change: -0.22% Day High: 137.7 Day Low: 135.3

If Serco experiences continued weakness below 135.3, it will invariably l ……..

</p

View Previous Serco & Big Picture ***

LSE:TRN The Trainline Close Mid-Price: 228.4 Percentage Change: -3.06% Day High: 237 Day Low: 226

Weakness on The Trainline below 226 will invariably lead to 222 with seco ……..

</p

View Previous The Trainline & Big Picture ***

LSE:VOD Vodafone Close Mid-Price: 70.06 Percentage Change: -3.62% Day High: 72.85 Day Low: 70.37

Target met. Continued weakness against VOD taking the price below 70.37 c ……..

</p

View Previous Vodafone & Big Picture ***