#Gold #NK225 While we count the minutes down to Monaco and what’s generally the most boring Grand Prix of the year, it’d be churlish not to review something fuel related. Shell, recently revealing astounding profit levels and surprising levels of PR incompetence at their AGM by allowing climate protesters to invade, while going on to defend their own emissions targets.

What remains funny is the habit of the media in continuing to attribute Shells doubling of profits to Ukraine, ignoring the reality of the jump in oil and gas prices occurring in the 3 months before the Ukraine thing kicked off. Thankfully, the pain of high fuel prices has eased considerably with today, here in Argyll, our local fuel station has Diesel priced at 129p/litre, Unleaded at 134p/litre. Across on the mainland, people are doubtless paying substantially less but fuel extortion is part of the cost of living in a remote area of Scotland.

To be honest, we’re clueless as to what brand of fuel is sold locally but think it’s probably Shell, due to the use of a corporate yellow everywhere in an independent outlet.

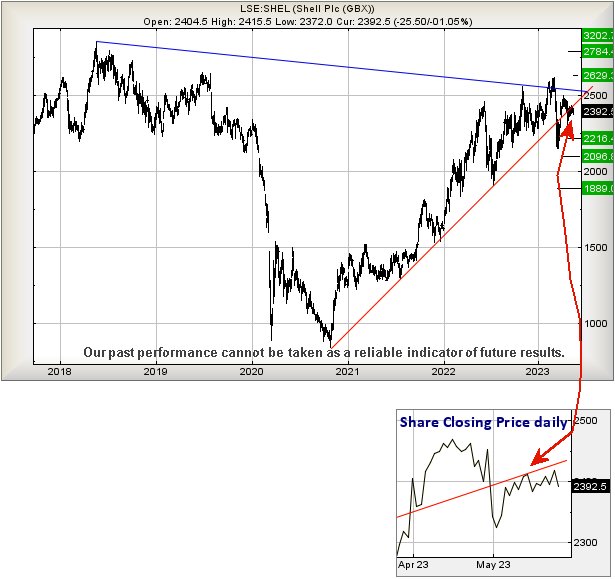

Since March, Shells share price movements have been just as chaotic as the company recent AGM proved. The value has pretended it’s going to go up, then produced a feint downward which also proved fake. But now, we’re a little worried, thanks to the share price carefully following an invisible path below the Red uptrend since 2020. The chart extract, showing the precise closing prices for each session,

begs the question, is this a warning for coming problems?

From an immediate perspective, if we take recent behaviour as a sign of nerves, it appears below 2320p risks triggering reversals to an initial 2216p with secondary, if broken, down at 2096p and hopefully a bounce. Just for light relief, we’ve decorated the chart with a 3rd level drop target should the secondary break as 1889p calculates as possible.

However, our inclination is to suspect Shell shall discover a reason for a share price boost. Unfortunately, it needs above 2496p to convince us of something useful happening as this works out with the potential of a visit to an initial 2629p with secondary, if bettered, at 2784p and doubtless some hesitation, due to prior highs back in 2018.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:11:49PM | BRENT | 77.97 | 77.54 | ||||||||

| 9:14:42PM | GOLD | 1959.65 | 1956 | 1943 | 1929 | 1970 | 1985 | 1992 | 2005 | 1971 | ‘cess |

| 9:20:45PM | FTSE | 7629.39 | 7612 | Success | |||||||

| 9:24:02PM | STOX50 | 4278.9 | 4294 | Success | |||||||

| 9:26:40PM | GERMANY | 15907 | 16013 | Success | |||||||

| 9:29:47PM | US500 | 4133.72 | 4143 | ‘cess | |||||||

| 9:32:30PM | DOW | 32810 | 32983 | Success | |||||||

| 9:35:35PM | NASDAQ | 13737 | 13688 | ‘cess | |||||||

| 9:37:55PM | JAPAN | 30555 | 30388 | 30306 | 29957 | 30594 | 30845 | 31006 | 31208 | 30660 | ‘cess |

24/05/2023 FTSE Closed at 7627 points. Change of -1.74%. Total value traded through LSE was: £ 6,784,933,914 a change of 44.14%

23/05/2023 FTSE Closed at 7762 points. Change of -0.1%. Total value traded through LSE was: £ 4,707,065,644 a change of -36.1%

22/05/2023 FTSE Closed at 7770 points. Change of 0.18%. Total value traded through LSE was: £ 7,366,100,317 a change of 37.01%

19/05/2023 FTSE Closed at 7756 points. Change of 0.18%. Total value traded through LSE was: £ 5,376,481,422 a change of -9.9%

18/05/2023 FTSE Closed at 7742 points. Change of 0.25%. Total value traded through LSE was: £ 5,967,034,656 a change of 12.56%

17/05/2023 FTSE Closed at 7723 points. Change of -0.36%. Total value traded through LSE was: £ 5,301,388,137 a change of 17.83%

16/05/2023 FTSE Closed at 7751 points. Change of -0.33%. Total value traded through LSE was: £ 4,499,249,343 a change of -9.01%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AV. Aviva** **LSE:GRG Greggs** **LSE:IDS International Distribution** **LSE:MKS Marks and Spencer** **LSE:MMAG Music Magpie** **LSE:NG. National Glib** **LSE:NWG Natwest** **LSE:PMG Parkmead** **LSE:QED Quadrise** **LSE:RBD Reabold Resources PLC** **

********

Updated charts published on : Aviva, Greggs, International Distribution, Marks and Spencer, Music Magpie, National Glib, Natwest, Parkmead, Quadrise, Reabold Resources PLC,

LSE:AV. Aviva Close Mid-Price: 398.9 Percentage Change: -5.88% Day High: 418.9 Day Low: 397.7

Weakness on Aviva below 397.7 will invariably lead to 387 with secondary, ……..

</p

View Previous Aviva & Big Picture ***

LSE:GRG Greggs Close Mid-Price: 2654 Percentage Change: -1.19% Day High: 2684 Day Low: 2624

If Greggs experiences continued weakness below 2624, it will invariably l ……..

</p

View Previous Greggs & Big Picture ***

LSE:IDS International Distribution Close Mid-Price: 196.95 Percentage Change: -1.82% Day High: 200 Day Low: 193.95

In the event International Distribution experiences weakness below 193.95 ……..

</p

View Previous International Distribution & Big Picture ***

LSE:MKS Marks and Spencer. Close Mid-Price: 184.75 Percentage Change: + 12.93% Day High: 188.15 Day Low: 173.9

Target met. All Marks and Spencer needs are mid-price trades ABOVE 188.15 ……..

</p

View Previous Marks and Spencer & Big Picture ***

LSE:MMAG Music Magpie Close Mid-Price: 19.25 Percentage Change: -3.75% Day High: 20 Day Low: 19.25

Weakness on Music Magpie below 19.25 will invariably lead to 17p with sec ……..

</p

View Previous Music Magpie & Big Picture ***

LSE:NG. National Glib Close Mid-Price: 1098.5 Percentage Change: -1.17% Day High: 1107 Day Low: 1088.5

Continued weakness against NG. taking the price below 1088.5 calculates a ……..

</p

View Previous National Glib & Big Picture ***

LSE:NWG Natwest Close Mid-Price: 268.1 Percentage Change: -2.15% Day High: 272.8 Day Low: 268.5

Natwest needs mid-price trades ABOVE 275.5 to improve acceleration toward ……..

</p

View Previous Natwest & Big Picture ***

LSE:PMG Parkmead Close Mid-Price: 20.25 Percentage Change: -3.57% Day High: 21 Day Low: 20.25

In the event Parkmead experiences weakness below 20.25 it calculates with ……..

</p

View Previous Parkmead & Big Picture ***

LSE:QED Quadrise Close Mid-Price: 1.11 Percentage Change: -2.63% Day High: 1.12 Day Low: 1.1

If Quadrise experiences continued weakness below 1.1, it will invariably ……..

</p

View Previous Quadrise & Big Picture ***

LSE:RBD Reabold Resources PLC Close Mid-Price: 0.14 Percentage Change: -1.69% Day High: 0.15 Day Low: 0.14

In the event Reabold Resources PLC experiences weakness below 0.14 it cal ……..

</p

View Previous Reabold Resources PLC & Big Picture ***