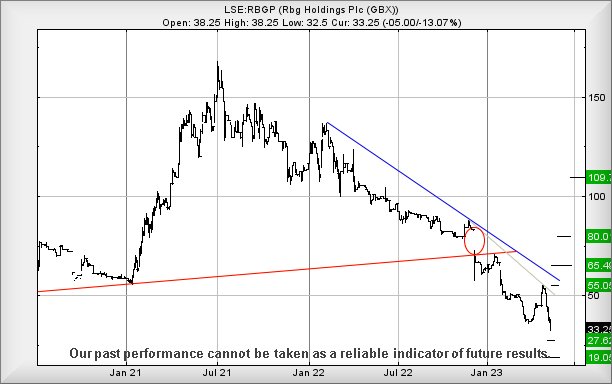

#FTSE #Nasdaq One of the few legal firms listed on the UK exchanges, RBG Holdings share price has not followed a great trajectory since July 2021 and finally, we suspect we’re seeing early signals it may be in the final stages of this death spiral. To be fair, if the market thinks there’s real strength present, ideally this share shall bounce anytime soon.

From our numbers perspective, it appears weakness continuing below 32p risks triggering further reversals to an initial 27.5p with secondary, if broken, calculating at an “ultimate bottom” down at an unpleasant looking 19p. We refer to this sort of thing as an “ultimate” bottom for the pretty basic reason we cannot calculate any reliable target below such a level. Surprisingly, quite a few shares experience a bounce prior to an “ultimate” making an appearance and visually, the share price is already in the zone.

However, it’s always worth remembering the market offers absolutely no guarantees of a bounce, along with the clichéd memory, warning of the dangers of catching a falling knife.

In this instance, above 41p looks like it could prove interesting, hopefully provoking movement to an initial 55p with secondary, if bettered, at a potentially useful 65p. We’re being a little cautious with this optimism as the share price requires (from our perspective) to close a session above 71p, over double the price level at time of writing, to signal proper recovery kicking into action for the longer term.

For now, it’s probably worth keeping an eye on how this price behaves in the next few weeks.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:20:38PM | BRENT | 74.54 | |||||||||

| 9:23:44PM | GOLD | 1989.57 | Success | ||||||||

| 9:26:01PM | FTSE | 7740.82 | 7726 | 7710 | 7678 | 7754 | 7761 | 7768 | 7782 | 7739 | ‘cess |

| 9:28:23PM | STOX50 | 4312.1 | |||||||||

| 9:30:22PM | GERMANY | 15906.6 | |||||||||

| 9:32:28PM | US500 | 4120.07 | |||||||||

| 9:35:21PM | DOW | 33063.6 | Success | ||||||||

| 9:37:30PM | NASDAQ | 13460 | 13377 | 13350 | 13298 | 13433 | 13506 | 13545 | 13586 | 13427 | Success |

| 9:41:03PM | JAPAN | 29895 | ‘cess |

16/05/2023 FTSE Closed at 7751 points. Change of -0.33%. Total value traded through LSE was: £ 4,499,249,343 a change of -9.01%

15/05/2023 FTSE Closed at 7777 points. Change of 0.3%. Total value traded through LSE was: £ 4,944,763,554 a change of 10.08%

12/05/2023 FTSE Closed at 7754 points. Change of 0.31%. Total value traded through LSE was: £ 4,492,113,080 a change of -8.91%

11/05/2023 FTSE Closed at 7730 points. Change of -0.14%. Total value traded through LSE was: £ 4,931,618,860 a change of 7.65%

10/05/2023 FTSE Closed at 7741 points. Change of -0.3%. Total value traded through LSE was: £ 4,581,255,813 a change of -35.41%

9/05/2023 FTSE Closed at 7764 points. Change of -0.18%. Total value traded through LSE was: £ 7,092,371,085 a change of 60.33%

5/05/2023 FTSE Closed at 7778 points. Change of -100%. Total value traded through LSE was: £ 4,423,579,038 a change of 0%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AV. Aviva** **LSE:CNA Centrica** **LSE:FRES Fresnillo** **LSE:IAG British Airways** **LSE:RR. Rolls Royce** **LSE:VOD Vodafone** **

********

Updated charts published on : Aviva, Centrica, Fresnillo, British Airways, Rolls Royce, Vodafone,

LSE:AV. Aviva Close Mid-Price: 410.3 Percentage Change: -0.61% Day High: 415.3 Day Low: 409.5

Now below 402 indicates the potential of reversals to an initial 387 with ……..

</p

View Previous Aviva & Big Picture ***

LSE:CNA Centrica. Close Mid-Price: 119.65 Percentage Change: + 1.79% Day High: 119.9 Day Low: 117.6

Target met. In the event of Centrica enjoying further trades beyond 119.9 ……..

</p

View Previous Centrica & Big Picture ***

LSE:FRES Fresnillo Close Mid-Price: 673 Percentage Change: -1.06% Day High: 681.8 Day Low: 674

Continued weakness against FRES taking the price below 674 calculates as ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:IAG British Airways. Close Mid-Price: 155.7 Percentage Change: + 0.91% Day High: 156.2 Day Low: 152.5

Continued trades against IAG with a mid-price ABOVE 156.2 should improve ……..

</p

View Previous British Airways & Big Picture ***

LSE:RR. Rolls Royce. Close Mid-Price: 148.15 Percentage Change: + 2.10% Day High: 151 Day Low: 146.95

Amazing to note this still needs above 160.25p to signal it’s breaking upw ……..

</p

View Previous Rolls Royce & Big Picture ***

LSE:VOD Vodafone Close Mid-Price: 83.33 Percentage Change: -7.44% Day High: 87.82 Day Low: 81.02

If Vodafone experiences continued weakness below 81.02, it will invariabl ……..

</p

View Previous Vodafone & Big Picture ***