#FTSE #Bitcoin As we go into the weekend with new snow on the mountains in Argyll, our lawn is finally cut, there’s reason for optimism. And of course, some puzzlement. The FTSE is looking capable of tracing new highs, Bitcoin looks like it’s about to enter a recovery phase, even Gold looks like it’s about to attempt to new levels above $2100.

Our puzzlement comes from conventional wisdom, essentially if the markets are tanking, smart money is supposed to head elsewhere like Gold or Bitcoin. But the markets, while certainly lacking flamboyant gestures, continue to exhibit gains on almost a daily basis. Firstly, we want to examine Bitcoin as it feels like it’s on the edge of doing something clever.

Currently, it appears Bitcoin (trading around 30,300 USD at time of writing) need only exceed 30,575 to apparently trigger a gain in the direction of $33,186, a fairly useful little jump. Our secondary, however, is of special interest as should this initial target be exceeded, we are calculating $47,938 as a secondary, a price level not seen for 12 months. Visually, it makes a lot of sense but do pay attention to the initial target as it “really” needs exceeded to better a funny batch of movements last year, making a strong lift to our $47k level a viable proposition.

For everything to go wrong for Bitcoin, it needs below $23,500 to spoil the party.

FTSE for Friday We’re a little hacked off about the UK Aim market once again riding second fiddle to the FTSE, making a series of pretty useless movements rather than exhibit the very real strength shown when it enacted pandemic recovery, quite literally leaving the FTSE 100 in the dust. However, movements since the start of 2022 almost felt the junior exchange was facing payback for its temerity and only now, are there slight signs things may be improving. But we need see the AIM above 900 points (currently 825 points) to start thinking happy thoughts again.

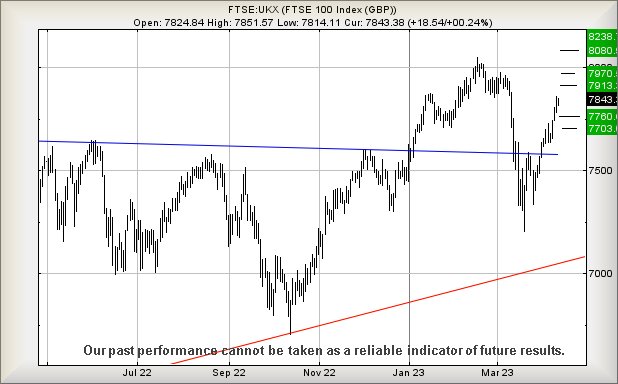

As for the FTSE, it’s looking very like the index is planning another forage into the land of higher highs.

Currently, above 7862 points should hopefully trigger gains to an initial 7913 points with secondary, if bettered, at 7970, a price level where the visuals suggest hesitation is possible. However, were it not for the previous stall at this level at the start of March, our secondary would work out at 8080 points but, in this instance, our software is probably taking the wiser stance. Market gains recently are proving slow and steady, making us wonder what shall be required to see days of 100+ point movements return. Perhaps a return to Government by Liz Truss will be needed to shake things up, ideally the Scottish Govt where many senior folk have resigned, doubtless pending police investigation results.

Our alternate scenario requires the FTSE to slither below 7808 points, risking a slight reversal cycle to an initial 7760 with secondary, if broken, at 7703 points and hopefully yet another bounce.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:21:33PM | BRENT | 86.02 | 85.17 | 84.32 | 86.15 | 87.2 | 87.61 | 86.3 | |||

| 10:23:38PM | GOLD | 2040.56 | 2015 | 2012 | 2030 | 2045 | 2051 | 2033 | Success | ||

| 10:25:38PM | FTSE | 7862.03 | 7794 | 7772 | 7830 | 7867 | 7872 | 7843 | |||

| 10:27:35PM | STOX50 | 4374.4 | 4338 | 4326 | 4362 | 4377 | 4388 | 4357 | |||

| 10:37:10PM | GERMANY | 15767.26 | 15671 | 15650 | 15739 | 15782 | 15798 | 15732 | |||

| 10:47:53PM | US500 | 4144.62 | 4110 | 4094 | 4125 | 4148 | 4152 | 4128 | |||

| 10:50:35PM | DOW | 34000.5 | 33585 | 33555 | 33785 | 34059 | 34065 | 33900 | |||

| 10:53:30PM | NASDAQ | 13087.84 | 12995 | 12974 | 13047 | 13122 | 13146 | 13047 | |||

| 10:55:28PM | JAPAN | 28368 | 28088 | 27955 | 28233 | 28426 | 28518 | 28301 | Success |

13/04/2023 FTSE Closed at 7843 points. Change of 0.24%. Total value traded through LSE was: £ 4,941,877,578 a change of -0.83%

12/04/2023 FTSE Closed at 7824 points. Change of 0.5%. Total value traded through LSE was: £ 4,983,460,119 a change of -24.23%

11/04/2023 FTSE Closed at 7785 points. Change of 0.57%. Total value traded through LSE was: £ 6,576,655,503 a change of 53.55%

6/04/2023 FTSE Closed at 7741 points. Change of 1.03%. Total value traded through LSE was: £ 4,283,125,901 a change of -14.63%

5/04/2023 FTSE Closed at 7662 points. Change of 0.37%. Total value traded through LSE was: £ 5,017,004,065 a change of -11.84%

4/04/2023 FTSE Closed at 7634 points. Change of -100%. Total value traded through LSE was: £ 5,690,797,913 a change of 0%

3/04/2023 FTSE Closed at 7673 points. Change of 0%. Total value traded through LSE was: £ 6,510,009,325 a change of 0%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AML Aston Martin** **LSE:AZN Astrazeneca** **LSE:BDEV Barrett Devs** **LSE:CAR Carclo** **LSE:GENL Genel** **LSE:GLEN Glencore Xstra** **LSE:NG. National Glib** **LSE:SBRY Sainsbury** **LSE:SCLP Scancell** **LSE:TSCO Tesco** **

********

Updated charts published on : Aston Martin, Astrazeneca, Barrett Devs, Carclo, Genel, Glencore Xstra, National Glib, Sainsbury, Scancell, Tesco,

LSE:AML Aston Martin Close Mid-Price: 231.8 Percentage Change: -0.09% Day High: 240 Day Low: 231.6

Target met. All Aston Martin needs are mid-price trades ABOVE 240 to impr ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:AZN Astrazeneca. Close Mid-Price: 11916 Percentage Change: + 0.80% Day High: 11912 Day Low: 11792

Continued trades against AZN with a mid-price ABOVE 11912 should improve ……..

</p

View Previous Astrazeneca & Big Picture ***

LSE:BDEV Barrett Devs. Close Mid-Price: 478.2 Percentage Change: + 2.38% Day High: 488.6 Day Low: 473.7

Target met. In the event of Barrett Devs enjoying further trades beyond 4 ……..

</p

View Previous Barrett Devs & Big Picture ***

LSE:CAR Carclo Close Mid-Price: 12.47 Percentage Change: -5.67% Day High: 0 Day Low: 0

Continued weakness against CAR taking the price below 12.47 calculates as ……..

</p

View Previous Carclo & Big Picture ***

LSE:GENL Genel. Close Mid-Price: 134 Percentage Change: + 5.51% Day High: 136.2 Day Low: 126

Continued trades against GENL with a mid-price ABOVE 136.2 should improve ……..

</p

View Previous Genel & Big Picture ***

LSE:GLEN Glencore Xstra. Close Mid-Price: 487.65 Percentage Change: + 0.84% Day High: 492.2 Day Low: 479.8

Further movement against Glencore Xstra ABOVE 492.2 should improve accele ……..

</p

View Previous Glencore Xstra & Big Picture ***

LSE:NG. National Glib Close Mid-Price: 1144 Percentage Change: -0.82% Day High: 1156 Day Low: 1140

All National Grid needs are mid-price trades ABOVE 1156 to improve accele ……..

</p

View Previous National Glib & Big Picture ***

LSE:SBRY Sainsbury Close Mid-Price: 278.2 Percentage Change: -0.61% Day High: 281.6 Day Low: 277.3

Continued trades against SBRY with a mid-price ABOVE 281.6 should improve ……..

</p

View Previous Sainsbury & Big Picture ***

LSE:SCLP Scancell. Close Mid-Price: 20.5 Percentage Change: + 5.13% Day High: 20.75 Day Low: 19.5

In the event of Scancell enjoying further trades beyond 20.75, the share ……..

</p

View Previous Scancell & Big Picture ***

LSE:TSCO Tesco. Close Mid-Price: 269 Percentage Change: + 0.60% Day High: 275.5 Day Low: 268.5

All Tesco needs are mid-price trades ABOVE 275.5 to improve acceleration ……..

</p

View Previous Tesco & Big Picture ***