#FTSE #GOLD

Numbers are supposed to be a personal strong point but, with a wedding anniversary imminent, simple arithmetic proved beyond me. The “problem” with our anniversary is neither of us remember the date of the wedding in the USA, either resorting to looking at the wedding licence or taking an unusual easier option. We count champagne bottles!

Neither of us enjoy champagne but as we were given a bottle in Colorado, it returned to the UK and sat alone in a wine rack, as popular as a British politician at an international meeting. As our first anniversary dawned, my wife thought it funny to buy a 2nd bottle to join the lonely one, accidentally kicking off an annual tradition. We’re now on our 3rd wine rack…

Guess who forgot the initial bottle shouldn’t be counted, when working out which anniversary was due? And worse, defended my position when challenged, until the quite decorative Marriage Licence was flourished, making the balloons utterly redundant. However, there’s one number I’m still fairly confident about and it’s 871 points.

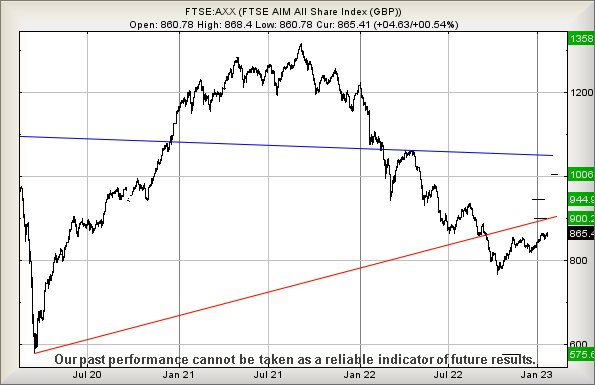

Unlike the FTSE 100 or the FTSE 250, the AIM market is now making early signs for true recovery. At present, it’s trading around 865 points and needs only better 871 to enter a cycle, hopefully, to 900 points next with secondary, if bettered, at 944 points. This will regain the uptrend since the pandemic low of 2020, giving considerable reason for longer term optimism across the AIM market. In plain English, it’s a market at the “fingers crossed” point.

FTSE 100 The FTSE had an all time high of 7903 points, back in May 2018.

Our reason we’re mentioning this is an attempt to forestall some of the incoherent excitement which shall doubtless occur, due to some immediate potentials on the market. From a near term perspective, we suspect the UK market should exhibit some gains as movement above 7787 points currently calculates with the potential of a lift to 7836 points next with our secondary, if such a target appears, working out at 7885 points. If triggered, the tightest stop loss level looks like a reasonable 7743 points.

The important detail about both the foregoing target levels is they’re both below 7903 points, the market failing to achieve a true higher high. We can calculate a 3rd level ambition at 7914 points but suggest taking care with any long term commitments (and avoid buying champagne) until such time the UK index actually closes a session above 7903 points. It’s liable to be quite a big deal, confirming a long term attraction at 8240 points.

If everything intends go wrong, the index requires an excuse to sink below 7617 points. Currently, below 7712 will give cause for worry, threatening reversals to 7678 points with secondary, if broken, down at 7636 and hopefully a bounce.

Have a good weekend

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:38:45PM | BRENT | 87.43 | 85.74 | 85.435 | 86.63 | 87.98 | 88.205 | 86.95 | ‘cess | ||

| 9:40:48PM | GOLD | 1929 | 1923 | 1918 | 1933 | 1945 | 1954 | 1932 | ‘cess | ||

| 9:44:29PM | FTSE | 7774.81 | 7744 | 7716 | 7778 | 7788 | 7799 | 7759 | ‘cess | ||

| 9:48:55PM | STOX50 | 4184.1 | 4159 | 4147 | 4182 | 4185 | 4192 | 4168 | ‘cess | ||

| 9:57:19PM | GERMANY | 15159.68 | 15065 | 15018 | 15134 | 15186 | 15224 | 15106 | Shambles | ||

| 9:59:02PM | US500 | 4054.12 | 4012 | 3996 | 4028 | 4063 | 4075 | 4028 | |||

| 10:02:46PM | DOW | 33932 | 33610 | 33540 | 33843 | 33969 | 34063 | 33698 | ‘cess | ||

| 10:05:25PM | NASDAQ | 12004.22 | 11820 | 11743 | 11918 | 12057 | 12099 | 11974 | Success | ||

| 10:07:35PM | JAPAN | 27505 | 27266 | 27231 | 27395 | 27527 | 27557 | 27384 | ‘cess |

26/01/2023 FTSE Closed at 7761 points. Change of 0.22%. Total value traded through LSE was: £ 5,661,516,595 a change of 15%

25/01/2023 FTSE Closed at 7744 points. Change of -0.17%. Total value traded through LSE was: £ 4,923,070,732 a change of -10.83%

24/01/2023 FTSE Closed at 7757 points. Change of -0.09%. Total value traded through LSE was: £ 5,520,852,512 a change of 27.06%

23/01/2023 FTSE Closed at 7764 points. Change of -0.08%. Total value traded through LSE was: £ 4,345,074,257 a change of -16.34%

20/01/2023 FTSE Closed at 7770 points. Change of 0.3%. Total value traded through LSE was: £ 5,193,532,558 a change of -8.71%

19/01/2023 FTSE Closed at 7747 points. Change of -1.06%. Total value traded through LSE was: £ 5,688,982,543 a change of 12.09%

18/01/2023 FTSE Closed at 7830 points. Change of -0.27%. Total value traded through LSE was: £ 5,075,315,047 a change of -21.93%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BARC Barclays** **LSE:DGE Diageo** **LSE:EMG MAN** **LSE:HSBA HSBC** **LSE:IPF International Personal Finance** **LSE:LLOY Lloyds Grp.** **LSE:NWG Natwest** **LSE:POLY Polymetal** **LSE:RR. Rolls Royce** **

********

Updated charts published on : Barclays, Diageo, MAN, HSBC, International Personal Finance, Lloyds Grp., Natwest, Polymetal, Rolls Royce,

LSE:BARC Barclays. Close Mid-Price: 185.04 Percentage Change: + 1.83% Day High: 185.06 Day Low: 182.24

Continued trades against BARC with a mid-price ABOVE 185.06 should improv ……..

</p

View Previous Barclays & Big Picture ***

LSE:DGE Diageo Close Mid-Price: 3472 Percentage Change: -5.52% Day High: 3554 Day Low: 3403

If Diageo experiences continued weakness below 3403, it will invariably l ……..

</p

View Previous Diageo & Big Picture ***

LSE:EMG MAN. Close Mid-Price: 248.4 Percentage Change: + 1.97% Day High: 250.3 Day Low: 241.9

Target met. All MAN needs are mid-price trades ABOVE 250.3 to improve acc ……..

</p

View Previous MAN & Big Picture ***

LSE:HSBA HSBC. Close Mid-Price: 603.9 Percentage Change: + 0.90% Day High: 603.7 Day Low: 596.9

All HSBC needs are mid-price trades ABOVE 603.7 to improve acceleration t ……..

</p

View Previous HSBC & Big Picture ***

LSE:IPF International Personal Finance. Close Mid-Price: 82.4 Percentage Change: + 2.74% Day High: 84 Day Low: 81.8

Further movement against International Personal Finance ABOVE 84 should i ……..

</p

View Previous International Personal Finance & Big Picture ***

LSE:LLOY Lloyds Grp.. Close Mid-Price: 52.5 Percentage Change: + 3.04% Day High: 52.67 Day Low: 51

All Lloyds Grp. needs are mid-price trades ABOVE 52.67 to improve acceler ……..

</p

View Previous Lloyds Grp. & Big Picture ***

LSE:NWG Natwest. Close Mid-Price: 304.9 Percentage Change: + 0.96% Day High: 305.5 Day Low: 301.6

Target met. Continued trades against NWG with a mid-price ABOVE 305.5 sho ……..

</p

View Previous Natwest & Big Picture ***

LSE:POLY Polymetal Close Mid-Price: 220 Percentage Change: -20.41% Day High: 270 Day Low: 214

If Polymetal experiences continued weakness below 214, it will invariably ……..

</p

View Previous Polymetal & Big Picture ***

LSE:RR. Rolls Royce. Close Mid-Price: 113.48 Percentage Change: + 1.58% Day High: 115 Day Low: 111.72

Continued trades against RR. with a mid-price ABOVE 115 should improve th ……..

</p

View Previous Rolls Royce & Big Picture ***