#BrentCrude #Dax

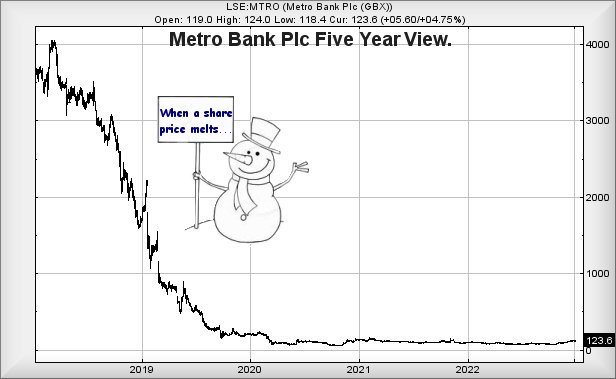

By popular demand, we’re taking another look at Metro due to some folk finding their share price interesting and thus, asking if we can update our outlook. Unfortunately, the first chart displayed, using our “default” setting is a 5 year view, one which provokes a sharp intake of breath. By any standards, the view since 2018 is utterly dreadful.

For the retail banking sector, the share high prior to Covid-19 looks like providing a reasonable ambition for most shares. Natwest is already flirting with such a level, Barclays has another 30p to gain, despite matching the level in 2022 then being hammered for it, and Lloyds needs discover 25p from somewhere. Metro Bank share price needs almost double from its current 123p, just to reach this important looking milestone. Despite this sounding awful, the reality ‘should be’, if Metro intends follow the rest of the sector in recovery, some fairly large jumps in the share price should be anticipated.

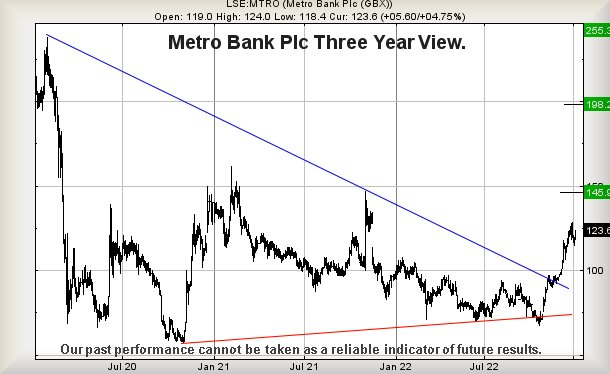

Currently, our optimism toward the Clown Sector – aka the retail banks – continues to improve. Metro share price movements prove to be at odds with the big three, failing to emulate a relatively strong start to the year. Instead of experiencing 4 sessions out of 5 as gains, Metro somehow managed to experience 2 pretty firm sessions of reversals and is now matching the opening price for 2023. Perhaps this means something, perhaps it’s just proving less attractive and is still wearing big clown shoes!

Should we opt to tar Metro with the same brush we’re using for the rest of the retail banks, it now appears above 129p should make an attempt at 145p next, a price level which looks capable of provoking some hesitation given prior terrors around the 150p level. It is surprising to note, should 145p be exceeded, our secondary calculation works out at a longer term 198p. We can even provide a 3rd level target at a distant and improbable looking 255p, our suspicions aroused as there’s no historical precedent to make such an ambition look viable. This may sound a little daft but experience has taught, when a future calculation “looks odd”, the chances are it’s going to be impossible.

For everything to go wrong with Metro, a bank we thoroughly approve of due to their dog friendly policy, the share price would need close a session below 93p. This would force us to revisit the numbers.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:03:36PM | BRENT | 79.91 | 78.98 | 78.27 | 77.22 | 80.2 | 81.42 | 81.84 | 83.1 | 80.1 | ‘cess |

| 10:05:17PM | GOLD | 1871 | ‘cess | ||||||||

| 10:07:51PM | FTSE | 7686.26 | Shambles | ||||||||

| 10:10:16PM | STOX50 | 4051.5 | ‘cess | ||||||||

| 10:14:46PM | GERMANY | 14738 | 14622 | 14536 | 14434 | 14718 | 14834 | 14958 | 15139 | 14687 | ‘cess |

| 10:18:11PM | US500 | 3891.87 | Success | ||||||||

| 10:21:01PM | DOW | 33516 | ‘cess | ||||||||

| 10:23:49PM | NASDAQ | 11106.34 | Success | ||||||||

| 10:26:30PM | JAPAN | 26208 | ‘cess |

9/01/2023 FTSE Closed at 7724 points. Change of 0.32%. Total value traded through LSE was: £ 5,327,251,474 a change of 8.1%

6/01/2023 FTSE Closed at 7699 points. Change of 0.86%. Total value traded through LSE was: £ 4,928,257,963 a change of -18.51%

5/01/2023 FTSE Closed at 7633 points. Change of 0.63%. Total value traded through LSE was: £ 6,047,458,257 a change of 10.27%

4/01/2023 FTSE Closed at 7585 points. Change of 0.97%. Total value traded through LSE was: £ 5,484,169,808 a change of 109.75%

29/12/2022 FTSE Closed at 7512 points. Change of -100%. Total value traded through LSE was: £ 2,614,666,454 a change of 0%

28/12/2022 FTSE Closed at 7497 points. Change of 0%. Total value traded through LSE was: £ 4,019,239,763 a change of 0%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AVCT Avacta** **LSE:BARC Barclays** **LSE:BT.A British Telecom** **LSE:CEY Centamin** **LSE:EZJ EasyJet** **LSE:FGP Firstgroup** **LSE:HIK Hikma** **LSE:IAG British Airways** **LSE:IGAS Igas Energy** **LSE:IHG Intercontinental Hotels Group** **LSE:ITRK Intertek** **LSE:ITV ITV** **LSE:MKS Marks and Spencer** **LSE:NG. National Glib** **LSE:OCDO Ocado Plc** **LSE:OXIG Oxford Instruments** **LSE:POLY Polymetal** **LSE:SBRY Sainsbury** **

********

Updated charts published on : Avacta, Barclays, British Telecom, Centamin, EasyJet, Firstgroup, Hikma, British Airways, Igas Energy, Intercontinental Hotels Group, Intertek, ITV, Marks and Spencer, National Glib, Ocado Plc, Oxford Instruments, Polymetal, Sainsbury,

LSE:AVCT Avacta. Close Mid-Price: 128.5 Percentage Change: + 1.98% Day High: 131 Day Low: 123

Further movement against Avacta ABOVE 131 should improve acceleration tow ……..

</p

View Previous Avacta & Big Picture ***

LSE:BARC Barclays. Close Mid-Price: 172.62 Percentage Change: + 0.30% Day High: 174.1 Day Low: 171.94

In the event of Barclays enjoying further trades beyond 174.1, the share ……..

</p

View Previous Barclays & Big Picture ***

LSE:BT.A British Telecom. Close Mid-Price: 128.05 Percentage Change: + 1.11% Day High: 130.8 Day Low: 126.75

All British Telecom needs are mid-price trades ABOVE 130.8 to improve acc ……..

</p

View Previous British Telecom & Big Picture ***

LSE:CEY Centamin Close Mid-Price: 122 Percentage Change: -2.79% Day High: 127.6 Day Low: 122.55

Further movement against Centamin ABOVE 127.6 should improve acceleration ……..

</p

View Previous Centamin & Big Picture ***

LSE:EZJ EasyJet. Close Mid-Price: 388.9 Percentage Change: + 4.49% Day High: 396.5 Day Low: 373.5

All EasyJet needs are mid-price trades ABOVE 396.5 to improve acceleratio ……..

</p

View Previous EasyJet & Big Picture ***

LSE:FGP Firstgroup Close Mid-Price: 104.8 Percentage Change: -0.19% Day High: 109 Day Low: 105.5

Continued trades against FGP with a mid-price ABOVE 109 should improve th ……..

</p

View Previous Firstgroup & Big Picture ***

LSE:HIK Hikma Close Mid-Price: 1665.5 Percentage Change: -0.54% Day High: 1690 Day Low: 1650.5

In the event of Hikma enjoying further trades beyond 1690, the share shou ……..

</p

View Previous Hikma & Big Picture ***

LSE:IAG British Airways. Close Mid-Price: 145.5 Percentage Change: + 3.54% Day High: 146.42 Day Low: 139.54

Further movement against British Airways ABOVE 146.42 should improve acc ……..

</p

View Previous British Airways & Big Picture ***

LSE:IGAS Igas Energy. Close Mid-Price: 22.4 Percentage Change: + 30.99% Day High: 22.2 Day Low: 17.5

In the event of Igas Energy enjoying further trades beyond 22.2, the shar ……..

</p

View Previous Igas Energy & Big Picture ***

LSE:IHG Intercontinental Hotels Group. Close Mid-Price: 5158 Percentage Change: + 1.14% Day High: 5170 Day Low: 5104

Target met. All Intercontinental Hotels Group needs are mid-price trades ……..

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:ITRK Intertek Close Mid-Price: 4225 Percentage Change: -0.21% Day High: 4266 Day Low: 4183

Continued trades against ITRK with a mid-price ABOVE 4266 should improve ……..

</p

View Previous Intertek & Big Picture ***

LSE:ITV ITV. Close Mid-Price: 81.48 Percentage Change: + 2.36% Day High: 81.42 Day Low: 79.88

Target met. Continued trades against ITV with a mid-price ABOVE 81.42 sho ……..

</p

View Previous ITV & Big Picture ***

LSE:MKS Marks and Spencer. Close Mid-Price: 141.1 Percentage Change: + 2.58% Day High: 141.4 Day Low: 137.95

Target met. All Marks and Spencer needs are mid-price trades ABOVE 141.4 ……..

</p

View Previous Marks and Spencer & Big Picture ***

LSE:NG. National Glib Close Mid-Price: 1037.5 Percentage Change: -0.67% Day High: 1054.5 Day Low: 1024.5

Further movement against National Glib ABOVE 1054.5 should improve accele ……..

</p

View Previous National Glib & Big Picture ***

LSE:OCDO Ocado Plc. Close Mid-Price: 743.2 Percentage Change: + 3.51% Day High: 755 Day Low: 716.8

All Ocado Plc needs are mid-price trades ABOVE 755 to improve acceleratio ……..

</p

View Previous Ocado Plc & Big Picture ***

LSE:OXIG Oxford Instruments Close Mid-Price: 2205 Percentage Change: -0.23% Day High: 2300 Day Low: 2160

In the event of Oxford Instruments enjoying further trades beyond 2300, t ……..

</p

View Previous Oxford Instruments & Big Picture ***

LSE:POLY Polymetal. Close Mid-Price: 315 Percentage Change: + 12.08% Day High: 320 Day Low: 280

Target met. All Polymetal needs are mid-price trades ABOVE 320 to improve ……..

</p

View Previous Polymetal & Big Picture ***

LSE:SBRY Sainsbury. Close Mid-Price: 247.1 Percentage Change: + 1.44% Day High: 248.9 Day Low: 242.8

Continued trades against SBRY with a mid-price ABOVE 248.9 should improve ……..

</p

View Previous Sainsbury & Big Picture ***