~Brent #Dax

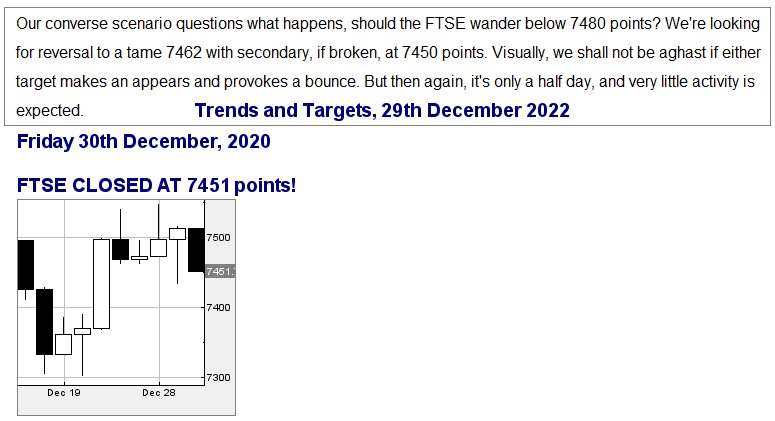

The final session of 2022 provided ample opportunity for us to dislocate a shoulder, trying to administer a pat on the back. Our scenario, the previous day, allowed for reversal to 7450 points and with London wrapping things up for the year at 7451 points, this was deemed close enough for self congratulations as we were out by 13 thousands of a percent. As always, New Year in Scotland was pretty boring with things only becoming interesting when friends dropped round the following day.

We walked our dogs, lit the fire, settled down with plenty of red wine, and for a few hours pretended we were competent musicians!

From a market perspective, it feels like the New Year is kicking off with good intentions. Not only the FTSE is giving encouraging squeaks but Natwest starts to feel like the share is finally burbling into life. Maybe we’re seeing a Santa Rally for Agnostics?

To cut down on the amount of reading, it now looks like near term movement above 275p shall continue trudging up hill to an initial 284p with secondary, if exceeded, now calculating at 305p. It’s important to remember movement above a closing price of 284p propels Natwest share price into a zone where a longer term 337p still calculates as a viable ambition.

Our alternate proposition demands Natwest weaken below 225p to ring alarm bells, risking reversal to an initial 200p with secondary, if broken, down at 175p and hopefully a bounce. But for now, it looks like it’s a Happy New Year for those patiently awaiting Natwest doing something useful.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop |

| 10:06:42PM | BRENT | 78.1 | 77.75 | 76.43 | 75.41 | 80.3 | 81.87 | 82.43 | 83.99 | 80.15 |

| 10:08:33PM | GOLD | 1855.84 | 1854 | |||||||

| 10:11:16PM | FTSE | 7574 | 7553 | |||||||

| 10:13:32PM | STOX50 | 3975.1 | 3945 | |||||||

| 10:25:24PM | GERMANY | 14483.63 | 14197 | 14083 | 13941 | 14248 | 14506 | 14516 | 14633 | 14197 |

| 10:27:29PM | US500 | 3852.07 | 3850 | |||||||

| 10:29:49PM | DOW | 33253 | 33235 | |||||||

| 10:31:27PM | NASDAQ | 10914 | 10890 | |||||||

| 10:34:15PM | JAPAN | 25846 | 25830 |

4/01/2023 FTSE Closed at 7585 points. Change of 0.97%. Total value traded through LSE was: £ 5,484,169,808 a change of 109.75%

29/12/2022 FTSE Closed at 7512 points. Change of 0.2%. Total value traded through LSE was: £ 2,614,666,454 a change of -34.95%

28/12/2022 FTSE Closed at 7497 points. Change of -100%. Total value traded through LSE was: £ 4,019,239,763 a change of 0%

23/12/2022 FTSE Closed at 7473 points. Change of 0%. Total value traded through LSE was: £ 2,007,879,926 a change of 0%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AGM Applied Graphene** **LSE:AVCT Avacta** **LSE:AZN Astrazeneca** **LSE:BARC Barclays** **LSE:BDEV Barrett Devs** **LSE:CEY Centamin** **LSE:FRES Fresnillo** **LSE:HIK Hikma** **LSE:HSBA HSBC** **LSE:ITRK Intertek** **LSE:MKS Marks and Spencer** **LSE:NWG Natwest** **LSE:OXIG Oxford Instruments** **LSE:RR. Rolls Royce** **LSE:SBRY Sainsbury** **LSE:STAN Standard Chartered** **

********

Updated charts published on : Applied Graphene, Avacta, Astrazeneca, Barclays, Barrett Devs, Centamin, Fresnillo, Hikma, HSBC, Intertek, Marks and Spencer, Natwest, Oxford Instruments, Rolls Royce, Sainsbury, Standard Chartered,

LSE:AGM Applied Graphene Close Mid-Price: 8.4 Percentage Change: -10.16% Day High: 9.6 Day Low: 8.25

Target met. In the event of Applied Graphene enjoying further trades beyo ……..

</p

View Previous Applied Graphene & Big Picture ***

LSE:AVCT Avacta. Close Mid-Price: 127 Percentage Change: + 4.53% Day High: 130.5 Day Low: 121.5

All Avacta needs are mid-price trades ABOVE 130.5 to improve acceleration ……..

</p

View Previous Avacta & Big Picture ***

LSE:AZN Astrazeneca. Close Mid-Price: 11602 Percentage Change: + 0.59% Day High: 11746 Day Low: 11536

In the event of Astrazeneca enjoying further trades beyond 11746, the sha ……..

</p

View Previous Astrazeneca & Big Picture ***

LSE:BARC Barclays. Close Mid-Price: 168.08 Percentage Change: + 2.74% Day High: 168.26 Day Low: 164.1

Target met. Further movement against Barclays ABOVE 168.26 should improve ……..

</p

View Previous Barclays & Big Picture ***

LSE:BDEV Barrett Devs. Close Mid-Price: 428.9 Percentage Change: + 3.50% Day High: 428.8 Day Low: 415.4

In the event of Barrett Devs enjoying further trades beyond 428.8, the sh ……..

</p

View Previous Barrett Devs & Big Picture ***

LSE:CEY Centamin. Close Mid-Price: 119.95 Percentage Change: + 4.30% Day High: 120.45 Day Low: 115.6

Target met. All Centamin needs are mid-price trades ABOVE 120.45 to impro ……..

</p

View Previous Centamin & Big Picture ***

LSE:FRES Fresnillo. Close Mid-Price: 967.4 Percentage Change: + 7.30% Day High: 989 Day Low: 909.8

Target met. Further movement against Fresnillo ABOVE 989 should improve a ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:HIK Hikma Close Mid-Price: 1606 Percentage Change: -0.93% Day High: 1625 Day Low: 1600

Target met. Further movement against Hikma ABOVE 1625 should improve acce ……..

</p

View Previous Hikma & Big Picture ***

LSE:HSBA HSBC. Close Mid-Price: 543.5 Percentage Change: + 2.57% Day High: 544.8 Day Low: 532.7

All HSBC needs are mid-price trades ABOVE 544.8 to improve acceleration t ……..

</p

View Previous HSBC & Big Picture ***

LSE:ITRK Intertek. Close Mid-Price: 4205 Percentage Change: + 2.79% Day High: 4205 Day Low: 4116

All Intertek needs are mid-price trades ABOVE 4205 to improve acceleratio ……..

</p

View Previous Intertek & Big Picture ***

LSE:MKS Marks and Spencer. Close Mid-Price: 131.65 Percentage Change: + 3.95% Day High: 132.6 Day Low: 126.95

Target met. Further movement against Marks and Spencer ABOVE 132.6 should ……..

</p

View Previous Marks and Spencer & Big Picture ***

LSE:NWG Natwest. Close Mid-Price: 274.6 Percentage Change: + 1.29% Day High: 274.3 Day Low: 270.7

Target met. In the event of Natwest enjoying further trades beyond 274.3, ……..

</p

View Previous Natwest & Big Picture ***

LSE:OXIG Oxford Instruments Close Mid-Price: 2245 Percentage Change: -1.75% Day High: 2295 Day Low: 2210

Further movement against Oxford Instruments ABOVE 2295 should improve acc ……..

</p

View Previous Oxford Instruments & Big Picture ***

LSE:RR. Rolls Royce. Close Mid-Price: 101.4 Percentage Change: + 2.52% Day High: 100.76 Day Low: 95.8

Target met. In the event of Rolls Royce enjoying further trades beyond 10 ……..

</p

View Previous Rolls Royce & Big Picture ***

LSE:SBRY Sainsbury. Close Mid-Price: 235.7 Percentage Change: + 4.80% Day High: 236.2 Day Low: 225.7

Target met. All Sainsbury needs are mid-price trades ABOVE 236.2 to impro ……..

</p

View Previous Sainsbury & Big Picture ***

LSE:STAN Standard Chartered. Close Mid-Price: 660.4 Percentage Change: + 3.16% Day High: 662.2 Day Low: 639.8

Target met. Continued trades against STAN with a mid-price ABOVE 662.2 sh ……..

</p

View Previous Standard Chartered & Big Picture ***