#FTSE #WallSt

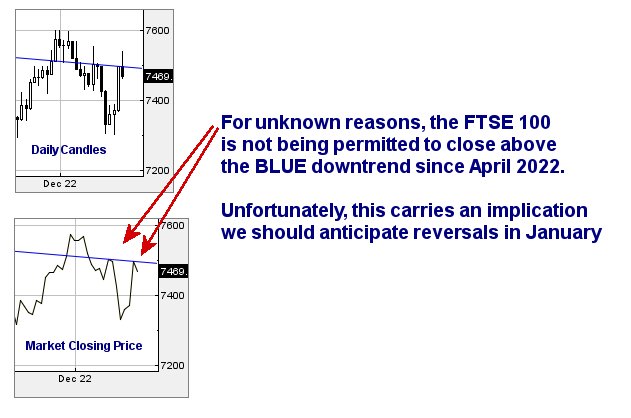

There’s something quite mysterious going on with the FTSE this week, almost a wilful effort to stifle market gains. It’s one of these movements which, at first glance, is a fanciful notion, the sort of nonsense spouted by conspiracy types. But once again, when we review the chart with closing prices vs intraday candles, the truth is shown with hideous clarity.

For today (23/12/22), the final few hours before Xmas needs to witness the FTSE close above roughly 7496.33 to suggest this Blue downtrend can be broken and in doing so, allow some cheer to intrude in our expectations. However, it doesn’t look great as for 5 sessions, the market has deemed closure above Blue as inviolate, suggesting we should anticipate the worst, probably in the new year.

From a near term perspective, we shall not be surprised in Friday actually produces very little in the way of movement, while everyone counts down the seconds until schools out at the LSE with FTSE closure at 12.30pm. However, there is a possibility of weakness below 7463 bringing a visit to a tame 7447 points and a possible bounce. Our secondary target level, should the initial break, works out at 7387 points. We’ve a strong suspicion such a secondary shouldn’t be expected until next week as it all feels like too much work for a lazy holiday period!

Our converse scenario demands the FTSE move above 7540 to be taken seriously, calculating with a lift potential to an initial 7557 with our secondary, if bettered, working out at 7643 points/ Once again, we think the secondary shall remain absent, even if triggered, until some time next week.

Have a good Xmas.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:57:57PM | BRENT | 82.17 | 81.16 | 80.745 | 82.01 | 83.37 | 83.56 | 82.5 | Success | ||

| 10:00:38PM | GOLD | 1792.29 | 1784 | 1776 | 1797 | 1803 | 1805 | 1794 | Success | ||

| 10:50:59PM | FTSE | 7474.17 | 7421 | 7375 | 7462 | 7482 | 7490 | 7448 | |||

| 10:53:22PM | STOX50 | 3834 | 3797 | 3771 | 3831 | 3889 | 3899 | 3840 | |||

| 11:03:56PM | GERMANY | 13943 | 13838 | 13786 | 13970 | 14164 | 14235 | 14030 | ‘cess | ||

| 11:09:35PM | US500 | 3819 | 3760 | 3715 | 3828 | 3829 | 3837 | 3792 | Success | ||

| 11:16:42PM | DOW | 33031 | 32830 | 32678 | 32966 | 33192 | 33494 | 32818 | Success | ||

| 11:18:49PM | NASDAQ | 10968 | 10900 | 10767 | 11020 | 10982 | 11041 | 10889 | Success | ||

| 11:20:57PM | JAPAN | 26119 | 25937 | 25805 | 26176 | 26769 | 26987 | 26402 |

22/12/2022 FTSE Closed at 7469 points. Change of -0.37%. Total value traded through LSE was: £ 4,366,369,327 a change of -6.1%

21/12/2022 FTSE Closed at 7497 points. Change of 1.72%. Total value traded through LSE was: £ 4,650,253,463 a change of -20.61%

20/12/2022 FTSE Closed at 7370 points. Change of 0.12%. Total value traded through LSE was: £ 5,857,237,056 a change of 57.46%

19/12/2022 FTSE Closed at 7361 points. Change of 0.4%. Total value traded through LSE was: £ 3,719,802,637 a change of -70.94%

16/12/2022 FTSE Closed at 7332 points. Change of -1.27%. Total value traded through LSE was: £ 12,798,409,041 a change of 152.21%

15/12/2022 FTSE Closed at 7426 points. Change of -0.92%. Total value traded through LSE was: £ 5,074,557,667 a change of -3.77%

14/12/2022 FTSE Closed at 7495 points. Change of -0.09%. Total value traded through LSE was: £ 5,273,114,917 a change of -15.16%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:ASC Asos** **LSE:BP. BP PLC** **LSE:DARK Darktrace Plc** **LSE:EZJ EasyJet** **LSE:HIK Hikma** **LSE:HSBA HSBC** **LSE:NWG Natwest** **LSE:STAN Standard Chartered** **LSE:ZOO Zoo Digital** **

********

Updated charts published on : Asos, BP PLC, Darktrace Plc, EasyJet, Hikma, HSBC, Natwest, Standard Chartered, Zoo Digital,

LSE:ASC Asos Close Mid-Price: 497 Percentage Change: -3.21% Day High: 519.5 Day Low: 486.4

In the event Asos experiences weakness below 486, it calculates with a dro ……..

</p

View Previous Asos & Big Picture ***

LSE:BP. BP PLC Close Mid-Price: 477.9 Percentage Change: -0.44% Day High: 485.05 Day Low: 476.5

In the event of BP PLC enjoying further trades beyond 486, the share shoul ……..

</p

View Previous BP PLC & Big Picture ***

LSE:DARK Darktrace Plc Close Mid-Price: 259.6 Percentage Change: -4.35% Day High: 271.7 Day Low: 259.7

The share is trying to prove the validity of our GaGa logic (circled). Con ……..

</p

View Previous Darktrace Plc & Big Picture ***

LSE:EZJ EasyJet Close Mid-Price: 337.7 Percentage Change: -2.26% Day High: 349.9 Day Low: 335.3

In the event EasyJet experiences weakness below 335, it calculates with a ……..

</p

View Previous EasyJet & Big Picture ***

LSE:HIK Hikma. Close Mid-Price: 1574 Percentage Change: + 0.96% Day High: 1579.5 Day Low: 1558

In the event of Hikma enjoying further trades beyond 1580, the share shoul ……..

</p

View Previous Hikma & Big Picture ***

LSE:HSBA HSBC. Close Mid-Price: 512.3 Percentage Change: + 0.20% Day High: 516 Day Low: 510.6

Now above 516 should still prove useful, giving the potential of an initia ……..

</p

View Previous HSBC & Big Picture ***

LSE:NWG Natwest Close Mid-Price: 264.6 Percentage Change: -0.23% Day High: 266.7 Day Low: 263.7

Further movement against Natwest ABOVE 267 should continue acceleration to ……..

</p

View Previous Natwest & Big Picture ***

LSE:STAN Standard Chartered Close Mid-Price: 625 Percentage Change: -0.13% Day High: 631.8 Day Low: 621.4

Target Met. Now above 632 looks capable of a cycle to 661 next with second ……..

</p

View Previous Standard Chartered & Big Picture ***

LSE:ZOO Zoo Digital. Close Mid-Price: 190 Percentage Change: + 4.11% Day High: 195 Day Low: 182.5

Above 195 promises 198 next with secondary, if beaten, a longer term 212 a ……..

</p

View Previous Zoo Digital & Big Picture ***