#Brent #Nasdaq

An unexpected advantage of receiving the Covid/Flu vaccines is a surprise inability to hear the faux screams of impoverished politicians confronted with Shell’s recent incursion into the kingdom of obscene profits, largely due to profiteering. A strange side effect is similar to a head cold, my hearing ability currently resembling someone wearing headphones, while listening to Yoko Ono music.

I’m told to anticipate also enjoying a fever, sometime within the next 36 hours.

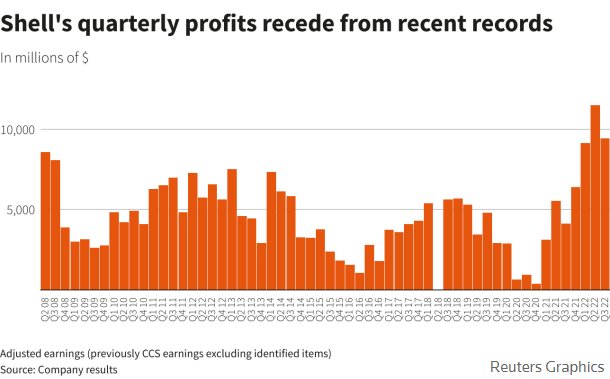

However, looking at the bar chart which supplies Shell’s performance each quarter since 2008, there was an immediate temptation to grab the numbers and run a series of calculations similar to those we use for shares. Unless Shell are careful, it looks like their next 1/4 report in January should be in the region of 11bn again, slightly below their July figure from earlier this year but a whimsical 2bn above Octobers figures, a number which doesn’t sound like it shall leave the company destitute. It’ll certainly be interesting to see how valid this projection proves, especially as oil prices continue to relaxThe company also announced the 5th increase in the level of dividend, since the pandemic low.

Hopefully the company remember to secrete some of their profits for the future, in preparation for future business interruptions.

Currently, Shell appear to be enjoying some useful potentials as we’ve two distinctly separate formula, each pointing at a future attempt around 2800p. We’re a little curious about this ambition as it visually challenges the high of 2018, when the share price reached 2810p. Our future target is marginally below the previous high, a reality which may prove problematic.

At time of writing, Shell are trading around 2356p and above just 2483p should be sufficient to kick-off another share price surge, giving an initial target at 2577p with our secondary, if beaten, calculating at 2797p and some almost certain hesitation. As always, we’ve an alternate scenario, one which suggests weakness below 2248p risks promoting reversal to an initial 2011 with our secondary, if broken, coming along at 1866p and a possible bounce.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:35:37PM | BRENT | 84.64 | 83.88 | 83.03 | 80.92 | 86.23 | 86.24 | 86.715 | 87.66 | 84.42 | Success |

| 10:39:18PM | GOLD | 1751.51 | ‘cess | ||||||||

| 10:43:04PM | FTSE | 7464 | ‘cess | ||||||||

| 10:45:00PM | STOX50 | 3954 | |||||||||

| 10:51:57PM | GERMANY | 14448 | |||||||||

| 10:53:41PM | US500 | 4035.32 | ‘cess | ||||||||

| 10:56:25PM | DOW | 34250.7 | Success | ||||||||

| 10:58:12PM | NASDAQ | 11858 | 11689 | 11635 | 11558 | 11765 | 11868 | 11918 | 11980 | 11708 | Success |

| 11:00:52PM | JAPAN | 28344 | ‘cess |

23/11/2022 FTSE Closed at 7465 points. Change of 0.17%. Total value traded through LSE was: £ 4,539,480,951 a change of 32.52%

22/11/2022 FTSE Closed at 7452 points. Change of 1.03%. Total value traded through LSE was: £ 3,425,428,256 a change of -30.51%

21/11/2022 FTSE Closed at 7376 points. Change of -0.12%. Total value traded through LSE was: £ 4,929,378,651 a change of -6.71%

18/11/2022 FTSE Closed at 7385 points. Change of 0.53%. Total value traded through LSE was: £ 5,283,705,968 a change of 16.51%

17/11/2022 FTSE Closed at 7346 points. Change of -0.31%. Total value traded through LSE was: £ 4,534,930,132 a change of -10.24%

15/11/2022 FTSE Closed at 7369 points. Change of -0.22%. Total value traded through LSE was: £ 5,052,481,735 a change of -8.73%

14/11/2022 FTSE Closed at 7385 points. Change of -100%. Total value traded through LSE was: £ 5,535,819,308 a change of 0%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AGM Applied Graphene** **LSE:FRES Fresnillo** **LSE:HIK Hikma** **LSE:IQE IQE** **LSE:NG. National Glib** **LSE:OXIG Oxford Instruments** **LSE:SBRY Sainsbury** **LSE:SRP Serco** **

********

Updated charts published on : Applied Graphene, Fresnillo, Hikma, IQE, National Glib, Oxford Instruments, Sainsbury, Serco,

LSE:AGM Applied Graphene Close Mid-Price: 3.35 Percentage Change: -31.63% Day High: 4.75 Day Low: 3.25

If Applied Graphene experiences continued weakness below 3.25, it will in ……..

</p

View Previous Applied Graphene & Big Picture ***

LSE:FRES Fresnillo. Close Mid-Price: 891.4 Percentage Change: + 0.61% Day High: 895.4 Day Low: 877.6

In the event of Fresnillo enjoying further trades beyond 895.4, the share ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:HIK Hikma. Close Mid-Price: 1511 Percentage Change: + 2.65% Day High: 1516 Day Low: 1466

Target met. Continued trades against HIK with a mid-price ABOVE 1516 shou ……..

</p

View Previous Hikma & Big Picture ***

LSE:IQE IQE. Close Mid-Price: 50 Percentage Change: + 1.42% Day High: 50.6 Day Low: 49

Further movement against IQE ABOVE 50.6 should improve acceleration towar ……..

</p

View Previous IQE & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 1032 Percentage Change: + 0.05% Day High: 1040.5 Day Low: 1025.5

All National Glib needs are mid-price trades ABOVE 1040.5 to improve acce ……..

</p

View Previous National Glib & Big Picture ***

LSE:OXIG Oxford Instruments. Close Mid-Price: 2210 Percentage Change: + 1.14% Day High: 2220 Day Low: 2140

Continued trades against OXIG with a mid-price ABOVE 2220 should improve ……..

</p

View Previous Oxford Instruments & Big Picture ***

LSE:SBRY Sainsbury. Close Mid-Price: 223.3 Percentage Change: + 1.18% Day High: 224.4 Day Low: 217.6

Target met. In the event of Sainsbury enjoying further trades beyond 224. ……..

</p

View Previous Sainsbury & Big Picture ***

LSE:SRP Serco Close Mid-Price: 168 Percentage Change: -1.23% Day High: 174.5 Day Low: 167.8

Further movement against Serco ABOVE 174.5 should improve acceleration to ……..

</p

View Previous Serco & Big Picture ***