#Gold #Stoxx50

We’re all in the wrong business and should retrain as Veterinarians. This epiphany came about when opening the mail as our local Vet finally had gotten around to sending out the bill for the removal of two teeth from a dog. There were no drama’s, no complications, and the dog still doesn’t hate the Vet the way I hate my dentist. A cheeky little £464 bill was enclosed, thanks to the Golden Retriever developing a habit of chewing stones she literally dives underwater for!

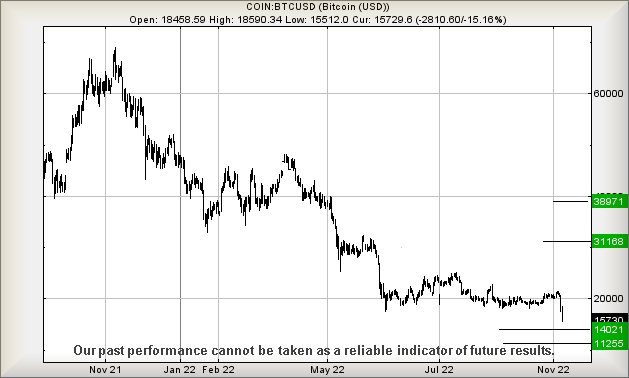

While this isn’t in the same financial ballpark, folk holding Bitcoin must be catatonic with the cost to their holdings, thanks to movements on November 9th. We fear the story isn’t over yet, despite the synchronicity of it painting lower lows exactly a year after its all time high.

Our previous glance at Bitcoin a couple of months ago proposed a very real threat of reversal to 16,200 dollars with secondary, if broken, at a toxic 12,900 dollars. The crypto currency eventually satisfied our criteria for a severe drop, hitting our initial drop target of 16,200 and hanging around for a whole 20 minutes. Then it fell further… We decided we’d better check our numbers to hopefully confirm where “bottom” actually should be.

Visually, there actually appears to be a chance of a bounce anytime now, thanks to the price closing on the Blue downtrend but given Bitcoin’s history of effectively reversing in $10k increments since it hit the 70,000 dollar level exactly a year ago, we’d be cautious in advocating the prospect of a bounce just yet. Instead, the current situation gives the prospect of a visit to 14,020 should the 15,500 level break with our secondary now calculating at 11,250 dollars. This secondary is quite interesting, rather neatly meeting the $10k drop increment criteria.

However, there’s something more important above the 11,250 level. We now cannot calculate a target below such a point and therefore suspect it almost must rebound at such a point. The bigger question is whether any bounce manages to somehow aim for the crypto’s previous highs?

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:42:28PM | BRENT | 91.89 | Success | ||||||||

| 9:44:42PM | GOLD | 1704.74 | 1701 | 1695 | 1686 | 1710 | 1722 | 1736 | 1748 | 1706 | |

| 9:46:40PM | FTSE | 7269.55 | |||||||||

| 9:51:39PM | STOX50 | 3705.4 | 3696 | 3689 | 3672 | 3716 | 3741 | 3754 | 3773 | 3710 | |

| 9:55:00PM | GERMANY | 13599 | |||||||||

| 10:03:26PM | US500 | 3752.62 | Success | ||||||||

| 10:06:00PM | DOW | 32538.2 | ‘cess | ||||||||

| 10:07:57PM | NASDAQ | 10805.15 | ‘cess | ||||||||

| 10:09:41PM | JAPAN | 27518 | Success |

9/11/2022 FTSE Closed at 7296 points. Change of -0.14%. Total value traded through LSE was: £ 4,054,252,272 a change of -13.25%

8/11/2022 FTSE Closed at 7306 points. Change of 0.1%. Total value traded through LSE was: £ 4,673,301,102 a change of -8.96%

7/11/2022 FTSE Closed at 7299 points. Change of -0.48%. Total value traded through LSE was: £ 5,133,479,286 a change of -2.79%

4/11/2022 FTSE Closed at 7334 points. Change of 2.03%. Total value traded through LSE was: £ 5,280,778,356 a change of 17.81%

3/11/2022 FTSE Closed at 7188 points. Change of 0.62%. Total value traded through LSE was: £ 4,482,607,171 a change of -6.53%

2/11/2022 FTSE Closed at 7144 points. Change of -0.58%. Total value traded through LSE was: £ 4,796,024,351 a change of -6.77%

1/11/2022 FTSE Closed at 7186 points. Change of 1.3%. Total value traded through LSE was: £ 5,144,430,090 a change of -18.4%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AML Aston Martin** **LSE:BLOE Block Energy PLC** **LSE:CEY Centamin** **LSE:ECO ECO (Atlantic) O & G** **LSE:FGP Firstgroup** **LSE:FRES Fresnillo** **LSE:IAG British Airways** **LSE:IPF International Personal Finance** **LSE:ITRK Intertek** **LSE:JET Just Eat** **LSE:MKS Marks and Spencer** **LSE:NG. National Glib** **LSE:OCDO Ocado Plc** **LSE:RR. Rolls Royce** **LSE:ZOO Zoo Digital** **

********

Updated charts published on : Aston Martin, Block Energy PLC, Centamin, ECO (Atlantic) O & G, Firstgroup, Fresnillo, British Airways, International Personal Finance, Intertek, Just Eat, Marks and Spencer, National Glib, Ocado Plc, Rolls Royce, Zoo Digital,

LSE:AML Aston Martin. Close Mid-Price: 143 Percentage Change: + 1.67% Day High: 146.1 Day Low: 136.4

Now above 147 looks capable of 153 next with secondary, if beaten, at a s ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:BLOE Block Energy PLC Close Mid-Price: 1.4 Percentage Change: -12.50% Day High: 1.6 Day Low: 1.35

Below 1.35 now suggests 1.28 next with secondary, if (when) broken at 0.90 ……..

</p

View Previous Block Energy PLC & Big Picture ***

LSE:CEY Centamin. Close Mid-Price: 98.78 Percentage Change: + 1.02% Day High: 99.72 Day Low: 97.5

Now above 100 points at 101.5 next with secondary, if bettered, up at 108. ……..

</p

View Previous Centamin & Big Picture ***

LSE:ECO ECO (Atlantic) O & G. Close Mid-Price: 42.5 Percentage Change: + 8.28% Day High: 44 Day Low: 42.5

Target Met. Now above 44 suggests coming movement to an initial 47.5 with ……..

</p

View Previous ECO (Atlantic) O & G & Big Picture ***

LSE:FGP Firstgroup Close Mid-Price: 96.3 Percentage Change: -9.92% Day High: 113.2 Day Low: 94.9

In the event Firstgroup experiences weakness below 94.9, it calculates wit ……..

</p

View Previous Firstgroup & Big Picture ***

LSE:FRES Fresnillo. Close Mid-Price: 821.4 Percentage Change: + 1.78% Day High: 829.6 Day Low: 805.2

Target Met. Wow, that was concise! Now above 830 should prove capable of t ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:IAG British Airways. Close Mid-Price: 129.98 Percentage Change: + 0.25% Day High: 130.36 Day Low: 127.74

In the event of British Airways enjoying further trades beyond 130.36, th ……..

</p

View Previous British Airways & Big Picture ***

LSE:IPF International Personal Finance Close Mid-Price: 76 Percentage Change: -2.69% Day High: 76.6 Day Low: 76

Now below 71 suggests reversal to an initial 65 with secondary, if broken, ……..

</p

View Previous International Personal Finance & Big Picture ***

LSE:ITRK Intertek Close Mid-Price: 3876 Percentage Change: -0.41% Day High: 3912 Day Low: 3867

Continued trades against ITRK with a mid-price ABOVE 3912 should improve t ……..

</p

View Previous Intertek & Big Picture ***

LSE:JET Just Eat Close Mid-Price: 1812 Percentage Change: -0.88% Day High: 1846.4 Day Low: 1794.4

Further movement against Just Eat ABOVE 1847 should improve acceleration t ……..

</p

View Previous Just Eat & Big Picture ***

LSE:MKS Marks and Spencer Close Mid-Price: 113.1 Percentage Change: -3.37% Day High: 119.7 Day Low: 108.9

In the event of Marks and Spencer enjoying further trades beyond 119.8, t ……..

</p

View Previous Marks and Spencer & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 986.6 Percentage Change: + 0.88% Day High: 987.6 Day Low: 966.4

Continued trades against NG. with a mid-price ABOVE 988 should improve the ……..

</p

View Previous National Glib & Big Picture ***

LSE:OCDO Ocado Plc Close Mid-Price: 668.4 Percentage Change: -5.00% Day High: 709 Day Low: 669.8

Continued trades against OCDO with a mid-price ABOVE 709 should improve th ……..

</p

View Previous Ocado Plc & Big Picture ***

LSE:RR. Rolls Royce. Close Mid-Price: 88.62 Percentage Change: + 0.20% Day High: 89.49 Day Low: 87.04

Above 90 suggests the potential of recovery to an initial 97p next with se ……..

</p

View Previous Rolls Royce & Big Picture ***

LSE:ZOO Zoo Digital Close Mid-Price: 180 Percentage Change: -2.70% Day High: 188.5 Day Low: 177.5

Above 189 comes with the hope of ongoing promises to 198 next with seconda ……..

</p

View Previous Zoo Digital & Big Picture ***