#Gold #SP500

Due to my little bout of leukaemia (incurable but treatable), I’ve become used to being singled out, when called in for Covid-19 vaccines. However, today brought a shock. The village hall had a Vaccine Day and I hadn’t been called! Popping along revealed a pleasant truth; it was “Only For Grown Ups.” It’s quite nice to discover I was too young for something, the current vaccine only being given to Over 65’s.

Another thing we currently suspect as being “Only For Grown Ups” is Bitcoin and the chart illustrates, quite clearly, why. The crypto has formed a Glass Floor just above the 18,700 level and is behaving badly, almost as if it’s trying to convince folk this level is impermeable. Our suspicion remains of the crypto lying in wait, the market planning a “Gotcha Suckers” movement with closure below 18,700 making reversal to 16,200 with secondary, if (when) broken at a bottom around 12,900 dollars.

Remember, Bitcoin appeared to stabilise between 40k & 50k for three months at the start of this year, then fell sharply. It also stabilised between 60 & 70k for a couple of months at the end of 2021. We’re far from convinced the current four month period of “stability” between 20 & 25k shall assure the market a bottom has been found and, literally daily, now expect to see yet another “gotcha” drop.

On the bright side, we do anticipate a reasonable bounce if the $13,000 level makes itself known.

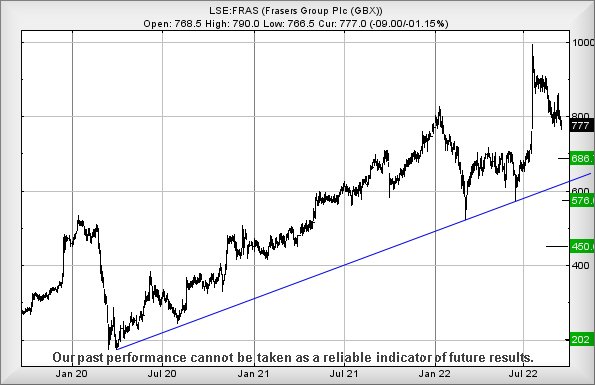

Frasers Group Plc Frasers share price is presenting a bit of a puzzle currently. A couple of pretty significant news items fuelled a suspicion of happier times coming but the reality looks quite different. Perhaps Mr Ashley stepping down from the board is a bad thing, along with other news the company is returning to the FTSE 100. A chair at the top table of the UK market has been created, due to Meggitt being bought over by US defence giant Parker Hannifin.

Maybe it’s the case the market regards the retail market as facing challenging conditions, due to ridiculous inflation coupled with an expected recession impacting company profit margins.

For now, the visuals suggest ongoing weakness below 765p shall promote the potential of share price reversal to an initial 688p. Should such a price level break, our secondary presents a major issue as it calculates down at 576p, along with a break of the uptrend since 2020. Movement like this effectively risks triggering a “Big Picture” scenario, along with the potential of reversal commencing to an eventual bottom around 202p.

We’d love to say this drop target is ridiculous but a glance at the chart below reveals an unpleasant reality. It has been there, done that, and there’s no rule inhibiting it happening again. Well, perhaps that’s wrong as their share price need only exceed 866p to turn this miserable outlook into a pile of tosh.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:19:13PM | BRENT | 90.17 | Shambles | ||||||||

| 10:21:02PM | GOLD | 1665.38 | 1659 | 1653 | 1645 | 1668 | 1680 | 1684 | 1692 | 1670 | |

| 10:23:27PM | FTSE | 7194 | Success | ||||||||

| 10:25:46PM | STOX50 | 3464 | Success | ||||||||

| 10:28:09PM | GERMANY | 12653 | Shambles | ||||||||

| 10:29:59PM | US500 | 3862 | 3826 | 3803 | 3765 | 3890 | 3920 | 3950 | 3990 | 3893 | ‘cess |

| 10:31:52PM | DOW | 30746 | ‘cess | ||||||||

| 10:34:23PM | NASDAQ | 11876 | |||||||||

| 10:36:45PM | JAPAN | 27453 | Success |

20/09/2022 FTSE Closed at 7192 points. Change of -0.61%. Total value traded through LSE was: £ 5,386,737,074 a change of -59.64%

16/09/2022 FTSE Closed at 7236 points. Change of -0.63%. Total value traded through LSE was: £ 13,346,961,271 a change of 170.28%

15/09/2022 FTSE Closed at 7282 points. Change of 0.07%. Total value traded through LSE was: £ 4,938,182,265 a change of -14.27%

14/09/2022 FTSE Closed at 7277 points. Change of -1.46%. Total value traded through LSE was: £ 5,760,077,523 a change of 12.58%

13/09/2022 FTSE Closed at 7385 points. Change of -1.18%. Total value traded through LSE was: £ 5,116,295,478 a change of -13.94%

12/09/2022 FTSE Closed at 7473 points. Change of 1.66%. Total value traded through LSE was: £ 5,944,877,720 a change of 11.08%

9/09/2022 FTSE Closed at 7351 points. Change of -100%. Total value traded through LSE was: £ 5,351,894,776 a change of 0%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:ASC Asos** **LSE:BT.A British Telecom** **LSE:IGG IG Group** **LSE:ITM ITM Power** **LSE:ITRK Intertek** **LSE:LLOY Lloyds Grp.** **LSE:MKS Marks and Spencer** **LSE:NG. National Glib** **LSE:OCDO Ocado Plc** **LSE:PHP Primary Health** **LSE:PPC President Energy** **LSE:RMG Royal Mail** **LSE:SBRY Sainsbury** **LSE:SPX Spirax** **LSE:TSCO Tesco** **

********

Updated charts published on : Asos, British Telecom, IG Group, ITM Power, Intertek, Lloyds Grp., Marks and Spencer, National Glib, Ocado Plc, Primary Health, President Energy, Royal Mail, Sainsbury, Spirax, Tesco,

LSE:ASC Asos. Close Mid-Price: 639.5 Percentage Change: + 1.19% Day High: 643.5 Day Low: 605.5

If Asos experiences continued weakness below 605.5, it will invariably le ……..

</p

View Previous Asos & Big Picture ***

LSE:BT.A British Telecom Close Mid-Price: 136.95 Percentage Change: -1.51% Day High: 141.35 Day Low: 136.55

Continued weakness against BT.A taking the price below 136.55 calculates ……..

</p

View Previous British Telecom & Big Picture ***

LSE:IGG IG Group Close Mid-Price: 784 Percentage Change: -1.01% Day High: 798 Day Low: 780

Continued weakness against IGG taking the price below 780 calculates as l ……..

</p

View Previous IG Group & Big Picture ***

LSE:ITM ITM Power Close Mid-Price: 109.95 Percentage Change: -4.47% Day High: 116.6 Day Low: 105.25

If ITM Power experiences continued weakness below 105.25, it will invaria ……..

</p

View Previous ITM Power & Big Picture ***

LSE:ITRK Intertek Close Mid-Price: 3821 Percentage Change: -1.95% Day High: 3923 Day Low: 3828

Weakness on Intertek below 3828 will invariably lead to 3806 with seconda ……..

</p

View Previous Intertek & Big Picture ***

LSE:LLOY Lloyds Grp.. Close Mid-Price: 49 Percentage Change: + 2.50% Day High: 48.98 Day Low: 48.04

All Lloyds Grp. needs are mid-price trades ABOVE 48.98 to improve acceler ……..

</p

View Previous Lloyds Grp. & Big Picture ***

LSE:MKS Marks and Spencer Close Mid-Price: 111.75 Percentage Change: -2.23% Day High: 115.5 Day Low: 110.8

In the event Marks and Spencer experiences weakness below 110.8 it calcul ……..

</p

View Previous Marks and Spencer & Big Picture ***

LSE:NG. National Glib Close Mid-Price: 1019 Percentage Change: -1.64% Day High: 1047 Day Low: 1016.5

Weakness on National Glib below 1016.5 will invariably lead to 953 with s ……..

</p

View Previous National Glib & Big Picture ***

LSE:OCDO Ocado Plc Close Mid-Price: 606.4 Percentage Change: -9.63% Day High: 674.2 Day Low: 603.6

Target met. Continued weakness against OCDO taking the price below 603.6 ……..

</p

View Previous Ocado Plc & Big Picture ***

LSE:PHP Primary Health Close Mid-Price: 128.8 Percentage Change: -2.57% Day High: 132.4 Day Low: 127

Continued weakness against PHP taking the price below 127 calculates as l ……..

</p

View Previous Primary Health & Big Picture ***

LSE:PPC President Energy. Close Mid-Price: 1.15 Percentage Change: + 2.22% Day High: 1.15 Day Low: 1.07

Target met. If President Energy experiences continued weakness below 1.07 ……..

</p

View Previous President Energy & Big Picture ***

LSE:RMG Royal Mail Close Mid-Price: 214.4 Percentage Change: -6.66% Day High: 233.1 Day Low: 211.6

Continued weakness against RMG taking the price below 211.6 calculates as ……..

</p

View Previous Royal Mail & Big Picture ***

LSE:SBRY Sainsbury Close Mid-Price: 194.2 Percentage Change: -4.24% Day High: 204.6 Day Low: 193.8

Target met. In the event Sainsbury experiences weakness below 193.8 it ca ……..

</p

View Previous Sainsbury & Big Picture ***

LSE:SPX Spirax Close Mid-Price: 10065 Percentage Change: -0.05% Day High: 10185 Day Low: 9962

If Spirax experiences continued weakness below 9962, it will invariably l ……..

</p

View Previous Spirax & Big Picture ***

LSE:TSCO Tesco Close Mid-Price: 224.1 Percentage Change: -3.20% Day High: 233.4 Day Low: 222.9

In the event Tesco experiences weakness below 222.9 it calculates with a ……..

</p

View Previous Tesco & Big Picture ***