#FTSE #DOW

Miracles do happen. Sitting at my desk and turning on my chair, I knocked a full cup of coffee off the desk and somehow, it landed bottom down. The only problem, it was now missing half its contents as it clearly had spun in mid air, spraying coffee upward over my keyboard, my trousers, a monitor, and spitefully, my left shoe. The experience proved somewhat whimsical, sipping half a perfect coffee while cleaning the mess with kitchen towels.

If someone had told me the story, I’d have believed it impossible. But on further consideration, once it splashed half the contents everywhere, there was probably the perfect weight left to inhibit a bounce when it landed. If only the markets were as predictable…

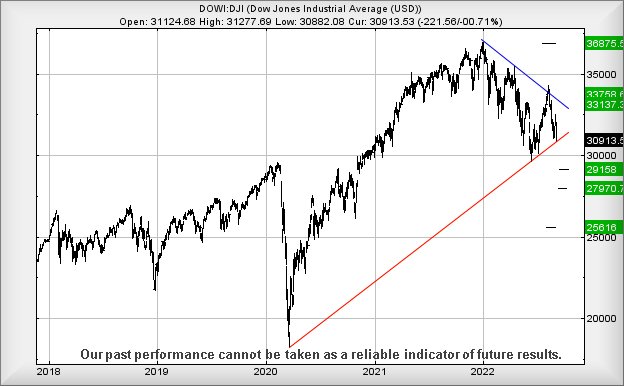

Writing this with 30 minutes to go before Wall St closes, we’ve taken a look at the uptrend since the Pandemic Drop in March 2020 and can calculate Wall St needs close above 30,914 points to avoid breaking below Red on the chart, destroying a pretty trend line and exposing the index to the risk of reversal, potentially to a bottom just above the 25,000 level. This sort of thing chimes true with the virtual industry in the USA, all sagely predicting the markets are due a correction in the final quarter of this year. We’ve been quite hesitant at accepting their predictions as gospel but now, with closure below the trend line, it’s a reason to pause for thought.

The Big Picture (aka, not in one day) situation now suggests weakness below 30,882 points risks reversal to 29,158 points and a short lived bounce. Our secondary, when this target level breaks, works out at 27,970 points, presenting a price level where a rebound is ‘almost’ certain. But closure below such a target level risks the index finding its way down to 25,600 points eventually!

As can be assumed, for those with a nerdish frame of mind, this evening is “interesting”, particularly because it’s clear the US index has been playing an elaborate game of chicken with this trend line since 8.13 this evening, almost as if ‘they’ know folk are watching it closely.

Now, with just 17 minutes until the market closes plus another 15 minutes for them to sort themselves out, perhaps we’re about to witness the edge of a disaster. Or perhaps we’re about to witness a panic recovery on Wall St. The excitement in the office is palpable, like watching paint dry!

STOP PRESS: Wall St closed at 30,951 points, remaining in relative safety. The market does not appear ready to immolate itself just yet.

FTSE for Friday (FTSE:UKX) If the FTSE intends throw itself off a similar cliff to that which Wall St faces, it currently needs close below 7162 points to kick open the door marked winter. However, the immediate outlook for Friday isn’t rosy and the FTSE only needs below 7258 points to risk triggering reversal to an initial 7193 points. Should such a target level break, our secondary calculates at 7103 points, pretty firmly in the region where longer term trouble becomes possible. If triggered, the index needs above 7354 points to greatly diminish the reversal potentials.

If the FTSE intends any form of miracle recovery, above the aforementioned potential stop loss level of 7354 looks interesting, perhaps able to provoke market recovery to an initial 7403 points with secondary, if bettered, at an impossible (in the short term) looking 7553 points.

Have a good long weekend.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:37:41PM | BRENT | 90.25 | 89.52 | 88.66 | 90.42 | 91.16 | 91.695 | 90.44 | ‘cess | ||

| 9:40:09PM | GOLD | 1664.57 | 1660 | 1654 | 1667 | 1671 | 1674 | 1665 | Success | ||

| 9:42:11PM | FTSE | 7255 | 7251 | 7219 | 7300 | 7329 | 7356 | 7292 | |||

| 9:44:51PM | STOX50 | 3528.8 | 3521 | 3496 | 3542 | 3585 | 3590 | 3555 | ‘cess | ||

| 9:46:57PM | GERMANY | 12904.34 | 12896 | 12867 | 12965 | 13113 | 13133 | 13050 | ‘cess | ||

| 9:49:34PM | US500 | 3889 | 3886 | 3867 | 3926 | 3961 | 3976 | 3931 | ‘cess | ||

| 9:52:22PM | DOW | 30894 | 30864 | 30765 | 31166 | 31278 | 31435 | 31106 | |||

| 9:54:55PM | NASDAQ | 11892 | 11859 | 11828 | 12000 | 12190 | 12304 | 12122 | |||

| 9:57:13PM | JAPAN | 27658 | 27635 | 27240 | 27793 | 27930 | 28054 | 27803 |

15/09/2022 FTSE Closed at 7282 points. Change of 0.07%. Total value traded through LSE was: £ 4,938,182,265 a change of -14.27%

14/09/2022 FTSE Closed at 7277 points. Change of -1.46%. Total value traded through LSE was: £ 5,760,077,523 a change of 12.58%

13/09/2022 FTSE Closed at 7385 points. Change of -1.18%. Total value traded through LSE was: £ 5,116,295,478 a change of -13.94%

12/09/2022 FTSE Closed at 7473 points. Change of 1.66%. Total value traded through LSE was: £ 5,944,877,720 a change of 11.08%

9/09/2022 FTSE Closed at 7351 points. Change of 1.23%. Total value traded through LSE was: £ 5,351,894,776 a change of 1.51%

8/09/2022 FTSE Closed at 7262 points. Change of 0.35%. Total value traded through LSE was: £ 5,272,168,524 a change of -28.82%

7/09/2022 FTSE Closed at 7237 points. Change of -0.86%. Total value traded through LSE was: £ 7,407,245,342 a change of 30.74%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AML Aston Martin** **LSE:CCL Carnival** **LSE:HIK Hikma** **LSE:LLOY Lloyds Grp.** **LSE:NG. National Glib** **LSE:NWG Natwest** **LSE:PPC President Energy** **LSE:TSCO Tesco** **

********

Updated charts published on : Aston Martin, Carnival, Hikma, Lloyds Grp., National Glib, Natwest, President Energy, Tesco,

LSE:AML Aston Martin. Close Mid-Price: 179.9 Percentage Change: + 17.05% Day High: 179.9 Day Low: 150.2

I think “they” are just playing games with AML share price. The situation ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:CCL Carnival. Close Mid-Price: 832 Percentage Change: + 8.16% Day High: 844 Day Low: 785.6

In the event of Carnival enjoying further trades beyond 844, the share sh ……..

</p

View Previous Carnival & Big Picture ***

LSE:HIK Hikma Close Mid-Price: 1231.5 Percentage Change: -0.85% Day High: 1243 Day Low: 1212.5

Target met. Continued weakness against HIK taking the price below 1212.5 ……..

</p

View Previous Hikma & Big Picture ***

LSE:LLOY Lloyds Grp.. Close Mid-Price: 47.62 Percentage Change: + 3.05% Day High: 47.89 Day Low: 46.38

Continued trades against LLOY with a mid-price ABOVE 47.89 should improve ……..

</p

View Previous Lloyds Grp. & Big Picture ***

LSE:NG. National Glib Close Mid-Price: 1034.5 Percentage Change: -1.80% Day High: 1051 Day Low: 1030.5

If National Gridl experiences continued weakness below 1030, it will inva ……..

</p

View Previous National Glib & Big Picture ***

LSE:NWG Natwest. Close Mid-Price: 274.2 Percentage Change: + 1.67% Day High: 275.8 Day Low: 272.4

In the event of Natwest enjoying further trades beyond 275.8, the share s ……..

</p

View Previous Natwest & Big Picture ***

LSE:PPC President Energy Close Mid-Price: 1.12 Percentage Change: -2.17% Day High: 1.15 Day Low: 1.12

In the event President Energy experiences weakness below 1.12 it calculat ……..

</p

View Previous President Energy & Big Picture ***

LSE:TSCO Tesco Close Mid-Price: 232 Percentage Change: -2.23% Day High: 238.9 Day Low: 230.9

Weakness on Tesco below 230.9 will invariably lead to 229 with secondary ……..

</p

View Previous Tesco & Big Picture ***