#Brent #SP500 We never expected to be confirming how successful a polymer companies products are but, in the case of Synthomer, we can testify their bitumen adhesive is superb, remaining pliable, waterproof, and is a complete sod to remove from human skin and the hair. Panic reading of the ingredients of the black gloop came with the realisation this very successful British company were involved in the contents. Most of which I was now ‘wearing’.

It all started with a good idea, gluing a roll of bitumen sheet to a steel roof, attempting to finally cure the level of condensation inside the shed. One half of the shed was easily treated, the gooey black adhesive painted on and solidly grabbing the roll of roofing bitumen. The rear of the shed was a different story, a spectacular drop available into a stream 12 feet below if the ladders shoogled the wrong way. The suggestion the roofing sheet be treated similar to wall-paper, the adhesive applied to the roll, not to the metal roof, was quickly adopted and within minutes, I was at the top of the ladders, starting to unfold the roofing sheet.

A gust of wind caught the 5 metre sheet, causing it to wrap around the idiot (me) at the top of the ladders, quickly bonding me to the side of the shed, along with the ladders. Utter panic ensued along with a painful realisation this was not a job I should be doing on my own. At least there was very little chance I’d topple backward into the stream below, thanks to the bonding capability of Synthomer’s fabulous product. But unfortunately, wrapped in black sticky glue, the only response was to tear myself out of the wrapping as I didn’t fancy a career as a human burrito.

Once my wife stopped laughing, when I appeared outside the kitchen window, she drove to the local hardware store to buy plenty of paint remover. The latex gloves I’d been wearing were a distant memory, the short sleeved shirt provided zero protection against the black ooze, and thankfully the shorts I’d been wearing were due to be replaced. Several hours later, the worst of the gunge had been removed, a long soak in a hot bath assisted the attempts to get the product out from under my fingernails, and we were confident my hair would grow back as it was decided it was safer to cut the worst off, rather than attempt trying to replace shampoo with paint brush cleaner.

As for Synthomers fundamentals, do your own research! However, from a personal perspective, their product works well but unfortunately, the markets look a bit nervous in the way their share price is moving.

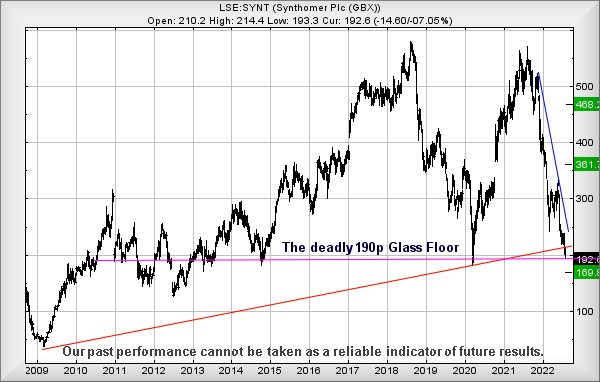

Since 2014, there’s been a visual promise the share price has a logical “floor” around 190p and once again, the market is tap dancing at this level. Doubtless, a bunch of folk will be anticipating a bounce anytime soon but unfortunately, we’re starting to develop some doubts. The ongoing problem with “glass ceilings” or “floors” is fairly brutal. They usually break around the 3rd or 4th time they are assaulted. Currently, the price is, for the 3rd time, engaging with this hypothetical floor but unfortunately, the share price has also dripped below the Red uptrend on the chart, a line which dates back to 2009. Basically, all the pieces are in place for a loss of confidence for any immediate bounce.

Thankfully, the curious series of movements since the pandemic hit tend suggest ongoing weakness below 192p should hopefully “only” provoke relaxation to 169p and hopefully a proper recoil. Our secondary target level calculates at 159p, virtually the same number. We literally cannot calculate a bottom number below 159p. This results in a scenario, by our own in-house rules, of a strong expectation for a bounce, ideally just above the 169p level.

In the event everything intends suddenly go right, the price presently needs better Blue on the chart, currently around 260p, to enter a cycle which gives a vague promise of a distant 468p.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:49:06PM | BRENT | 96.87 | 96.27 | 95.6 | 93.2 | 97.82 | 98.99 | 99.65 | 100.77 | 97.84 | Success |

| 9:51:14PM | GOLD | 1765 | |||||||||

| 9:55:25PM | FTSE | 7456 | Success | ||||||||

| 9:58:22PM | STOX50 | 3740 | Success | ||||||||

| 10:42:25PM | GERMANY | 13624 | Success | ||||||||

| 10:44:47PM | US500 | 4151.52 | 4123 | 4110 | 4091 | 4139 | 4159 | 4174 | 4187 | 4141 | Success |

| 10:47:04PM | DOW | 32806 | Success | ||||||||

| 11:18:01PM | NASDAQ | 13221 | Success | ||||||||

| 11:19:59PM | JAPAN | 27995 | Success |

3/08/2022 FTSE Closed at 7445 points. Change of 0.49%. Total value traded through LSE was: £ 5,602,756,478 a change of -3.28%

2/08/2022 FTSE Closed at 7409 points. Change of -0.05%. Total value traded through LSE was: £ 5,792,539,911 a change of 52.35%

1/08/2022 FTSE Closed at 7413 points. Change of -0.13%. Total value traded through LSE was: £ 3,802,113,332 a change of -37.81%

29/07/2022 FTSE Closed at 7423 points. Change of 1.06%. Total value traded through LSE was: £ 6,113,428,375 a change of 2.61%

28/07/2022 FTSE Closed at 7345 points. Change of -0.04%. Total value traded through LSE was: £ 5,958,117,609 a change of -17.71%

27/07/2022 FTSE Closed at 7348 points. Change of 0.57%. Total value traded through LSE was: £ 7,240,157,901 a change of 9.37%

26/07/2022 FTSE Closed at 7306 points. Change of 0%. Total value traded through LSE was: £ 6,619,636,706 a change of 9.19%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BP. BP PLC** **LSE:CBX Cellular Goods** **LSE:DARK Darktrace Plc** **LSE:EXPN Experian** **LSE:IGG IG Group** **LSE:IPF International Personal Finance** **LSE:OCDO Ocado Plc** **LSE:ODX Omega Diags** **LSE:PMG Parkmead** **LSE:TRN The Trainline** **LSE:ZOO Zoo Digital** **

********

Updated charts published on : BP PLC, Cellular Goods, Darktrace Plc, Experian, IG Group, International Personal Finance, Ocado Plc, Omega Diags, Parkmead, The Trainline, Zoo Digital,

LSE:BP. BP PLC. Close Mid-Price: 410.7 Percentage Change: + 1.82% Day High: 416 Day Low: 402.4

Further movement against BP PLC ABOVE 416 should improve acceleration tow ……..

</p

View Previous BP PLC & Big Picture ***

LSE:CBX Cellular Goods Close Mid-Price: 2.1 Percentage Change: -25.00% Day High: 3.05 Day Low: 2.05

All Cellular Goods needs are mid-price trades ABOVE 3.05 to improve accel ……..

</p

View Previous Cellular Goods & Big Picture ***

LSE:DARK Darktrace Plc. Close Mid-Price: 399.9 Percentage Change: + 4.74% Day High: 399.8 Day Low: 377.3

Target met. Further movement against Darktrace Plc ABOVE 399.8 should imp ……..

</p

View Previous Darktrace Plc & Big Picture ***

LSE:EXPN Experian. Close Mid-Price: 2896 Percentage Change: + 1.44% Day High: 2893 Day Low: 2840

Continued trades against EXPN with a mid-price ABOVE 2893 should improve ……..

</p

View Previous Experian & Big Picture ***

LSE:IGG IG Group. Close Mid-Price: 814 Percentage Change: + 2.58% Day High: 820 Day Low: 787.5

In the event of IG Group enjoying further trades beyond 820, the share sh ……..

</p

View Previous IG Group & Big Picture ***

LSE:IPF International Personal Finance Close Mid-Price: 105 Percentage Change: -0.94% Day High: 109 Day Low: 99.1

Further movement against International Personal Finance ABOVE 109 should ……..

</p

View Previous International Personal Finance & Big Picture ***

LSE:OCDO Ocado Plc. Close Mid-Price: 912.2 Percentage Change: + 4.90% Day High: 919.4 Day Low: 857

All Ocado Plc needs are mid-price trades ABOVE 919.4 to improve accelerat ……..

</p

View Previous Ocado Plc & Big Picture ***

LSE:ODX Omega Diags. Close Mid-Price: 3.38 Percentage Change: + 5.47% Day High: 3.8 Day Low: 3.35

Further movement against Omega Diags ABOVE 3.8 should improve acceleratio ……..

</p

View Previous Omega Diags & Big Picture ***

LSE:PMG Parkmead. Close Mid-Price: 79 Percentage Change: + 7.63% Day High: 79.6 Day Low: 73

Target met. All Parkmead needs are mid-price trades ABOVE 79.6 to improve ……..

</p

View Previous Parkmead & Big Picture ***

LSE:TRN The Trainline Close Mid-Price: 401.4 Percentage Change: -1.62% Day High: 416.3 Day Low: 397.8

Target met. In the event of The Trainline enjoying further trades beyond ……..

</p

View Previous The Trainline & Big Picture ***

LSE:ZOO Zoo Digital. Close Mid-Price: 140 Percentage Change: + 4.48% Day High: 140 Day Low: 134

Continued trades against ZOO with a mid-price ABOVE 140 should improve th ……..

</p

View Previous Zoo Digital & Big Picture ***