#FTSE #STOXX50

With news the incompetent UK Prime Minister was finally doing the right thing, we’d expected the FTSE to show some flamboyant behaviour but it proved not the case. It’s hard to believe the bloke is hanging onto the job for a few more months, so he can get free use of Chequers, the official PM residence, for his next wedding & the unusual experience of hosting a party without being fined.

This tends encapsulate the impression given by the PM throughout the pandemic, essentially not caring about anything other than personal vanity.

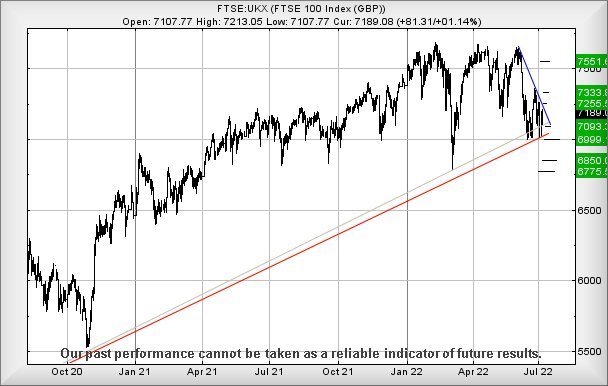

When the PM made his announcement, the FTSE did manage to rise immediately by a fairly trivial 25 points, deciding to stabilise around the 7200 point level for the rest of the session. We certainly could not describe it as a wild celebration by the markets due to Boris’s less than graceful exit. If we’re honest, we still suspect the FTSE is awaiting an excuse for a bit of a bloodletting, thanks to its behaviour since the start of June. Initially, July started with the first couple of trading days showing astoundingly low volumes, making us fear the worst. However, volumes appear to have returned to “normal” levels and the FTSE now requires exceed just 7220 points to kick its way through the immediate Blue downtrend. Thankfully, there are some immediate potentials which suggest slight optimism may be permissible.

Currently, above 7220 should prove capable of triggering movement to an initial 7255 points, a modest 35 point rise. If exceeded, our secondary calculates at 7333 points, visually matching the highs of last month doubtless provoking some hesitation for this reason. It’s important we mention our suspicion of a coming near term bloodbath recedes quite dramatically in this scenario, the FTSE proving able to break free of the suspiciously concise Blue downtrend..

For things to start going wrong for the FTSE, the index needs flop below 7135 points to risk triggering reversal to an initial 7093 points. In the event this level breaks, things risk becoming quite twitchy as our secondary works out at 6999 points, below the Red uptrend since 2020. This represents a market level which could swiftly lose another 200 points without much effort, should the markets discover news which is perceived as bad.

Have a good weekend, the weather looks great and hopefully the Austrian GP proves as entertaining as last weekends efforts from Silverstone.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:59:58PM | BRENT | 103.16 | 97.65 | 95.86 | 100.22 | 105.28 | 106.71 | 102.5 | Success | ||

| 10:01:51PM | GOLD | 1740.41 | 1736 | 1732 | 1745 | 1750 | 1756 | 1739 | |||

| 10:04:49PM | FTSE | 7194.01 | 7126 | 7112 | 7168 | 7214 | 7234 | 7169 | ‘cess | ||

| 10:09:55PM | STOX50 | 3491 | 3450 | 3445 | 3490 | 3498 | 3509 | 3470 | |||

| 10:13:17PM | GERMANY | 12853 | 12701 | 12689 | 12767 | 12877 | 12923 | 12798 | ‘cess | ||

| 10:32:30PM | US500 | 3895 | 3829 | 3812 | 3865 | 3911 | 3928 | 3881 | ‘cess | ||

| 10:39:31PM | DOW | 31351 | 31034 | 30885 | 31190 | 31431 | 31593 | 31305 | ‘cess | ||

| 10:44:17PM | NASDAQ | 12092 | 11859 | 11757 | 11945 | 12138 | 12252 | 11996 | |||

| 10:53:44PM | JAPAN | 26630 | 26376 | 26295 | 26585 | 26692 | 26844 | 26457 | Success |

7/07/2022 FTSE Closed at 7189 points. Change of 1.15%. Total value traded through LSE was: £ 7,840,836,272 a change of 27.41%

6/07/2022 FTSE Closed at 7107 points. Change of 1.17%. Total value traded through LSE was: £ 6,153,962,952 a change of -14.34%

5/07/2022 FTSE Closed at 7025 points. Change of -2.86%. Total value traded through LSE was: £ 7,184,234,461 a change of 102.6%

4/07/2022 FTSE Closed at 7232 points. Change of 0.64%. Total value traded through LSE was: £ 3,546,030,521 a change of -26.75%

1/07/2022 FTSE Closed at 7186 points. Change of 0.24%. Total value traded through LSE was: £ 4,840,883,193 a change of -20.03%

30/06/2022 FTSE Closed at 7169 points. Change of -1.96%. Total value traded through LSE was: £ 6,053,180,020 a change of 8.35%

29/06/2022 FTSE Closed at 7312 points. Change of -0.15%. Total value traded through LSE was: £ 5,586,821,429 a change of -8.41%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:ASC Asos** **LSE:AZN Astrazeneca** **LSE:BBY BALFOUR BEATTY** **LSE:GKP Gulf Keystone** **LSE:GLEN Glencore Xstra** **LSE:HSBA HSBC** **LSE:MKS Marks and Spencer** **LSE:OCDO Ocado Plc** **LSE:PMG Parkmead** **LSE:PPC President Energy** **LSE:SCLP Scancell** **LSE:SDY Speedyhire** **LSE:SPX Spirax** **LSE:TERN Tern Plc** **LSE:TW. Taylor Wimpey** **

********

Updated charts published on : Asos, Astrazeneca, BALFOUR BEATTY, Gulf Keystone, Glencore Xstra, HSBC, Marks and Spencer, Ocado Plc, Parkmead, President Energy, Scancell, Speedyhire, Spirax, Tern Plc, Taylor Wimpey,

LSE:ASC Asos. Close Mid-Price: 982.5 Percentage Change: + 8.09% Day High: 981.5 Day Low: 896.5

Above 983 still looks capable of a lift to 992 with secondary, if bettered ……..

</p

View Previous Asos & Big Picture ***

LSE:AZN Astrazeneca. Close Mid-Price: 11004 Percentage Change: + 0.24% Day High: 11170 Day Low: 10990

Further movement against Astrazeneca ABOVE 11170 should improve accelerati ……..

</p

View Previous Astrazeneca & Big Picture ***

LSE:BBY BALFOUR BEATTY. Close Mid-Price: 259.8 Percentage Change: + 2.53% Day High: 260.6 Day Low: 254.4

Further movement against BALFOUR BEATTY ABOVE 261 should improve accelerat ……..

</p

View Previous BALFOUR BEATTY & Big Picture ***

LSE:GKP Gulf Keystone. Close Mid-Price: 243.5 Percentage Change: + 6.10% Day High: 246 Day Low: 230

Apparently above 246 now points at 256 next with secondary, if beaten, at ……..

</p

View Previous Gulf Keystone & Big Picture ***

LSE:GLEN Glencore Xstra. Close Mid-Price: 433.25 Percentage Change: + 6.07% Day High: 443.05 Day Low: 416.45

Now above 444 suggests coming recovery to 475 next with secondary, if exce ……..

</p

View Previous Glencore Xstra & Big Picture ***

LSE:HSBA HSBC. Close Mid-Price: 535.6 Percentage Change: + 3.26% Day High: 538.1 Day Low: 525.4

All HSBC needs are mid-price trades ABOVE 556 to signal ongoing traffic t ……..

</p

View Previous HSBC & Big Picture ***

LSE:MKS Marks and Spencer. Close Mid-Price: 138.7 Percentage Change: + 2.74% Day High: 139.15 Day Low: 135.2

In the event Marks and Spencer experiences weakness below 129 it calculate ……..

</p

View Previous Marks and Spencer & Big Picture ***

LSE:OCDO Ocado Plc. Close Mid-Price: 851.4 Percentage Change: + 3.40% Day High: 851.6 Day Low: 812.8

Now above 853 calculates with the potential of 922 next with secondary, if ……..

</p

View Previous Ocado Plc & Big Picture ***

LSE:PMG Parkmead. Close Mid-Price: 48.45 Percentage Change: + 10.24% Day High: 49.9 Day Low: 45.7

The share price now needs exceed 50 to fuel breathless enthusiasm, apparen ……..

</p

View Previous Parkmead & Big Picture ***

LSE:PPC President Energy Close Mid-Price: 1.35 Percentage Change: -1.82% Day High: 1.38 Day Low: 1.35

Target met. Or near enough. Continued weakness against PPC taking the pric ……..

</p

View Previous President Energy & Big Picture ***

LSE:SCLP Scancell Close Mid-Price: 12.25 Percentage Change: -4.85% Day High: 12.88 Day Low: 12.12

Now below 12 suggests imminent weakness to an initial 9.5p. If broken, our ……..

</p

View Previous Scancell & Big Picture ***

LSE:SDY Speedyhire. Close Mid-Price: 43.05 Percentage Change: + 2.01% Day High: 43.1 Day Low: 41.7

Target Met or sufficiently close. If Speedyhire experiences continued weak ……..

</p

View Previous Speedyhire & Big Picture ***

LSE:SPX Spirax. Close Mid-Price: 10710 Percentage Change: + 0.89% Day High: 10795 Day Low: 10595

All Spirax needs are mid-price trades ABOVE 10795 to continue acceleration ……..

</p

View Previous Spirax & Big Picture ***

LSE:TERN Tern Plc Close Mid-Price: 9.85 Percentage Change: -6.19% Day High: 10.5 Day Low: 9.75

Ongoing weakness below 9.7 continues to point at reversal to an initial 8. ……..

</p

View Previous Tern Plc & Big Picture ***

LSE:TW. Taylor Wimpey Close Mid-Price: 114.85 Percentage Change: -0.52% Day High: 116.25 Day Low: 113.35

Continued weakness against TW. taking the price below 113.2 calculates as ……..

</p

View Previous Taylor Wimpey & Big Picture ***