#Gold #SP500

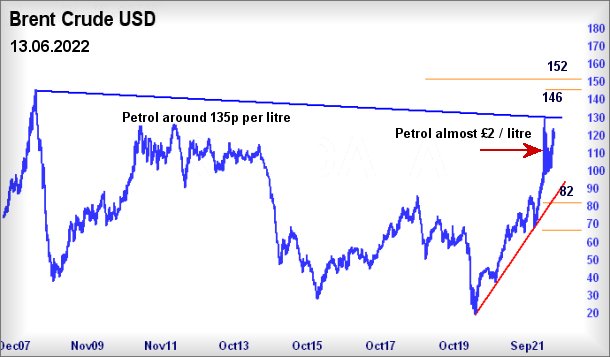

Why are fuel prices so high? Nearly £2 a litre makes little sense as Crude Oil was at this price level from 2008 through to 2014. VAT & Fuel Duty were roughly at current levels too! One might even wonder if the oil companies are indulging in a little profiteering to make up for the lean years of the pandemic? But if that’s the case, why are oiler share prices still dodgy?

Shell Plc (LSE:SHEL)

With the price of fuel, along with reports of record profit levels, we’d expect Shell to be enjoying a share price which is soaring to new levels. Unfortunately, this appears not to be the case, quite the opposite. We’re fond of treating the pre-pandemic price level for shares as a benchmark, requiring prices to solidly exceed a value before Covid-19 hit everything. In the case of Shell Plc, their share price matched the pre-pandemic level, even exceeded it slightly, and now appears destined to experience some reversals.

At least people are returning to their offices, so they can work harder to afford the extra cost of fuel to return to their offices… Things appear to be messy from virtually any perspective.

Currently for Shell, price movement below 2255p risks triggering near term reversal to a pretty tame sounding 2191p. The share price level, pre-pandemic, was around 2300p, so this scenario isn’t particularly nasty. The danger comes, should Shell manage to close a session below 2191p, as further reversal to our secondary of 1983p calculates as possible.

As the chart below highlights, this is a big issue, returning Shells share price below the Blue downtrend and placing it in a region where an eventual return to the £12 level calculates as possible. Unfortunately, such a mess also makes a lot of visual sense.

We’ve given quite a lot of doom and gloom against this share price. Please remember, we’re indulging in “worst case scenario”, especially as the share price needs close a session below 2191p to tick the first box.

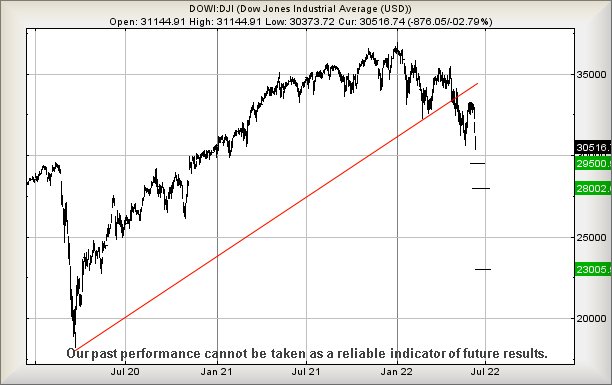

Wall St (Dowi:DJI) When we reviewed Wall St a month ago, our thoughts about a target level of 30,000 points where relegated to the final paragraph. To employ a technical term, Oops! The index has managed to shed 2,000 points and is virtually at our initial drop target. Things have gotten really messy with the US index and if the market fails to bounce above 30,100 points, it could easily continue a slide down to 29,500. Our secondary, if such a level breaks, calculates down at 28,000 points, a price level where a bounce is “almost” mandatory.

Currently, Wall St needs astounding movement above 33,700 points, just to confirm a serious escape attempt from the current spiral of misery.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 11:00:17PM | BRENT | 120.63 | Shambles | ||||||||

| 11:07:21PM | GOLD | 1819.34 | 1808 | 1786 | 1740 | 1833 | 1834 | 1838 | 1848 | 1817 | Success |

| 11:11:04PM | FTSE | 7235 | ditto | ||||||||

| 11:13:58PM | FRANCE | 6026 | ditto | ||||||||

| 11:19:16PM | GERMANY | 13499 | ditto | ||||||||

| 11:22:14PM | US500 | 3767 | 3734 | 3718 | 3594 | 3823 | 3853 | 3868 | 3912 | 3797 | ditto |

| 11:23:57PM | DOW | 30620 | ditto | ||||||||

| 11:29:42PM | NASDAQ | 11364 | ditto | ||||||||

| 11:32:16PM | JAPAN | 26511 | ditto |

13/06/2022 FTSE Closed at 7205 points. Change of -1.53%. Total value traded through LSE was: £ 7,343,380,444 a change of 22%

10/06/2022 FTSE Closed at 7317 points. Change of -2.13%. Total value traded through LSE was: £ 6,019,204,674 a change of -10.01%

9/06/2022 FTSE Closed at 7476 points. Change of -1.54%. Total value traded through LSE was: £ 6,688,998,845 a change of -1.03%

8/06/2022 FTSE Closed at 7593 points. Change of -0.07%. Total value traded through LSE was: £ 6,758,685,339 a change of -1.74%

7/06/2022 FTSE Closed at 7598 points. Change of -0.13%. Total value traded through LSE was: £ 6,878,313,102 a change of 13.3%

6/06/2022 FTSE Closed at 7608 points. Change of -100%. Total value traded through LSE was: £ 6,070,626,814 a change of 0%

1/06/2022 FTSE Closed at 7532 points. Change of 0%. Total value traded through LSE was: £ 5,845,714,503 a change of 0%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AFC AFC Energy** **LSE:AML Aston Martin** **LSE:ASC Asos** **LSE:CCL Carnival** **LSE:DDDD 4D Pharma** **LSE:EXPN Experian** **LSE:EZJ EasyJet** **LSE:FRES Fresnillo** **LSE:HIK Hikma** **LSE:HL. Hargreaves Lansdown** **LSE:HUR Hurrican Energy** **LSE:IAG British Airways** **LSE:IGG IG Group** **LSE:ITM ITM Power** **LSE:ITRK Intertek** **LSE:LLOY Lloyds Grp.** **LSE:RMG Royal Mail** **LSE:SBRY Sainsbury** **LSE:SPX Spirax** **LSE:TSCO Tesco** **

********

Updated charts published on : AFC Energy, Aston Martin, Asos, 4D Pharma, Experian, EasyJet, Fresnillo, Hikma, Hargreaves Lansdown, Hurrican Energy, British Airways, IG Group, ITM Power, Intertek, Lloyds Grp., Royal Mail, Sainsbury, Spirax, Tesco,

LSE:AFC AFC Energy Close Mid-Price: 22.96 Percentage Change: -6.82% Day High: 24.44 Day Low: 22.5

Target met. Continued weakness against AFC taking the price below 22.5 ca ……..

</p

View Previous AFC Energy & Big Picture ***

LSE:AML Aston Martin Close Mid-Price: 540 Percentage Change: -11.74% Day High: 603.2 Day Low: 536

Target met. In the event Aston Martin experiences weakness below 536 it c ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:ASC Asos Close Mid-Price: 1209 Percentage Change: -6.93% Day High: 1285 Day Low: 1214

Continued weakness against ASC taking the price below 1214 calculates as ……..

</p

View Previous Asos & Big Picture ***

LSE:CCL Carnival Close Mid-Price: 749.2 Percentage Change: -8.83% Day High: 817.4 Day Low: 734.2

Target met. If Carnival experiences continued weakness below 734.2, it wi ……..

</p

View Previous Carnival & Big Picture ***

LSE:DDDD 4D Pharma Close Mid-Price: 25.75 Percentage Change: -4.98% Day High: 26.5 Day Low: 25.4

In the event 4D Pharma experiences weakness below 25.4 it calculates with ……..

</p

View Previous 4D Pharma & Big Picture ***

LSE:EXPN Experian Close Mid-Price: 2378 Percentage Change: -1.86% Day High: 2404 Day Low: 2370

Target met. If Experian experiences continued weakness below 2370, it wil ……..

</p

View Previous Experian & Big Picture ***

LSE:EZJ EasyJet Close Mid-Price: 423.2 Percentage Change: -6.41% Day High: 445 Day Low: 420.3

Target met. Weakness on EasyJet below 420.3 will invariably lead to 408 w ……..

</p

View Previous EasyJet & Big Picture ***

LSE:FRES Fresnillo. Close Mid-Price: 790 Percentage Change: + 5.56% Day High: 844.2 Day Low: 745.8

Target met. Continued trades against FRES with a mid-price ABOVE 844.2 sh ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:HIK Hikma Close Mid-Price: 1537.5 Percentage Change: -2.90% Day High: 1567 Day Low: 1524

Target met. Weakness on Hikma below 1524 will invariably lead to 1504 wit ……..

</p

View Previous Hikma & Big Picture ***

LSE:HL. Hargreaves Lansdown Close Mid-Price: 783.4 Percentage Change: -0.84% Day High: 795.6 Day Low: 778.6

If Hargreaves Lansdown experiences continued weakness below 778.6, it wil ……..

</p

View Previous Hargreaves Lansdown & Big Picture ***

LSE:HUR Hurrican Energy Close Mid-Price: 7.19 Percentage Change: -6.50% Day High: 7.7 Day Low: 7.13

Weakness on Hurrican Energy below 7.13 will invariably lead to 6p with se ……..

</p

View Previous Hurrican Energy & Big Picture ***

LSE:IAG British Airways Close Mid-Price: 115.02 Percentage Change: -4.55% Day High: 119.84 Day Low: 115.72

Target met. Continued weakness against IAG taking the price below 115.72 ……..

</p

View Previous British Airways & Big Picture ***

LSE:IGG IG Group Close Mid-Price: 658 Percentage Change: -3.80% Day High: 685 Day Low: 653.5

If IG Group experiences continued weakness below 653.5, it will invariabl ……..

</p

View Previous IG Group & Big Picture ***

LSE:ITM ITM Power Close Mid-Price: 210.9 Percentage Change: -8.78% Day High: 227.4 Day Low: 209.6

Target met. In the event ITM Power experiences weakness below 209.6 it ca ……..

</p

View Previous ITM Power & Big Picture ***

LSE:ITRK Intertek Close Mid-Price: 4266 Percentage Change: -2.54% Day High: 4351 Day Low: 4226

Target met. Continued weakness against ITRK taking the price below 4226 c ……..

</p

View Previous Intertek & Big Picture ***

LSE:LLOY Lloyds Grp. Close Mid-Price: 42.83 Percentage Change: -2.00% Day High: 43.38 Day Low: 42.53

If Lloyds Grp. experiences continued weakness below 42.53, it will invari ……..

</p

View Previous Lloyds Grp. & Big Picture ***

LSE:RMG Royal Mail Close Mid-Price: 273.2 Percentage Change: -2.11% Day High: 275 Day Low: 268.2

Target met. Continued weakness against RMG taking the price below 268.2 c ……..

</p

View Previous Royal Mail & Big Picture ***

LSE:SBRY Sainsbury Close Mid-Price: 204.9 Percentage Change: -3.94% Day High: 213.7 Day Low: 204.4

In the event Sainsbury experiences weakness below 204.4 it calculates wit ……..

</p

View Previous Sainsbury & Big Picture ***

LSE:SPX Spirax Close Mid-Price: 9552 Percentage Change: -2.93% Day High: 9808 Day Low: 9470

Target met. Weakness on Spirax below 9470 will invariably lead to 9214 wi ……..

</p

View Previous Spirax & Big Picture ***

LSE:TSCO Tesco Close Mid-Price: 246.1 Percentage Change: -1.60% Day High: 251.2 Day Low: 242.4

Target met. Continued weakness against TSCO taking the price below 242.4 ……..

</p

View Previous Tesco & Big Picture ***