LSE:BLVN #FTSE #SP500)

Sometimes, when an AIM share makes a spectacular jump, it will quickly mimic our unwanted cat. The animals food bowl is in the kitchen, safely above opportunistic dog levels. To get to her food, she steps onto a footstool, then jumps to “her” feeding area. Sometimes when not paying attention, she fails to make the last few inches, her claws scraping the cupboard door as she slides to ground level with furious indignity.

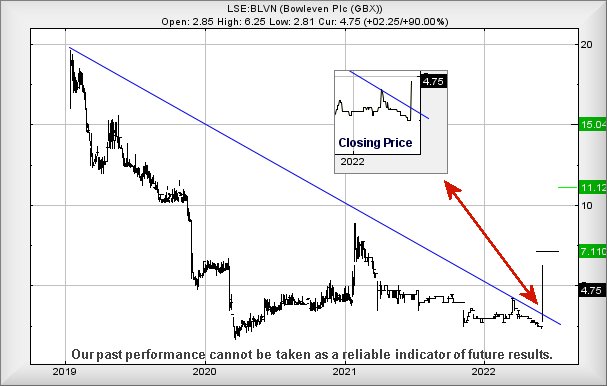

Thankfully, Bowleven share price doesn’t appear determined to mimic the cat. We’ve been flooded with emails, due to the shares flamboyant Tuesday. Presumably they’ve released some good news to the marketplace, something which justifies real movement. We hope!

To get the bad news out of the way immediately, the price needs relax below 3.2p before we’d experience concerns for the future. And by relax, we mean ‘close a session’ below 3.2p, the level at which the share broke through the Blue downtrend since 2019.

However, the share price has now closed a session above the Blue downtrend and, perhaps more importantly, has also closed higher than its previous high in March. Despite “only” closing the session at 4.75p, it has officially entered the realms of “higher highs” and therefore, optimism is justified. From a near term perspective, should it trade above just 5.3p, we’ve a pretty weak argument favouring ongoing price recovery to 7.1p next. In the normal scheme of events, we’d propose a “safe” trigger level above Tuesdays 6.25p but when we review what actually happened after this initial high was achieved, it seems 5.3p can be nominated as the next growth trigger.

Above 7.1p and things start to become a little strange, due to a collection of quite strong recovery potentials.

Our secondary target calculates at 11.1p, an ambition which makes quite a lot of visual sense as there’s even the impression of a glass ceiling waiting in the future distance. We can even provide a 3rd level ambition, should the share price manage to actually CLOSE a session above 7.1p in the future. In this scenario, we can politely mention 15p. To be fair, we rarely produce a report where we give the potential of a share price trebling but in this instance, it’s difficult not to mention the potentials.

Hopefully the company avoid shooting themselves in the foot.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:52:07PM | BRENT | 120.08 | |||||||||

| 9:54:45PM | GOLD | 1852.46 | |||||||||

| 10:12:55PM | FTSE | 7623 | 7569 | 7538 | 7501 | 7599 | 7626 | 7638 | 7661 | 7602 | |

| 10:15:19PM | FRANCE | 6521 | Success | ||||||||

| 10:25:34PM | GERMANY | 14585 | |||||||||

| 10:27:30PM | US500 | 4152.12 | 4096 | 4081 | 4053 | 4126 | 4165 | 4173 | 4206 | 4125 | Shambles |

| 10:29:41PM | DOW | 33122.6 | ‘cess | ||||||||

| 10:31:31PM | NASDAQ | 12683 | Success | ||||||||

| 10:33:23PM | JAPAN | 28141 |

7/06/2022 FTSE Closed at 7598 points. Change of -0.13%. Total value traded through LSE was: £ 6,878,313,102 a change of 13.3%

6/06/2022 FTSE Closed at 7608 points. Change of 1.01%. Total value traded through LSE was: £ 6,070,626,814 a change of 3.85%

1/06/2022 FTSE Closed at 7532 points. Change of -0.99%. Total value traded through LSE was: £ 5,845,714,503 a change of -53.49%

31/05/2022 FTSE Closed at 7607 points. Change of 0.09%. Total value traded through LSE was: £ 12,568,637,540 a change of 132.45%

30/05/2022 FTSE Closed at 7600 points. Change of 0.2%. Total value traded through LSE was: £ 5,407,099,048 a change of 2.21%

27/05/2022 FTSE Closed at 7585 points. Change of -100%. Total value traded through LSE was: £ 5,290,006,868 a change of 0%

26/05/2022 FTSE Closed at 7564 points. Change of 0%. Total value traded through LSE was: £ 5,961,976,188 a change of 0%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BLOE Block Energy PLC** **LSE:BLVN Bowleven** **LSE:BP. BP PLC** **LSE:DDDD 4D Pharma** **LSE:GKP Gulf Keystone** **LSE:GLEN Glencore Xstra** **LSE:ITRK Intertek** **LSE:SCLP Scancell** **

********

Updated charts published on : Block Energy PLC, Bowleven, BP PLC, 4D Pharma, Gulf Keystone, Glencore Xstra, Intertek, Scancell,

LSE:BLOE Block Energy PLC. Close Mid-Price: 2 Percentage Change: + 21.21% Day High: 2 Day Low: 1.65

Target met. All Block Energy PLC needs are mid-price trades ABOVE 2 to im ……..

</p

View Previous Block Energy PLC & Big Picture ***

LSE:BLVN Bowleven. Close Mid-Price: 4.75 Percentage Change: + 90.00% Day High: 6.25 Day Low: 2.81

Target met. Continued trades against BLVN with a mid-price ABOVE 6.25 sho ……..

</p

View Previous Bowleven & Big Picture ***

LSE:BP. BP PLC. Close Mid-Price: 446.5 Percentage Change: + 1.37% Day High: 449.3 Day Low: 439.2

Target met. In the event of BP PLC enjoying further trades beyond 449.3, ……..

</p

View Previous BP PLC & Big Picture ***

LSE:DDDD 4D Pharma Close Mid-Price: 31.6 Percentage Change: -4.24% Day High: 33.05 Day Low: 30.55

In the event 4D Pharma experiences weakness below 30.55 it calculates wit ……..

</p

View Previous 4D Pharma & Big Picture ***

LSE:GKP Gulf Keystone. Close Mid-Price: 300.5 Percentage Change: + 1.86% Day High: 303 Day Low: 295

Further movement against Gulf Keystone ABOVE 303 should improve accelerat ……..

</p

View Previous Gulf Keystone & Big Picture ***

LSE:GLEN Glencore Xstra Close Mid-Price: 539.6 Percentage Change: -0.35% Day High: 548.3 Day Low: 535.6

In the event of Glencore Xstra enjoying further trades beyond 548.3, the ……..

</p

View Previous Glencore Xstra & Big Picture ***

LSE:ITRK Intertek Close Mid-Price: 4561 Percentage Change: -1.13% Day High: 4617 Day Low: 4519

Continued weakness against ITRK taking the price below 4519 calculates as ……..

</p

View Previous Intertek & Big Picture ***

LSE:SCLP Scancell Close Mid-Price: 12.25 Percentage Change: -3.54% Day High: 13.12 Day Low: 12.25

This is rather unsettled as now below 12.25 suggests imminent weakness to ……..

</p

View Previous Scancell & Big Picture ***