#Gold #SP500

Prudential provided a bit of a shock, when a client asked us to review the share. We try and loop through most of the FTSE 100 but somehow, last reviewed Prudential back in November 2014! At the time, the price was around 1300p and we gave a target level around an eventual 2000p. It took years, reached target, and has been floundering a bit uncertainly since.

Circled on the chart is something peculiar which occurred last year, the share price quite deliberately gapped below the uptrend since 2020. This sort of thing tends broadcast all the wrong signals (unless, of course, by some miracle the market opts to gap a price back above the trend. In which case, take a Long position and wait!). The provider of life and health insurance, focussed on Africa and Asia, look set for continued share price tumbles currently.

Below 882p projects the potential of reversal to an initial 833p. Should such a level break, our secondary calculation comes in at 752p. We’d normally hope for a proper rebound, should 833p make an appearance but closure below such a level makes our secondary almost essential to provide an excuse for a bounce. The problem comes, if the price closes below our 752p secondary target as an ultimate bottom of 397p becomes dangerously viable.

Currently the share price needs exceed 1085 just to suggest the immediate rate of descent has eased, entering a zone where a path to 1377 works out as possible. For now, it doesn’t look like ‘Dear Prudence’ wants to come out to play.

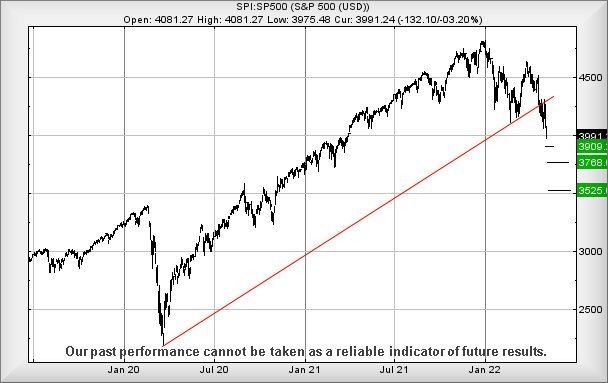

The US markets (DOW, S&P500, Nasdaq) The league table of disaster on Monday was led by the Nasdaq, boasting a daily reversal at -4%. The S&P came second, down -3.2% and the Dow proved fairly half hearted, only dropping by -2%. As the Nasdaq has taken the lead in this calamity, we’re extremely interested if 12,130 points breaks anytime soon. Such a mess would remove logic which asked for a bounce, instead risking triggering ongoing reversals to an initial 10,946 with secondary, if broken, at 9243 points. This level of trouble looks almost ridiculous, negating growth over the last year and visually dumping the index back to the level it enjoyed, prior to the pandemic. The index requires exceed 13,500 to cancel the logic pointing to this drop scenario.

The S&P500 looks pretty painful, perhaps approaching a level where some sort of rebound can be hoped. Currently, below 3975 threatens ongoing reversal to 3909 points with secondary, if broken, at 3768 points. The market requires exceed 4270 just to get out of trouble and in this instance, we can calculate a 3rd level target at 3,525. This is just above the pre-pandemic high, creating a visually pleasing level hopefully capable of generating a trampoline moment.

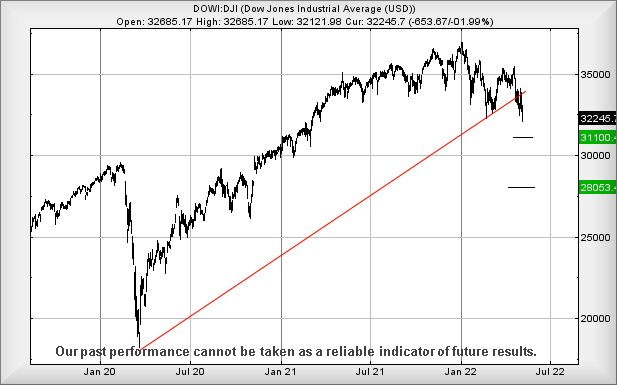

The DOW JONES is a bit of a puzzle. For some time we’ve been expecting the 31,000 level to make a guest appearance and now, despite the rest of the market being on fire, the index resisted the temptation. Of course, with Earnings Season in full swing in the USA, there are liable to be plenty of mitigating circumstances avoiding an immediate rout. Glancing through headlines, the falls are being blamed on interest rate rise concerns, worries about market growth, Russia, oil prices, and whether the US Miami Grand Prix justified $13,000 ticket prices for the VIP area, where lack of a grandstand made watching the race extremely difficult and lack of booze deliveries made forgetting the event even harder. Reports suggest there were catering issues…

Now below 32,100 points for Wall St calculates with a hopeful bottom potential at 31,100 points. If broken, our secondary calculates down at an incredible 28,050 points but in this instance, we’re inclined to regard below 30,800 at a final trigger level down to the 28,000 level. This numbers have been muddied, thanks to the index being gapped down several times at the open of trade in recent days.

To start digging its way out of trouble, Wall St needs miracle recovery above 33,700 to negate the reversal potentials.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:18:59PM | BRENT | 104.51 | Success | ||||||||

| 10:21:30PM | GOLD | 1854.24 | 1852 | 1846 | 1838 | 1860 | 1871 | 1875 | 1883 | 1861 | ‘cess |

| 10:29:46PM | FTSE | 7211 | Success | ||||||||

| 10:32:21PM | FRANCE | 6081 | Success | ||||||||

| 10:48:15PM | GERMANY | 13397 | Success | ||||||||

| 10:50:23PM | US500 | 3994 | 3974 | 3964 | 3900 | 4008 | 4075 | 4089 | 4127 | 4033 | Success |

| 10:54:11PM | DOW | 32266 | ‘cess | ||||||||

| 11:00:06PM | NASDAQ | 12199 | Success | ||||||||

| 11:02:51PM | JAPAN | 26016 | ‘cess |

9/05/2022 FTSE Closed at 7216 points. Change of -2.31%. Total value traded through LSE was: £ 6,257,631,157 a change of -11.88%

6/05/2022 FTSE Closed at 7387 points. Change of -1.55%. Total value traded through LSE was: £ 7,100,975,536 a change of 2.72%

5/05/2022 FTSE Closed at 7503 points. Change of 0.13%. Total value traded through LSE was: £ 6,912,828,845 a change of 20.87%

4/05/2022 FTSE Closed at 7493 points. Change of -0.9%. Total value traded through LSE was: £ 5,719,365,474 a change of -24.49%

3/05/2022 FTSE Closed at 7561 points. Change of 0.23%. Total value traded through LSE was: £ 7,574,559,700 a change of 8.37%

29/04/2022 FTSE Closed at 7544 points. Change of 0.47%. Total value traded through LSE was: £ 6,989,742,428 a change of 18.72%

28/04/2022 FTSE Closed at 7509 points. Change of -100%. Total value traded through LSE was: £ 5,887,371,702 a change of 0%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AFC AFC Energy** **LSE:AGM Applied Graphene** **LSE:AML Aston Martin** **LSE:BDEV Barrett Devs** **LSE:CBX Cellular Goods** **LSE:CCL Carnival** **LSE:DDDD 4D Pharma** **LSE:EXPN Experian** **LSE:EZJ EasyJet** **LSE:FOXT Foxtons** **LSE:HL. Hargreaves Lansdown** **LSE:IGG IG Group** **LSE:IQE IQE** **LSE:ITM ITM Power** **LSE:ITRK Intertek** **LSE:ITV ITV** **LSE:JET Just Eat** **LSE:OXIG Oxford Instruments** **LSE:RMG Royal Mail** **LSE:TRN The Trainline** **LSE:TW. Taylor Wimpey** **

********

Updated charts published on : AFC Energy, Applied Graphene, Aston Martin, Barrett Devs, Cellular Goods, Carnival, 4D Pharma, Experian, EasyJet, Foxtons, Hargreaves Lansdown, IG Group, IQE, ITM Power, Intertek, ITV, Just Eat, Oxford Instruments, Royal Mail, The Trainline, Taylor Wimpey,

LSE:AFC AFC Energy Close Mid-Price: 28.92 Percentage Change: -4.87% Day High: 30.24 Day Low: 28.1

In the event AFC Energy experiences weakness below 28.1 it calculates wit ……..

</p

View Previous AFC Energy & Big Picture ***

LSE:AGM Applied Graphene Close Mid-Price: 18 Percentage Change: -2.70% Day High: 18 Day Low: 17.5

In the event Applied Graphene experiences weakness below 17.5 it calculat ……..

</p

View Previous Applied Graphene & Big Picture ***

LSE:AML Aston Martin Close Mid-Price: 748.4 Percentage Change: -9.81% Day High: 827.2 Day Low: 745.4

Target met. If Aston Martin experiences continued weakness below 745.4, i ……..

</p

View Previous Aston Martin & Big Picture ***

LSE:BDEV Barrett Devs Close Mid-Price: 459.1 Percentage Change: -2.34% Day High: 470.8 Day Low: 457.6

Target met. Weakness on Barrett Devs below 457.6 will invariably lead to ……..

</p

View Previous Barrett Devs & Big Picture ***

LSE:CBX Cellular Goods Close Mid-Price: 2.2 Percentage Change: -4.35% Day High: 2.3 Day Low: 2.2

Continued weakness against CBX taking the price below 2.2 calculates as l ……..

</p

View Previous Cellular Goods & Big Picture ***

LSE:CCL Carnival Close Mid-Price: 1074 Percentage Change: -9.67% Day High: 1181 Day Low: 1069

Target met. Weakness on Carnival below 1069 will invariably lead to 1002 ……..

</p

View Previous Carnival & Big Picture ***

LSE:DDDD 4D Pharma Close Mid-Price: 36.25 Percentage Change: -4.35% Day High: 38 Day Low: 34.55

In the event 4D Pharma experiences weakness below 34.55 it calculates wit ……..

</p

View Previous 4D Pharma & Big Picture ***

LSE:EXPN Experian Close Mid-Price: 2630 Percentage Change: -0.60% Day High: 2666 Day Low: 2593

Weakness on Experian below 2593 will invariably lead to 2555 with seconda ……..

</p

View Previous Experian & Big Picture ***

LSE:EZJ EasyJet Close Mid-Price: 492 Percentage Change: -3.61% Day High: 512.8 Day Low: 488.4

In the event EasyJet experiences weakness below 488.4 it calculates with ……..

</p

View Previous EasyJet & Big Picture ***

LSE:FOXT Foxtons Close Mid-Price: 36.8 Percentage Change: -5.03% Day High: 38 Day Low: 36.1

Weakness on Foxtons below 36.1 will invariably lead to 32 with secondary ……..

</p

View Previous Foxtons & Big Picture ***

LSE:HL. Hargreaves Lansdown. Close Mid-Price: 854 Percentage Change: + 1.04% Day High: 865.8 Day Low: 833.8

Target met. Weakness on Hargreaves Lansdown below 833.8 will invariably l ……..

</p

View Previous Hargreaves Lansdown & Big Picture ***

LSE:IGG IG Group Close Mid-Price: 727 Percentage Change: -0.34% Day High: 731 Day Low: 713.5

Target met. If IG Group experiences continued weakness below 713.5, it wi ……..

</p

View Previous IG Group & Big Picture ***

LSE:IQE IQE Close Mid-Price: 28.25 Percentage Change: -6.15% Day High: 30.15 Day Low: 28.4

In the event IQE experiences weakness below 28.4 it calculates with a dro ……..

</p

View Previous IQE & Big Picture ***

LSE:ITM ITM Power Close Mid-Price: 277 Percentage Change: -8.25% Day High: 303.9 Day Low: 277.5

If ITM Power experiences continued weakness below 277.5, it will invariab ……..

</p

View Previous ITM Power & Big Picture ***

LSE:ITRK Intertek Close Mid-Price: 4896 Percentage Change: -0.55% Day High: 4961 Day Low: 4835

If Intertek experiences continued weakness below 4835, it will invariably ……..

</p

View Previous Intertek & Big Picture ***

LSE:ITV ITV Close Mid-Price: 67.92 Percentage Change: -2.13% Day High: 69.46 Day Low: 67.4

Weakness on ITV below 67.4 will invariably lead to 63 with secondary, if ……..

</p

View Previous ITV & Big Picture ***

LSE:JET Just Eat Close Mid-Price: 1590.8 Percentage Change: -8.16% Day High: 1731.4 Day Low: 1575.6

Target met. Weakness on Just Eat below 1575.6 will invariably lead to 139 ……..

</p

View Previous Just Eat & Big Picture ***

LSE:OXIG Oxford Instruments Close Mid-Price: 2140 Percentage Change: -4.46% Day High: 2260 Day Low: 2100

If Oxford Instruments experiences continued weakness below 2100, it will ……..

</p

View Previous Oxford Instruments & Big Picture ***

LSE:RMG Royal Mail Close Mid-Price: 322.4 Percentage Change: -1.32% Day High: 325.2 Day Low: 316.1

Weakness on Royal Mail below 316.1 will invariably lead to 301 with secon ……..

</p

View Previous Royal Mail & Big Picture ***

LSE:TRN The Trainline Close Mid-Price: 290.4 Percentage Change: -6.89% Day High: 324 Day Low: 289.4

Continued trades against TRN with a mid-price ABOVE 324 should improve th ……..

</p

View Previous The Trainline & Big Picture ***

LSE:TW. Taylor Wimpey Close Mid-Price: 120.25 Percentage Change: -2.59% Day High: 123.75 Day Low: 120.2

Continued weakness against TW. taking the price below 120.2 calculates as ……..

</p

View Previous Taylor Wimpey & Big Picture ***