#FTSE #Gold

There was a time when we looked forward to producing our Friday outlook for the FTSE. There was always a reasonable chance the volatile UK leading indicator would do something useful but unfortunately, since the Russia drop, things are proving pretty fake, the market essentially pretending to move while effectively remaining enmeshed in place.

Visually, we need to zoom out and glance at market behaviour since the start of 2020 to appreciate how horrific the situation really is!

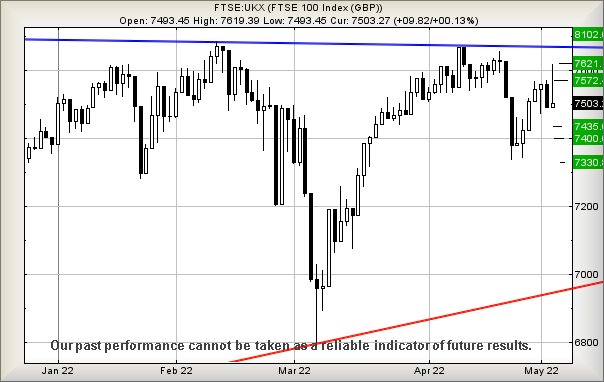

The big blue line on the chart below can be called a Glass Ceiling or, more accurately, a horizontal trend. It’s effectively broadcasting a harsh reality, the UK index has a solid border crossing at 7690 points and this creates a reasonable expectation growth cannot be regarded as real until such time the FTSE actually exceeds this trend. What proved a bit of a surprise was we’d expected the FTSE to follow a similar model to markets elsewhere in the world. From the US to Asia, once a market exceeded its personal Pre-Pandemic High, that market started to go up. By the time the FTSE managed to better 7550 points, the model was pretty firmly established and we’d expected London to dutifully follow the pack.

For a few sessions, it appeared this was indeed going to be the case, then along came the Russia issue with the FTSE behaving badly at every excuse thereafter. To be fair, neither the USA nor Europe appear to be covering themselves in glory while Ukraine remains an issue, perhaps the UK is even performing better than our neighbours.

Except, of course, for the issue at 7690 points.

From a fairly Big Picture perspective, above 7690 remains with the “almost certain” prospect of a FTSE lift to the 8100 point level. If the FTSE were regarded as a share, we’d probably describe the prospect as a “no brainer” category of trade, throwing in a gentle caveat of a reality reminder; The FTSE IS NOT a share!

FTSE for FRIDAY As for near term movements for Friday, we’re a little nervous about immediate market prospects, suspecting some imminent reversals risk proving possible. It’s worth remembering it’s a US Payrolls Friday, often an excuse to display some flamboyant movements and therefore, extreme caution is recommended with any positions open just prior to 1.30pm.

For the FTSE, we’re nervous at any excuse to drive the index below 7477 points as this now risks imminent reversal to an initial 7435 points with secondary, if broken, at 7400 and hopefully a bounce. Below 7400 risks spoiling the party (sorry Boris) as a further 70 point reversal to 7330 becomes possible. If triggered, the tightest stop loss appears to be hideously wide at 7557 points.

The alternate scenario comes, should the FTSE somehow manage to stagger above 7557 points. Initially, we’re looking for recovery to a useless 7572 points with secondary, if exceeded, calculating at 7621 points.

Have a good weekend. Hopefully the Miami Grand Prix proves worth watching.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:03:25PM | BRENT | 110.75 | 108.76 | 107.49 | 111 | 113.55 | 114.0825 | 109.55 | Success | ||

| 10:05:51PM | GOLD | 1877.45 | 1872 | 1865 | 1890 | 1909 | 1915 | 1887 | Success | ||

| 10:07:45PM | FTSE | 7499.65 | 7458 | 7417 | 7521 | 7522 | 7547 | 7488 | |||

| 10:09:39PM | FRANCE | 6358.9 | 6310 | 6297 | 6382 | 6382 | 6412 | 6347 | ‘cess | ||

| 10:11:56PM | GERMANY | 13886 | 13790 | 13740 | 13911 | 13936 | 13984 | 13857 | ‘cess | ||

| 10:14:15PM | US500 | 4155 | 4104 | 4089 | 4141 | 4176 | 4191 | 4136 | ‘cess | ||

| 10:16:40PM | DOW | 33025.6 | 32668 | 32531 | 32927 | 33208 | 33297 | 32986 | |||

| 10:19:39PM | NASDAQ | 12897 | 12702 | 12613 | 12825 | 12993 | 13093 | 12860 | |||

| 10:25:25PM | JAPAN | 26741 | 26572 | 26445 | 26774 | 26861 | 26936 | 26757 |

5/05/2022 FTSE Closed at 7503 points. Change of 0.13%. Total value traded through LSE was: £ 6,912,828,845 a change of 20.87%

4/05/2022 FTSE Closed at 7493 points. Change of -0.9%. Total value traded through LSE was: £ 5,719,365,474 a change of -24.49%

3/05/2022 FTSE Closed at 7561 points. Change of 0.23%. Total value traded through LSE was: £ 7,574,559,700 a change of 8.37%

29/04/2022 FTSE Closed at 7544 points. Change of 0.47%. Total value traded through LSE was: £ 6,989,742,428 a change of 18.72%

28/04/2022 FTSE Closed at 7509 points. Change of 1.13%. Total value traded through LSE was: £ 5,887,371,702 a change of -15.1%

27/04/2022 FTSE Closed at 7425 points. Change of 0.53%. Total value traded through LSE was: £ 6,934,236,931 a change of -7.56%

26/04/2022 FTSE Closed at 7386 points. Change of -100%. Total value traded through LSE was: £ 7,501,270,625 a change of 0%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BARC Barclays** **LSE:BP. BP PLC** **LSE:CAR Carclo** **LSE:CCL Carnival** **LSE:CPI Capita** **LSE:GENL Genel** **LSE:GKP Gulf Keystone** **LSE:HIK Hikma** **LSE:HL. Hargreaves Lansdown** **LSE:IGG IG Group** **LSE:JET Just Eat** **LSE:OCDO Ocado Plc** **LSE:OXIG Oxford Instruments** **LSE:RR. Rolls Royce** **LSE:STAN Standard Chartered** **LSE:TRN The Trainline** **

********

Updated charts published on : Barclays, BP PLC, Carclo, Carnival, Capita, Genel, Gulf Keystone, Hikma, Hargreaves Lansdown, IG Group, Just Eat, Ocado Plc, Oxford Instruments, Rolls Royce, Standard Chartered, The Trainline,

LSE:BARC Barclays Close Mid-Price: 149.82 Percentage Change: -0.49% Day High: 154.44 Day Low: 149.52

Further movement against Barclays ABOVE 154.44 should improve acceleratio ……..

</p

View Previous Barclays & Big Picture ***

LSE:BP. BP PLC. Close Mid-Price: 418.9 Percentage Change: + 0.72% Day High: 427.35 Day Low: 416.65

Target met. Further movement against BP PLC ABOVE 427.35 should improve a ……..

</p

View Previous BP PLC & Big Picture ***

LSE:CAR Carclo Close Mid-Price: 20.95 Percentage Change: -9.11% Day High: 22.5 Day Low: 21

Weakness on Carclo below 21 will invariably lead to 18.7 with secondary ( ……..

</p

View Previous Carclo & Big Picture ***

LSE:CCL Carnival Close Mid-Price: 1211 Percentage Change: -2.06% Day High: 1287.5 Day Low: 1210

Target met. Continued weakness against CCL taking the price below 1210 ca ……..

</p

View Previous Carnival & Big Picture ***

LSE:CPI Capita Close Mid-Price: 24.12 Percentage Change: -9.93% Day High: 27.9 Day Low: 23.9

Continued trades against CPI with a mid-price ABOVE 27.9 should improve t ……..

</p

View Previous Capita & Big Picture ***

LSE:GENL Genel Close Mid-Price: 195.6 Percentage Change: -0.51% Day High: 200 Day Low: 195

Target met. Continued trades against GENL with a mid-price ABOVE 200 shou ……..

</p

View Previous Genel & Big Picture ***

LSE:GKP Gulf Keystone. Close Mid-Price: 269 Percentage Change: + 2.67% Day High: 275 Day Low: 262

Target met. Further movement against Gulf Keystone ABOVE 275 should impro ……..

</p

View Previous Gulf Keystone & Big Picture ***

LSE:HIK Hikma Close Mid-Price: 1685.5 Percentage Change: -9.01% Day High: 1734.5 Day Low: 1657.5

Continued weakness against HIK taking the price below 1657.5 calculates a ……..

</p

View Previous Hikma & Big Picture ***

LSE:HL. Hargreaves Lansdown Close Mid-Price: 885.2 Percentage Change: -2.36% Day High: 916.2 Day Low: 881.2

Target met. If Hargreaves Lansdown experiences continued weakness below 8 ……..

</p

View Previous Hargreaves Lansdown & Big Picture ***

LSE:IGG IG Group Close Mid-Price: 747.5 Percentage Change: -2.35% Day High: 775.5 Day Low: 741

Continued weakness against IGG taking the price below 741 calculates as l ……..

</p

View Previous IG Group & Big Picture ***

LSE:JET Just Eat Close Mid-Price: 1809.8 Percentage Change: -10.65% Day High: 2122 Day Low: 1810

Target met. If Just Eat experiences continued weakness below 1810, it wil ……..

</p

View Previous Just Eat & Big Picture ***

LSE:OCDO Ocado Plc Close Mid-Price: 830 Percentage Change: -6.93% Day High: 931 Day Low: 830.2

Target met. If Ocado Plc experiences continued weakness below 830.2, it w ……..

</p

View Previous Ocado Plc & Big Picture ***

LSE:OXIG Oxford Instruments Close Mid-Price: 2285 Percentage Change: -0.87% Day High: 2360 Day Low: 2260

In the event of Oxford Instruments enjoying further trades beyond 2360, t ……..

</p

View Previous Oxford Instruments & Big Picture ***

LSE:RR. Rolls Royce Close Mid-Price: 81.74 Percentage Change: -1.78% Day High: 86.22 Day Low: 81.69

In the event Rolls Royce experiences weakness below 81.69 it calculates w ……..

</p

View Previous Rolls Royce & Big Picture ***

LSE:STAN Standard Chartered Close Mid-Price: 565 Percentage Change: -0.67% Day High: 584 Day Low: 567.8

Further movement against Standard Chartered ABOVE 584 should improve acce ……..

</p

View Previous Standard Chartered & Big Picture ***

LSE:TRN The Trainline. Close Mid-Price: 303.7 Percentage Change: + 9.28% Day High: 320 Day Low: 284.1

In the event of The Trainline enjoying further trades beyond 320, the sha ……..

</p

View Previous The Trainline & Big Picture ***