#Gold #SP500

Publishing giant, Pearson Plc, founded 178 years ago, enjoy a company history which makes for a fascinating read. Quite a few organisations within the FTSE 100 boast of a chequered history but Pearson surely must come close to the top, if only for their formative years at the top of the construction industry. But then they learned to read, taking a new direction!

An example of their work is the existence of Mexico City. Pearson drained the swamp bowl, literally allowing the city to exist. They also appear to have specialised in tunnel works as evidenced with the railway tunnels under New York city. There appears nothing logical about their transition into becoming one of the largest publishers in the world and now, specialise in educational areas, both with conventional textbooks along with digital learning technologies. Inevitably, there are concerns around the world of the influence Pearson Plc has on education due to their influence through every part of the teaching and qualification process.

As rabbit holes go, it’s certainly worth an hour or so to research Pearson Plc’s history.

As for their share price, it “feels” like it’s on the verge of doing something interesting and we’ve received a couple of emails prompting us to take a look.

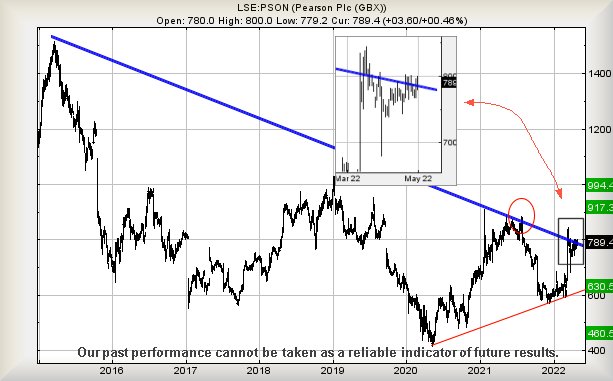

The immediate situation is mildly confusing, the share price opting to pole dance around the Blue downtrend which dates back to 2015. This trend has been pretty well defined and we’re inclined to take the circled brief spike above the trend as a promise, something is in the wind. This year, things were looking especially hopeful in March until the overall market dampening effect of Ukrainian events took hold, creating a situation where the price is now hugging the Blue line (see insert).

However, we are inclined to allocate 806p as a potential trigger to get things moving, calculating an initial ambition at 917p with secondary, if bettered, a longer term visually sane 994p.

For everything to go pear shaped, below 738p looks problematic, allowing a reversal cycle to an initial 630p with secondary, if broken, a hopeful bottom down at 460p.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:05:02PM | BRENT | 105.58 | |||||||||

| 10:06:22PM | GOLD | 1868.57 | 1850 | 1846 | 1821 | 1866 | 1876 | 1883 | 1894 | 1860 | |

| 10:08:11PM | FTSE | 7565.15 | Success | ||||||||

| 10:10:03PM | FRANCE | 6467 | |||||||||

| 10:11:27PM | GERMANY | 14032.51 | |||||||||

| 10:12:52PM | US500 | 4181.54 | 4132 | 4116 | 4088 | 4181 | 4200 | 4221 | 4274 | 4149 | |

| 10:15:12PM | DOW | 33163 | |||||||||

| 10:16:55PM | NASDAQ | 13121 | |||||||||

| 10:19:47PM | JAPAN | 27046 | ‘cess |

3/05/2022 FTSE Closed at 7561 points. Change of 0.23%. Total value traded through LSE was: £ 7,574,559,700 a change of 8.37%

29/04/2022 FTSE Closed at 7544 points. Change of 0.47%. Total value traded through LSE was: £ 6,989,742,428 a change of 18.72%

28/04/2022 FTSE Closed at 7509 points. Change of 1.13%. Total value traded through LSE was: £ 5,887,371,702 a change of -15.1%

27/04/2022 FTSE Closed at 7425 points. Change of 0.53%. Total value traded through LSE was: £ 6,934,236,931 a change of -7.56%

26/04/2022 FTSE Closed at 7386 points. Change of 0.08%. Total value traded through LSE was: £ 7,501,270,625 a change of 7.74%

25/04/2022 FTSE Closed at 7380 points. Change of -1.87%. Total value traded through LSE was: £ 6,962,693,363 a change of 2.9%

22/04/2022 FTSE Closed at 7521 points. Change of -100%. Total value traded through LSE was: £ 6,766,539,663 a change of 0%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BP. BP PLC** **LSE:CAR Carclo** **LSE:CASP Caspian** **LSE:CPI Capita** **LSE:HL. Hargreaves Lansdown** **LSE:IGG IG Group** **LSE:OCDO Ocado Plc** **LSE:STAN Standard Chartered** **

********

Updated charts published on : BP PLC, Carclo, Caspian, Capita, Hargreaves Lansdown, IG Group, Ocado Plc, Standard Chartered,

LSE:BP. BP PLC. Close Mid-Price: 414.25 Percentage Change: + 5.80% Day High: 413.15 Day Low: 395.05

All BP PLC needs are mid-price trades ABOVE 413.15 to improve acceleratio ……..

</p

View Previous BP PLC & Big Picture ***

LSE:CAR Carclo Close Mid-Price: 23 Percentage Change: -6.12% Day High: 25.5 Day Low: 22

Target met. If Carclo experiences continued weakness below 22, it will in ……..

</p

View Previous Carclo & Big Picture ***

LSE:CASP Caspian. Close Mid-Price: 2.7 Percentage Change: + 0.00% Day High: 2.7 Day Low: 2.65

If Caspian experiences continued weakness below 2.65, it will invariably ……..

</p

View Previous Caspian & Big Picture ***

LSE:CPI Capita. Close Mid-Price: 25.14 Percentage Change: + 4.84% Day High: 25.52 Day Low: 23.86

In the event of Capita enjoying further trades beyond 25.52, the share sh ……..

</p

View Previous Capita & Big Picture ***

LSE:HL. Hargreaves Lansdown. Close Mid-Price: 918 Percentage Change: + 0.09% Day High: 927.2 Day Low: 896

Continued weakness against HL. taking the price below 896 calculates as l ……..

</p

View Previous Hargreaves Lansdown & Big Picture ***

LSE:IGG IG Group Close Mid-Price: 802.5 Percentage Change: -1.59% Day High: 815 Day Low: 800.5

This is looking a little awkward as weakness below 800 now points at the p ……..

</p

View Previous IG Group & Big Picture ***

LSE:OCDO Ocado Plc Close Mid-Price: 919.4 Percentage Change: -0.50% Day High: 925 Day Low: 889.6

Continued weakness against OCDO taking the price below 889.6 calculates a ……..

</p

View Previous Ocado Plc & Big Picture ***

LSE:STAN Standard Chartered. Close Mid-Price: 566 Percentage Change: + 2.57% Day High: 565.6 Day Low: 548

In the event of Standard Chartered enjoying further trades beyond 565.6, ……..

</p

View Previous Standard Chartered & Big Picture ***