#Gold #SP500

Kenmare Resources Plc, an established mining company, operate in Mozambique. Therefore, they obviously have absolutely nothing in common with the “twee” Scottish village of Kenmore in Perthshire, home of what is probably the tightest hairpin bend in existence. It’s a pity, ‘cos the email request immediately reminded on the time my wife and her motorbike vanished at slow speed into the heather as we made our way down to Kenmore.

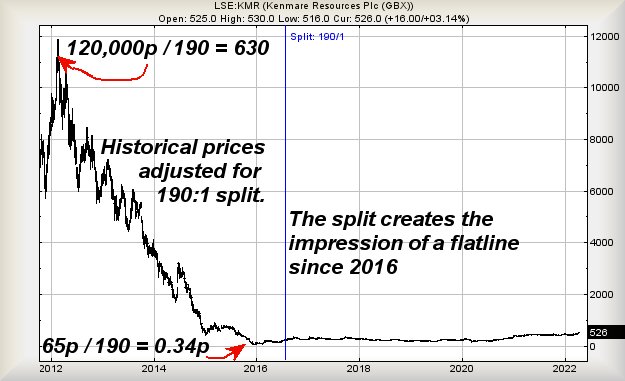

However, Kenmare Resources Plc do present a mildly interesting facet of share price history, especially what can happen when a share suffers a 190:1 share split. Historically, we abhor these movements as they almost never work out well for folk who were invested prior to the “here’s One Share to replace your existing One Hundred and Ninety Shares”. When the price of Kenmare is adjusted to handle the manipulation, there’s visually little chance of the price ever achieving recompense for the folk trapped from the days in 2012, when the price was around 630p. It now needs achieve 120,000p just for these folk to break even.

The chart below endeavours to outline how painful this is for long term investors. While it was certainly not a fun experience watching the share tumble from the 630p level to under a penny, just 4 years later, the share split has only served to make the price once again sound respectable, leaving many folk destined to ‘walk funny’ due to the massive reduction in real value.

Importantly though, the flatline isn’t quite as flat as the Big Picture chart implies, the share price now trading roughly twice the level when the split occurred and, perhaps more importantly, some folk who’ve been invested since 2015 are now showing an actual profit! Better still, it feels some continued price recovery is now possible as movement above 530p looks capable of provoking ongoing travel to an initial 552p with secondary, if bettered, at 588p and some probable hesitation.

For the longer term, closure above 588p shall prove crucial as this would emplace the share price in a region where influences from before the 190:1 share split become viable. As a result, we can calculate a future 683p as presenting a logical future ambition.

Finally, thanks for the emails regarding the photo of the muddy Easter dog. Glad to know it’s not just our monster who does this.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:05:05PM | BRENT | 106.95 | Success | ||||||||

| 10:12:04PM | GOLD | 1950.42 | 1942 | 1939 | 1920 | 1960 | 1968 | 1974 | 1979 | 1956 | Success |

| 10:13:40PM | FTSE | 7613.68 | |||||||||

| 10:15:46PM | FRANCE | 6576.8 | ‘cess | ||||||||

| 10:18:09PM | GERMANY | 14197.58 | ‘cess | ||||||||

| 10:37:49PM | US500 | 4444.72 | 4430 | 4419 | 4402 | 4456 | 4472 | 4482 | 4500 | 4437 | Success |

| 10:40:09PM | DOW | 34858.2 | Success | ||||||||

| 10:42:25PM | NASDAQ | 14084.97 | Success | ||||||||

| 10:44:40PM | JAPAN | 27221 | ‘cess |

19/04/2022 FTSE Closed at 7601 points. Change of -0.2%. Total value traded through LSE was: £ 6,126,164,773 a change of -7.53%

14/04/2022 FTSE Closed at 7616 points. Change of 0.47%. Total value traded through LSE was: £ 6,624,976,338 a change of 20.3%

13/04/2022 FTSE Closed at 7580 points. Change of 0.05%. Total value traded through LSE was: £ 5,507,163,189 a change of -5.24%

12/04/2022 FTSE Closed at 7576 points. Change of -0.55%. Total value traded through LSE was: £ 5,811,485,837 a change of 3.97%

11/04/2022 FTSE Closed at 7618 points. Change of -0.67%. Total value traded through LSE was: £ 5,589,702,864 a change of 0.53%

8/04/2022 FTSE Closed at 7669 points. Change of -100%. Total value traded through LSE was: £ 5,560,387,967 a change of 0%

7/04/2022 FTSE Closed at 7551 points. Change of 0%. Total value traded through LSE was: £ 6,503,801,029 a change of 0%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:ASC Asos** **LSE:AVCT Avacta** **LSE:BP. BP PLC** **LSE:DARK Darktrace Plc** **LSE:EXPN Experian** **LSE:GLEN Glencore Xstra** **LSE:HL. Hargreaves Lansdown** **LSE:ITRK Intertek** **LSE:JET Just Eat** **LSE:TLW Tullow** **

********

Updated charts published on : Asos, Avacta, BP PLC, Darktrace Plc, Experian, Glencore Xstra, Hargreaves Lansdown, Intertek, Just Eat, Tullow,

LSE:ASC Asos Close Mid-Price: 1447 Percentage Change: -1.23% Day High: 1501 Day Low: 1398

Weakness on Asos below 1398 will invariably lead to 1378 with secondary ( ……..

</p

View Previous Asos & Big Picture ***

LSE:AVCT Avacta. Close Mid-Price: 133.5 Percentage Change: + 5.20% Day High: 136.5 Day Low: 125.5

Target met. Further movement against Avacta ABOVE 136.5 should improve ac ……..

</p

View Previous Avacta & Big Picture ***

LSE:BP. BP PLC. Close Mid-Price: 401.05 Percentage Change: + 0.40% Day High: 407.7 Day Low: 401.25

Target met. Continued trades against BP. with a mid-price ABOVE 407.7 sho ……..

</p

View Previous BP PLC & Big Picture ***

LSE:DARK Darktrace Plc. Close Mid-Price: 384.2 Percentage Change: + 5.29% Day High: 388.9 Day Low: 361.6

Weakness on Darktrace Plc below 361.6 will invariably lead to 351 with se ……..

</p

View Previous Darktrace Plc & Big Picture ***

LSE:EXPN Experian Close Mid-Price: 2711 Percentage Change: -1.02% Day High: 2774 Day Low: 2649

Target met. Continued weakness against EXPN taking the price below 2649 c ……..

</p

View Previous Experian & Big Picture ***

LSE:GLEN Glencore Xstra. Close Mid-Price: 535.6 Percentage Change: + 1.67% Day High: 540.2 Day Low: 527

In the event of Glencore Xstra enjoying further trades beyond 540.2, the ……..

</p

View Previous Glencore Xstra & Big Picture ***

LSE:HL. Hargreaves Lansdown Close Mid-Price: 959.2 Percentage Change: -0.91% Day High: 971 Day Low: 949.4

Continued weakness against HL. taking the price below 949.4 calculates as ……..

</p

View Previous Hargreaves Lansdown & Big Picture ***

LSE:ITRK Intertek Close Mid-Price: 4943 Percentage Change: -2.74% Day High: 5066 Day Low: 4912

Target met. In the event Intertek experiences weakness below 4912 it calc ……..

</p

View Previous Intertek & Big Picture ***

LSE:JET Just Eat Close Mid-Price: 2171 Percentage Change: -3.62% Day High: 2253.5 Day Low: 2114.5

Target met. Continued weakness against JET taking the price below 2114.5 ……..

</p

View Previous Just Eat & Big Picture ***

LSE:TLW Tullow Close Mid-Price: 58.25 Percentage Change: -0.77% Day High: 60 Day Low: 57.35

Now above 63 should indicate recovery to an initial 68 with secondary, if ……..

</p

View Previous Tullow & Big Picture ***