#FTSE #Brent_short With the FTSE staggering around like a drunk looking for a kebab shop, it makes some sense to take a quick glance at one of the majors in the hospitality industry. After all, thanks to FTSE behaviour since May, surely many traders must require refreshment?

Perhaps this shall not prove the case. While the owner of 1,600 venues reports improvements in profits, along with a few moans which point out footfall has improved in their suburban locations, while city centre establishments continue to find things tight. In addition, they claim Brexit has harmed trade and warn paying staff a reasonable wage from 2022 will damage their bottom line. But on the bright side, the company report they’ve bought a few white vans to collect goods, if supply chain issues result in lorry loads of booze failing to arrive!

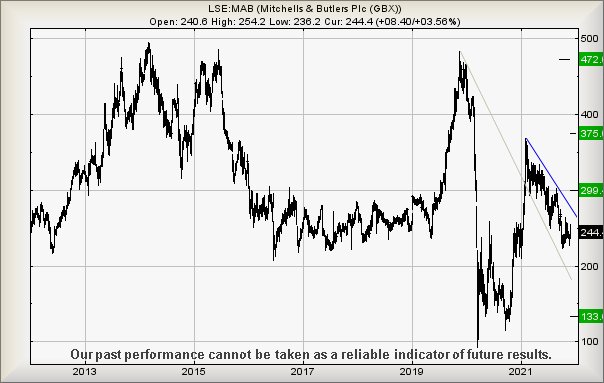

We’re curious whether the share price shall enjoy a return to normality. Presently trading around 244p, the share needs exceed 264p to provide an early sign of hope, calculating with the potential of a journey to 299p initially. If exceeded (visually, we expect hesitation at this level, regardless) our longer term secondary works out at 375p.

Achieving such a target as 375p is liable to be useful for the longer term. According to our software, if the company share price manages to close a session above 334p, a cycle should commence to 472p, challenging the high of 2019. As the chart illustrates, this appears to be a favourite level for the price, a glass ceiling forming since 2014.

For everything to go wrong, the share needs relax below 220p as we’d need take another look at the tea leaves. At present, the best we can calculate is a dangerous plunge to 133p.

FTSE for FRIDAY With the FTSE essentially marching on the spot, while the USA conducted turkey genocide, the market enacted an small but interesting movement from 3pm, producing a rare emotion called ‘Hope’ for Friday. The market closed the day at 7310 points and now, it need only exceed 7319 points to make an attempt at 7335. While a 16 point gain is tame by any standards, our secondary at 7355 is slightly more worthwhile.

In addition, we stumbled across an interesting number from a bigger picture potential. Apparently we are to believe the UK market is now on track to make an attempt at 7375 points. If bettered, we can calculate a longer term secondary at 7550 points and regular readers will be aware we regard this specific number as critical. This is exactly the level of the market before the pandemic drop in 2020. Good things tend happen to markets around the world when they finally exceed this Covid-19 point in time.

If things intend go horribly wrong, the FTSE now requires trade below 7265, risking reversal to 7235 with secondary, if broken, at 7202 points.

Have a good weekend. We won’t, thanks to Scotlands west coast promising 75mph winds along with snow and ice! It must be winter…

Our thanks, as ever, to those who discover a fascinating advert on this page and choose to visit it. It buys us a coffee, a needed coffee!

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:48:28PM | BRENT | 81.15 | 80.81 | 80.36 | 81.54 | 82.04 | 82.43 | 80.94 | ‘cess | ||

| 9:52:30PM | GOLD | 1788.29 | 1777 | 1773 | 1792 | 1796 | 1799 | 1785 | |||

| 9:54:04PM | FTSE | 7302 | 7242 | 7227 | 7282 | 7308 | 7320 | 7278 | ‘cess | ||

| 9:59:14PM | FRANCE | 7047 | 6981 | 6944 | 7041 | 7054 | 7071 | 7023 | Success | ||

| 10:04:17PM | GERMANY | 15913.2 | 15866 | 15815 | 15960 | 15932 | 15976 | 15865 | Success | ||

| 10:05:55PM | US500 | 4704.82 | 4658 | 4636 | 4690 | 4704 | 4712 | 4676 | |||

| 10:21:30PM | DOW | 35837 | 35581 | 35502 | 35728 | 35837 | 35909 | 35740 | |||

| 10:23:13PM | NASDAQ | 16361 | 16103 | 16058 | 16290 | 16368 | 16482 | 16250 | ‘cess | ||

| 10:25:14PM | JAPAN | 29445 | 29190 | 29087 | 29344 | 29454 | 29520 | 29290 | Success |

25/11/2021 FTSE Closed at 7310 points. Change of 0.33%. Total value traded through LSE was: £ 3,734,503,289 a change of -30.71%

24/11/2021 FTSE Closed at 7286 points. Change of 0.28%. Total value traded through LSE was: £ 5,389,556,678 a change of 0.75%

23/11/2021 FTSE Closed at 7266 points. Change of 0.15%. Total value traded through LSE was: £ 5,349,222,584 a change of 8.04%

22/11/2021 FTSE Closed at 7255 points. Change of 0.44%. Total value traded through LSE was: £ 4,951,055,285 a change of -23.97%

19/11/2021 FTSE Closed at 7223 points. Change of -0.44%. Total value traded through LSE was: £ 6,512,253,332 a change of 26.1%

18/11/2021 FTSE Closed at 7255 points. Change of -0.49%. Total value traded through LSE was: £ 5,164,170,076 a change of -21.09%

17/11/2021 FTSE Closed at 7291 points. Change of -0.48%. Total value traded through LSE was: £ 6,544,197,629 a change of 2.92%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:DGE Diageo** **LSE:ECO ECO (Atlantic) O & G** **LSE:GKP Gulf Keystone** **LSE:HSBA HSBC** **LSE:IGG IG Group** **LSE:ITRK Intertek** **LSE:NG. National Glib** **LSE:ODX Omega Diags** **LSE:PPC President Energy** **LSE:TW. Taylor Wimpey** **

********

Updated charts published on : Diageo, ECO (Atlantic) O & G, Gulf Keystone, HSBC, IG Group, Intertek, National Glib, Omega Diags, President Energy, Taylor Wimpey,

LSE:DGE Diageo. Close Mid-Price: 3912 Percentage Change: + 0.95% Day High: 3944 Day Low: 3891

All Diageo needs are mid-price trades ABOVE 3944 to improve acceleration ……..

</p

View Previous Diageo & Big Picture ***

LSE:ECO ECO (Atlantic) O & G Close Mid-Price: 19.75 Percentage Change: -3.66% Day High: 20.75 Day Low: 19.75

If ECO (Atlantic) O & G experiences continued weakness below 19.75, it wi ……..

</p

View Previous ECO (Atlantic) O & G & Big Picture ***

LSE:GKP Gulf Keystone Close Mid-Price: 193.2 Percentage Change: -1.02% Day High: 195.6 Day Low: 191.8

Anything now below 186 suggests coming reversal to an initial 172p. If bro ……..

</p

View Previous Gulf Keystone & Big Picture ***

LSE:HSBA HSBC. Close Mid-Price: 443.8 Percentage Change: + 0.10% Day High: 445.75 Day Low: 439.85

Above 446 now is allegedly capable of 455 next. If bettered, our secondary ……..

</p

View Previous HSBC & Big Picture ***

LSE:IGG IG Group Close Mid-Price: 762 Percentage Change: -0.85% Day High: 773 Day Low: 757.5

In the event IG Group experiences weakness below 757.5 it calculates with ……..

</p

View Previous IG Group & Big Picture ***

LSE:ITRK Intertek. Close Mid-Price: 5544 Percentage Change: + 1.35% Day High: 5572 Day Low: 5434

Further movement against Intertek ABOVE 5572 should improve acceleration ……..

</p

View Previous Intertek & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 1007 Percentage Change: + 0.87% Day High: 1008.8 Day Low: 998.1

In the event of National Glib enjoying further trades beyond 1008.8, the ……..

</p

View Previous National Glib & Big Picture ***

LSE:ODX Omega Diags Close Mid-Price: 29.5 Percentage Change: -26.25% Day High: 35 Day Low: 26.25

Target met. If Omega Diags experiences continued weakness below 26.25, it ……..

</p

View Previous Omega Diags & Big Picture ***

LSE:PPC President Energy. Close Mid-Price: 2.5 Percentage Change: + 4.17% Day High: 2.65 Day Low: 2.45

Target met. All President Energy needs are mid-price trades ABOVE 2.65 to ……..

</p

View Previous President Energy & Big Picture ***

LSE:TW. Taylor Wimpey. Close Mid-Price: 163 Percentage Change: + 1.46% Day High: 163.45 Day Low: 159.95

Further movement against Taylor Wimpey ABOVE 163.45 should improve accele ……..

</p

View Previous Taylor Wimpey & Big Picture ***