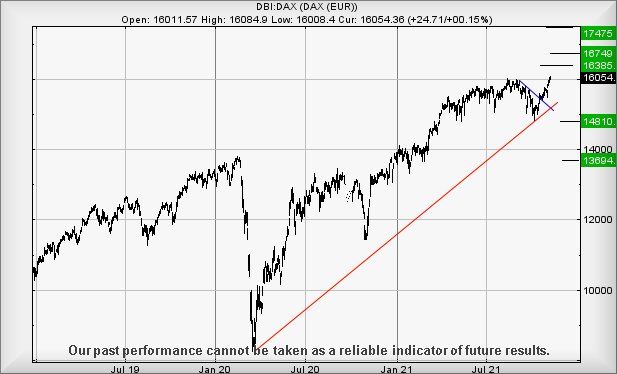

#Dax #BrentFutures The German DAX is looking quite extraordinary, now trading higher than any point ever. It has long bettered its pre-pandemic high, the index reached a logical ceiling level, and now is cheerfully powering upward to hitherto unimagined levels. The argument will doubtless be made of such performance occurring, due to a change in the DAX’ makeup last month. It’s wrong, the DAX high back in August was a new all time high, achieved before the constituents were shuffled.

The immediate situation is quite positive, the Big Picture claiming the DAX intends head to 17,475 points eventually as the next major point of interest, a price level where normal calculations imply some hesitation should be expected. Even nearer term, any ability to exceed 16,090 points signals the potential of movement continuing to 16,385 points with our secondary, if bettered, working out at 16,749 points.

For everything to go horribly wrong for Germany, the market requires to trade below 15,100. Such weakness permits reversal to 14,810 initially with secondary, if broken, a rather more painful 13,694

Lloyds Bank When we previously reviewed Lloyds three weeks ago, we had been privately comfortable the share price was heading to 51.9p next. The movement triggered eventually, the price surged over a few sessions and instead of achieving our smug 51.9p, the highest achieved was just 51.58p. In the days since, the share price experienced mild hysterics at its temerity, slamming itself back down to the 48p level again.

The implication of this surge bothers us quite a lot. The suggestion is of weakness, despite the share breaking through its Blue downtrend last October. If this theory proves correct, travel below 48p brings the potential of a trip down memory lane to 46.3p. We’re being a little sarcastic, thanks to Lloyds appearing to enjoy the 46p level since April this year, hinting of a desire to pivot above and below such. If broken, our secondary is a less likely visit to 44.4p.

Should things start to go right for Lloyds Bank, the share price now needs better 50.7p to hopefully trigger movement to an initial 53p with our secondary calculating at an attractive 58.3p. As ever, due to this matching the pre-pandemic high, we would anticipate some stutters, should such a target make an appearance.

Many thanks to the kind folk who find adverts on this page worth a visit. It buys the morning coffee!

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:41:01PM | BRENT | 82.34 | 79.97 | 79.225 | 77.99 | 81.3 | 82.93 | 84 | 85.35 | 81.87 | |

| 9:43:37PM | GOLD | 1818.56 | Success | ||||||||

| 9:45:46PM | FTSE | 7308.15 | Success | ||||||||

| 9:51:49PM | FRANCE | 7047 | Success | ||||||||

| 7:28:40PM | GERMANY | 16049 | 15993 | 15974 | 15935 | 16063 | 16091 | 16108 | 16146 | 16013 | ‘cess |

| 7:50:16PM | US500 | 4695.02 | Success | ||||||||

| 7:52:54PM | DOW | 36322.2 | Success | ||||||||

| 7:58:06PM | NASDAQ | 16353 | |||||||||

| 8:01:25PM | JAPAN | 29660 |

5/11/2021 FTSE Closed at 7303 points. Change of 0.33%. Total value traded through LSE was: £ 5,378,363,881 a change of -21.99%

4/11/2021 FTSE Closed at 7279 points. Change of 0.43%. Total value traded through LSE was: £ 6,894,189,975 a change of 28.51%

3/11/2021 FTSE Closed at 7248 points. Change of -0.36%. Total value traded through LSE was: £ 5,364,561,051 a change of -4.12%

2/11/2021 FTSE Closed at 7274 points. Change of -0.19%. Total value traded through LSE was: £ 5,594,886,752 a change of 24.19%

1/11/2021 FTSE Closed at 7288 points. Change of 0.7%. Total value traded through LSE was: £ 4,505,252,834 a change of -24.3%

29/10/2021 FTSE Closed at 7237 points. Change of -0.17%. Total value traded through LSE was: £ 5,951,106,978 a change of 27.04%

28/10/2021 FTSE Closed at 7249 points. Change of -0.06%. Total value traded through LSE was: £ 4,684,429,352 a change of -6.92%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:CBX Cellular Goods** **LSE:CCL Carnival** **LSE:DARK Darktrace Plc** **LSE:DGE Diageo** **LSE:EZJ EasyJet** **LSE:FOXT Foxtons** **LSE:IHG Intercontinental Hotels Group** **LSE:MKS Marks and Spencer** **LSE:ODX Omega Diags** **LSE:PPC President Energy** **LSE:TSCO Tesco** **

********

Updated charts published on : Cellular Goods, Carnival, Darktrace Plc, Diageo, EasyJet, Foxtons, Intercontinental Hotels Group, Marks and Spencer, Omega Diags, President Energy, Tesco,

LSE:CBX Cellular Goods. Close Mid-Price: 7 Percentage Change: + 3.09% Day High: 7.1 Day Low: 6.71

In the event Cellular Goods experiences weakness below 6.71 it calculates ……..

</p

View Previous Cellular Goods & Big Picture ***

LSE:CCL Carnival. Close Mid-Price: 1696 Percentage Change: + 9.42% Day High: 1709.6 Day Low: 1539.4

All Carnival needs are mid-price trades ABOVE 1709.6 to improve accelerat ……..

</p

View Previous Carnival & Big Picture ***

LSE:DARK Darktrace Plc Close Mid-Price: 577.5 Percentage Change: -3.59% Day High: 599.5 Day Low: 576

This has been performing pretty much according to our “rules” with the res ……..

</p

View Previous Darktrace Plc & Big Picture ***

LSE:DGE Diageo. Close Mid-Price: 3778.5 Percentage Change: + 0.21% Day High: 3789.5 Day Low: 3758

Target met. Further movement against Diageo ABOVE 3789.5 should improve a ……..

</p

View Previous Diageo & Big Picture ***

LSE:EZJ EasyJet. Close Mid-Price: 657.2 Percentage Change: + 6.03% Day High: 662.8 Day Low: 605.6

In the event of EasyJet enjoying further trades beyond 662.8, the share s ……..

</p

View Previous EasyJet & Big Picture ***

LSE:FOXT Foxtons Close Mid-Price: 45.05 Percentage Change: -0.55% Day High: 45.95 Day Low: 44

Target met. Weakness on Foxtons below 44 will invariably lead to 42 with ……..

</p

View Previous Foxtons & Big Picture ***

LSE:IHG Intercontinental Hotels Group. Close Mid-Price: 5336 Percentage Change: + 2.34% Day High: 5376 Day Low: 5138

Target met. Continued trades against IHG with a mid-price ABOVE 5376 shou ……..

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:MKS Marks and Spencer. Close Mid-Price: 193.9 Percentage Change: + 0.67% Day High: 196.15 Day Low: 189.85

Further movement against Marks and Spencer ABOVE 196.15 should improve ac ……..

</p

View Previous Marks and Spencer & Big Picture ***

LSE:ODX Omega Diags Close Mid-Price: 44 Percentage Change: -3.72% Day High: 45.5 Day Low: 43.5

Weakness on Omega Diags below 43.5 will invariably lead to 39 with second ……..

</p

View Previous Omega Diags & Big Picture ***

LSE:PPC President Energy. Close Mid-Price: 2.1 Percentage Change: + 12.00% Day High: 2.17 Day Low: 1.95

All President Energy needs are mid-price trades ABOVE 2.17 to improve acc ……..

</p

View Previous President Energy & Big Picture ***

LSE:TSCO Tesco Close Mid-Price: 275.35 Percentage Change: -0.09% Day High: 279.2 Day Low: 275.55

Target met. Continued trades against TSCO with a mid-price ABOVE 280 shou ……..

</p

View Previous Tesco & Big Picture ***