#Gold #WallSt With considerable disappointment, we came to realise The Hut Group have absolutely nothing to do with garden huts. As we’re currently building a new garden hut, it would have been nice to discover a real synergy with the subject of our report. A visit to their Wikipedia page quickly reveals THG to be a truly impressive organisation, based in Manchester but with sales predominantly outwith our shores.

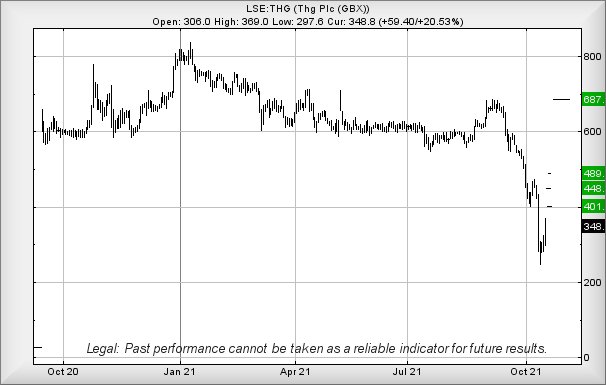

Floated on the LSE just a year ago, the company were excluded from membership of the FTSE 100 due to certain areas of corporate governance. A recent effort to unveil their future strategy to investors saw the market celebrate by plunging their share price from 457p down to 248p over just a couple of sessions. It was not a pretty site but, from our perspective, the drop was incredibly precise from an arithmetic viewpoint, especially as we couldn’t produce any target level below 248p. This, it appeared, was to be regarded as “ultimate bottom” at that time. In the period since, an announcement of a change to their CEO’s so called “golden share”, is regarded as an attempt to regain the confidence of the city and allow the company to apply to join the FTSE100 next year.

If this is indeed the case, we need examine criteria which should justify further price recovery.

Presently trading around 348p, the price need only exceed 370p to promote further movement to an initial 401p. If bettered, we can calculate a secondary at 448p. While the secondary effectively matches the share price highs in the days prior to their fateful fall, any expectation of some hesitation will doubtless prove justified but there’s an important detail worthy of consideration. In the even the share actually closes a session an iota above 448p, a new cycle becomes possible with the potential of 489p in the future, perhaps even an astounding 687p. We shall need revisit price movements, if it ever successfully closes above 448p, just to confirm these numbers.

After all, they’re almost too good.

As always, our thanks to the folk who find adverts on this page worthy of visiting. It literally buys a daily thank-you coffee.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:15:08PM | BRENT | 83.7 | Success | ||||||||

| 10:17:12PM | GOLD | 1765.12 | 1759 | 1747 | 1729 | 1771 | 1777 | 1780 | 1783 | 1765 | |

| 10:20:34PM | FTSE | 7202.9 | ‘cess | ||||||||

| 10:22:48PM | FRANCE | 6675 | Success | ||||||||

| 10:26:00PM | GERMANY | 15484 | ‘cess | ||||||||

| 10:27:58PM | US500 | 4486.47 | ‘cess | ||||||||

| 10:30:25PM | DOW | 35257 | 35137 | 35053.5 | 34966 | 35228 | 35326 | 35458 | 35600 | 35202 | |

| 10:32:45PM | NASDAQ | 15299 | Success | ||||||||

| 10:34:33PM | JAPAN | 29054 | Shambles |

18/10/2021 FTSE Closed at 7203 points. Change of -0.43%. Total value traded through LSE was: £ 5,194,650,270 a change of -14.83%

15/10/2021 FTSE Closed at 7234 points. Change of 0.37%. Total value traded through LSE was: £ 6,099,387,832 a change of 10.37%

14/10/2021 FTSE Closed at 7207 points. Change of 0.92%. Total value traded through LSE was: £ 5,526,155,922 a change of -16.32%

13/10/2021 FTSE Closed at 7141 points. Change of 0.15%. Total value traded through LSE was: £ 6,604,225,806 a change of 15.2%

12/10/2021 FTSE Closed at 7130 points. Change of -0.22%. Total value traded through LSE was: £ 5,733,075,032 a change of 19.23%

11/10/2021 FTSE Closed at 7146 points. Change of 0.72%. Total value traded through LSE was: £ 4,808,445,394 a change of -16.31%

9/10/2021 FTSE Closed at 7095 points. Change of 0%. Total value traded through LSE was: £ 5,745,415,827 a change of -6.11%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:ASC Asos** **LSE:BARC Barclays** **LSE:BP. BP PLC** **LSE:BT.A British Telecom** **LSE:EMG MAN** **LSE:FRES Fresnillo** **LSE:GENL Genel** **LSE:GKP Gulf Keystone** **LSE:GLEN Glencore Xstra** **LSE:ITM ITM Power** **LSE:RKH Rockhopper** **

********

Updated charts published on : Asos, Barclays, BP PLC, British Telecom, MAN, Fresnillo, Genel, Gulf Keystone, Glencore Xstra, ITM Power, Rockhopper,

LSE:ASC Asos. Close Mid-Price: 2560 Percentage Change: + 6.93% Day High: 2582 Day Low: 2406

Further movement against Asos ABOVE 2582 should improve acceleration towa ……..

</p

View Previous Asos & Big Picture ***

LSE:BARC Barclays. Close Mid-Price: 199.46 Percentage Change: + 0.83% Day High: 200.3 Day Low: 197.36

Target met. Continued trades against BARC with a mid-price ABOVE 200.3 sh ……..

</p

View Previous Barclays & Big Picture ***

LSE:BP. BP PLC Close Mid-Price: 361.45 Percentage Change: -0.59% Day High: 366.4 Day Low: 361

Target met. All BP PLC needs are mid-price trades ABOVE 366.4 to improve ……..

</p

View Previous BP PLC & Big Picture ***

LSE:BT.A British Telecom Close Mid-Price: 137.45 Percentage Change: -2.24% Day High: 141 Day Low: 137.3

Target met. Weakness on British Telecom below 137.3 will invariably lead ……..

</p

View Previous British Telecom & Big Picture ***

LSE:EMG MAN. Close Mid-Price: 229.2 Percentage Change: + 0.92% Day High: 233 Day Low: 227

In the event of MAN enjoying further trades beyond 233, the share should ……..

</p

View Previous MAN & Big Picture ***

LSE:FRES Fresnillo. Close Mid-Price: 863 Percentage Change: + 2.06% Day High: 874.4 Day Low: 845.6

Continued trades against FRES with a mid-price ABOVE 874.4 should improve ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:GENL Genel Close Mid-Price: 156.6 Percentage Change: -0.76% Day High: 160 Day Low: 155

Target met. Continued trades against GENL with a mid-price ABOVE 160 shou ……..

</p

View Previous Genel & Big Picture ***

LSE:GKP Gulf Keystone. Close Mid-Price: 220 Percentage Change: + 1.38% Day High: 224.5 Day Low: 219

Continued trades against GKP with a mid-price ABOVE 224.5 should improve ……..

</p

View Previous Gulf Keystone & Big Picture ***

LSE:GLEN Glencore Xstra. Close Mid-Price: 392.45 Percentage Change: + 0.49% Day High: 397.55 Day Low: 391.35

All Glencore Xstra needs are mid-price trades ABOVE 397.55 to improve acc ……..

</p

View Previous Glencore Xstra & Big Picture ***

LSE:ITM ITM Power. Close Mid-Price: 463.2 Percentage Change: + 2.66% Day High: 474.4 Day Low: 436.8

Continued trades against ITM with a mid-price ABOVE 474.4 should improve ……..

</p

View Previous ITM Power & Big Picture ***

LSE:RKH Rockhopper. Close Mid-Price: 6.9 Percentage Change: + 6.15% Day High: 6.9 Day Low: 6.28

Target met. Further movement against Rockhopper ABOVE 6.9 should improve ……..

</p

View Previous Rockhopper & Big Picture ***