#Brent #DOW With the world anxiously waiting to discover what colour of car Louis Hamilton will be wearing on his head in the coming Russian GP, we decided to take a glance at how the Ruble is doing against the US Dollar. In addition, with some pundits describing the problems at Evergrande as an ‘end of the world’ event, perhaps it shall prove worth glancing at the dead parrot from China!

Apparently, the level of financial problems with China Evergrande are such that they make the 2008 issue with Lehman Brothers look like a dress rehearsal for real contagion problems. The, essentially at core, property company has suffered historically, due to obeying government directives to invest without satisfying themselves of repayment. With rather a lot of defaults, the company finds itself unable to repay bond holders, creating a situation where investors quite literally recently took a senior executive hostage. Obviously, the big fear comes of Evergrande problems infecting the wider markets, if the Chinese government decide to with-hold assistance. Many other talking heads, however, deem Evergrande as “Too Big to Fail” and unlikely to give markets cause to switch into headless chicken mode. We were hoping, following Covid-19, China would be satisfied it had given the world sufficient reason for worry, for a while!

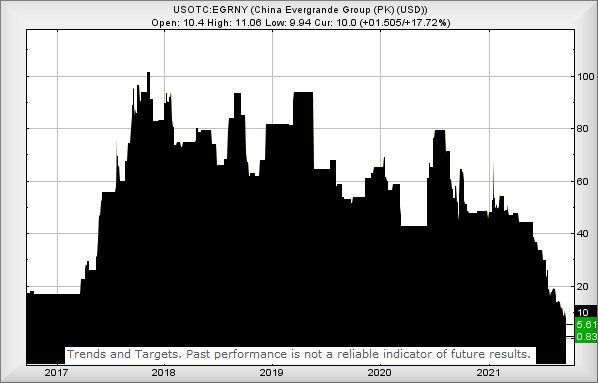

Amusingly, when we opt to employ a ‘Shaded’ chart for Evergrande, the result looks like like a city skyline, the focus of their investments. It’s also perhaps worth remembering the company do actually own property, unlike Lehman which owned financial positions. This critical difference may prove important.

We’ve chosen to display the share price from the popular USOTC exchange in New York, the one many people are not aware of. Despite being thought of as the home of ‘Penny Stocks’, the US Over The Counter exchange caters for instruments from young companies, unable to meet the criteria for a “proper” stock market listing. But some notable companies are also listed on USOTC, some even maintaining joint listings in their home country. This includes organisations such as Heineken, Siemers, Deutsche Telecom, Nestle, etc. We did a quick trawl through platforms in an effort to discover how China Evergrande were listed. Where listings did exist, the price was either in HK$ or US$, the latter presumably coming from the USOTC listing.

At present, the NY OTC lists Evergrande at US $10, already substantially below our conventional ‘ultimate bottom’ level of 17 dollars. This effectively places the share in a region where it’s stuffed. From a Big Picture perspective, we cannot calculate a bottom. If we opt to review price movements for 2021 only, it appears there’s a chance weakness below 7.25 may discover the potential of a bounce at 5.6 dollars. If broken, our secondary works out at 0.83 dollars. Please remember, the price is already pretty dire, trading below any Big Picture targets. But the chart certainly serves to remind what the company core business was.

US Dollar vs RUB (FX:USDRUB) Despite the chilling visuals of Louis Hamilton’s championship rival walking away from their crash, not bothering to check on his competitor who was sitting with a crashed car on his head, we’re looking forward to this weekends Russian Grand Prix. For this race, the big question isn’t really whether the sole Russian driver has a chance of winning but instead, on which lap will the unfortunate driver again spin off the track! We can also use the event as an excuse to review how the Ruble is doing against the dollar.

The immediate situation is far from clear. Despite the dollar proving quite strong against the Ruble since 2015, there are some early signs of faltering. For instance, at present weakness below 72.2 looks perfectly capable of promoting reversal to an initial 69.20 and a challenge against the long term Red uptrend. Should the pairing manage to close a session below 69.20, we can calculate the potential of a bouncy bottom at 65 eventually.

To escape the potentials of dollar weakness, the relationship needs exceed 74.75 as this threatens recovery toward an initial 76.4 with our longer term secondary, if exceeded, working out at 78 and very probable hesitation.

For now, we suspect the Ruble intends strengthen.

FUTURES

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

10:31:17PM |

BRENT |

75.35 |

74.49 |

74 |

73.45 |

75.05 |

75.65 |

75.9475 |

76.21 |

74.57 |

Success |

|

10:33:26PM |

GOLD |

1768.78 |

‘cess |

||||||||

|

10:40:19PM |

FTSE |

7075.46 |

Success |

||||||||

|

10:42:10PM |

FRANCE |

6631.5 |

Success |

||||||||

|

10:45:09PM |

GERMANY |

15514.98 |

Success |

||||||||

|

10:49:04PM |

US500 |

4398 |

Shambles |

||||||||

|

10:55:31PM |

DOW |

34288 |

33885 |

33823 |

33620 |

34097 |

34432 |

34491.5 |

34596 |

34185 |

Shambles |

|

10:57:14PM |

NASDAQ |

15191 |

‘cess |

||||||||

|

10:59:24PM |

JAPAN |

29971 |

Success |

22/09/2021 FTSE Closed at 7083 points. Change of 1.48%. Total value traded through LSE was: £ 5,122,671,663 a change of -18.56%

21/09/2021 FTSE Closed at 6980 points. Change of 1.12%. Total value traded through LSE was: £ 6,290,005,050 a change of -2.8%

20/09/2021 FTSE Closed at 6903 points. Change of -0.86%. Total value traded through LSE was: £ 6,471,386,958 a change of -56.78%

17/09/2021 FTSE Closed at 6963 points. Change of -0.91%. Total value traded through LSE was: £ 14,974,489,872 a change of 149%

16/09/2021 FTSE Closed at 7027 points. Change of 0.16%. Total value traded through LSE was: £ 6,013,769,162 a change of 0.85%

15/09/2021 FTSE Closed at 7016 points. Change of -0.26%. Total value traded through LSE was: £ 5,962,830,996 a change of 19.14%

14/09/2021 FTSE Closed at 7034 points. Change of -0.73%. Total value traded through LSE was: £ 5,004,739,047 a change of 6.33%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AGM Applied Graphene** **LSE:BP. BP PLC** **LSE:CBX Cellular Goods** **LSE:CNA Centrica** **LSE:EXPN Experian** **LSE:EZJ EasyJet** **LSE:GKP Gulf Keystone** **LSE:ODX Omega Diags** **LSE:RR. Rolls Royce** **LSE:TSCO Tesco** **LSE:ZOO Zoo Digital** **

********

Updated charts published on : Applied Graphene, BP PLC, Cellular Goods, Centrica, Experian, EasyJet, Gulf Keystone, Omega Diags, Rolls Royce, Tesco, Zoo Digital,

LSE:AGM Applied Graphene Close Mid-Price: 29.5 Percentage Change: -1.67% Day High: 30 Day Low: 29.5

This remains feeling quite dreadful, still needing movements above 31.5 to ……..

</p

View Previous Applied Graphene & Big Picture ***

LSE:BP. BP PLC. Close Mid-Price: 316.75 Percentage Change: + 2.57% Day High: 319.7 Day Low: 313.15

All BP PLC needs are mid-price trades ABOVE 319.7 to improve acceleration ……..

</p

View Previous BP PLC & Big Picture ***

LSE:CBX Cellular Goods. Close Mid-Price: 5.68 Percentage Change: + 1.43% Day High: 5.6 Day Low: 5.55

In the event Cellular Goods experiences weakness below 5.55 it calculates ……..

</p

View Previous Cellular Goods & Big Picture ***

LSE:CNA Centrica Close Mid-Price: 53.74 Percentage Change: -0.41% Day High: 55.18 Day Low: 53.88

In the event of Centrica enjoying further trades beyond 55.18, the share ……..

</p

View Previous Centrica & Big Picture ***

LSE:EXPN Experian. Close Mid-Price: 3388 Percentage Change: + 1.77% Day High: 3406 Day Low: 3335

Target met. In the event of Experian enjoying further trades beyond 3406, ……..

</p

View Previous Experian & Big Picture ***

LSE:EZJ EasyJet. Close Mid-Price: 661.2 Percentage Change: + 0.88% Day High: 672.2 Day Low: 647

Further movement against EasyJet ABOVE 672.2 should improve acceleration ……..

</p

View Previous EasyJet & Big Picture ***

LSE:GKP Gulf Keystone. Close Mid-Price: 199.2 Percentage Change: + 4.29% Day High: 201.5 Day Low: 193.6

Further movement against Gulf Keystone ABOVE 201.5 should improve acceler ……..

</p

View Previous Gulf Keystone & Big Picture ***

LSE:ODX Omega Diags. Close Mid-Price: 52.75 Percentage Change: + 7.65% Day High: 52.75 Day Low: 45.75

Target met. Continued weakness against ODX taking the price below 45.75 c ……..

</p

View Previous Omega Diags & Big Picture ***

LSE:RR. Rolls Royce. Close Mid-Price: 122.18 Percentage Change: + 2.17% Day High: 121.94 Day Low: 119.34

Continued trades against RR. with a mid-price ABOVE 121.94 should improve ……..

</p

View Previous Rolls Royce & Big Picture ***

LSE:TSCO Tesco. Close Mid-Price: 261.65 Percentage Change: + 1.73% Day High: 261.5 Day Low: 258.05

In the event of Tesco enjoying further trades beyond 261.5, the share sho ……..

</p

View Previous Tesco & Big Picture ***

LSE:ZOO Zoo Digital Close Mid-Price: 121 Percentage Change: -3.20% Day High: 122.5 Day Low: 118.5

Zoo Digital appears to be taking a walk past the monkey enclosure as weakn ……..

</p

View Previous Zoo Digital & Big Picture ***