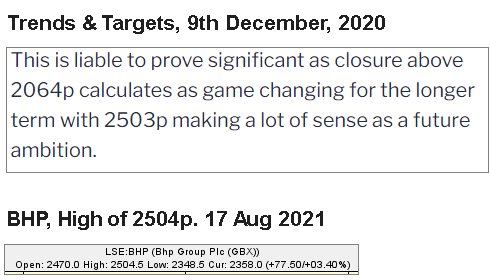

#CAC40 #Nasdaq In a stunning movement, #BHP reached a high of 2,504p on 17th August. It was “stunning” for various reasons. When we reviewed the share 9 months ago, our secondary target was at 2,503p. Being just 1p out in target logic for a 25 quid share is quite pleasing. Also, this represented a new post-pandemic High for the company, well deserved given their reported boost in profits and payment of a decent dividend.

Of course, we’d wondered if the announcement of the company intending delisting from the FTSE in London and fleeing to the Sydney exchange would foul things up. On paper, this shouldn’t be an issue for shareholders but there may prove to be a problem with funds which only track FTSE 100 components. Perhaps a bunch of shares may require sold, prior to BHP moving house. But for the FTSE itself, losing BHP may not be a bad thing. The massive capital size of BHP ensures miners price movements can disproportionately effect the FTSE and the loss of the biggest may redress the balance. Then again, if this is so with BHP enjoying All Time Highs, why the heck is the FTSE in such a dire state? Especially when compared to other countries and their national indices.

The chart below certainly presents a pretty picture with BHP “only” needing trades now above 2,505p to trigger further growth to 2,575p. If bettered, our longer term secondary calculation comes out with a future 2,751p as a major ambition.

For everything to go pear shaped, BHP share price currently needs weaken below 1,980p. Such a movement looks capable of inspiring greater terror than being offered Vegemite in Australia. Initially, if this level triggers, we’re looking for reversal to 1,793p which is a problem from our perspective. The trend break circled in Red on the chart shows the current growth cycle triggered from 1,800p. Anything capable of driving the price below such a level has dire implication for the longer term, suggesting a painful reversal cycle to 1,558p shall become probable.

Given the companies record profits and stated aims for reorganisation, we’re not currently convinced by any threat of weakness.

Trends and Targets. Past performance is not a reliable indicator of future results.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:43:35PM | BRENT | 68.75 | |||||||||

| 9:45:30PM | GOLD | 1785.61 | ‘cess | ||||||||

| 9:48:25PM | FTSE | 7168.34 | Shambles | ||||||||

| 9:56:47PM | FRANCE | 6818.2 | 6785 | 6776 | 6759 | 6810 | 6826 | 6836 | 6853 | 6799 | Success |

| 9:59:02PM | GERMANY | 15895 | |||||||||

| 10:01:19PM | US500 | 4443 | Success | ||||||||

| 10:03:30PM | DOW | 35289.5 | Success | ||||||||

| 10:07:46PM | NASDAQ | 14974.6 | 14903 | 14895 | 14812 | 14980 | 15096 | 15143 | 15223 | 15025 | |

| 10:10:06PM | JAPAN | 27427 | Success |

17/08/2021 FTSE Closed at 7181 points. Change of 0.39%. Total value traded through LSE was: £ 5,034,493,544 a change of 2.47%

16/08/2021 FTSE Closed at 7153 points. Change of -0.9%. Total value traded through LSE was: £ 4,913,032,412 a change of 23.5%

13/08/2021 FTSE Closed at 7218 points. Change of 0.35%. Total value traded through LSE was: £ 3,978,009,773 a change of -26.52%

12/08/2021 FTSE Closed at 7193 points. Change of -0.37%. Total value traded through LSE was: £ 5,413,411,006 a change of 4.45%

11/08/2021 FTSE Closed at 7220 points. Change of 0.96%. Total value traded through LSE was: £ 5,182,803,131 a change of -6.82%

10/08/2021 FTSE Closed at 7151 points. Change of 0.27%. Total value traded through LSE was: £ 5,561,861,537 a change of 12.31%

9/08/2021 FTSE Closed at 7132 points. Change of 0.14%. Total value traded through LSE was: £ 4,952,268,424 a change of -14.01%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AVCT Avacta** **LSE:DDDD 4D Pharma** **LSE:IHG Intercontinental Hotels Group** **LSE:NG. National Glib** **LSE:PMG Parkmead** **LSE:QFI Quadrise** **LSE:TSCO Tesco** **LSE:VOG VICTORIA** **

********

Updated charts published on : Avacta, 4D Pharma, Intercontinental Hotels Group, National Glib, Parkmead, Quadrise, Tesco, VICTORIA,

LSE:AVCT Avacta Close Mid-Price: 105 Percentage Change: -4.55% Day High: 109 Day Low: 97

Target met. If Avacta experiences continued weakness below 97, it will in ……..

</p

View Previous Avacta & Big Picture ***

LSE:DDDD 4D Pharma Close Mid-Price: 80.2 Percentage Change: -0.50% Day High: 84.4 Day Low: 78.5

Target met. In the event 4D Pharma experiences weakness below 78.5 it cal ……..

</p

View Previous 4D Pharma & Big Picture ***

LSE:IHG Intercontinental Hotels Group Close Mid-Price: 4500 Percentage Change: -1.90% Day High: 4573 Day Low: 4473

In the event Intercontinental Hotels Group experiences weakness below 447 ……..

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:NG. National Glib. Close Mid-Price: 962.7 Percentage Change: + 0.61% Day High: 966.6 Day Low: 951.9

All National Glib needs are mid-price trades ABOVE 966.6 to improve accel ……..

</p

View Previous National Glib & Big Picture ***

LSE:PMG Parkmead Close Mid-Price: 45 Percentage Change: -0.99% Day High: 44.2 Day Low: 44.2

Parkmead looks like engaging reverse. Movement next below 44 suggests trav ……..

</p

View Previous Parkmead & Big Picture ***

LSE:QFI Quadrise Close Mid-Price: 4.42 Percentage Change: -1.01% Day High: 5 Day Low: 4.4

In the event of Quadrise enjoying further trades beyond 5p, the share sho ……..

</p

View Previous Quadrise & Big Picture ***

LSE:TSCO Tesco. Close Mid-Price: 245.25 Percentage Change: + 1.30% Day High: 246.15 Day Low: 239.7

Target met. Further movement against Tesco ABOVE 246.15 should improve ac ……..

</p

View Previous Tesco & Big Picture ***

LSE:VOG VICTORIA. Close Mid-Price: 3.55 Percentage Change: + 5.97% Day High: 3.55 Day Low: 3.33

In the event VICTORIA experiences weakness below 3.33 it calculates with ……..

</p

View Previous VICTORIA & Big Picture ***