#FTSE #Nasdaq Given #WestminsterGroup core function, the company are probably drooling at the prospect of Northern Ireland being separated from the UK. The current ludicrous situation, pet dogs (and all livestock) needing a passport to board the ferry, along with increasingly draconian regulations on trade (within the UK, it must be remembered!) must be weakening any argument for the province to remain as part of the UK. Of course, this sort of thing is Westminster Groups specialist subject, literally a global player in strategic security for many countries.

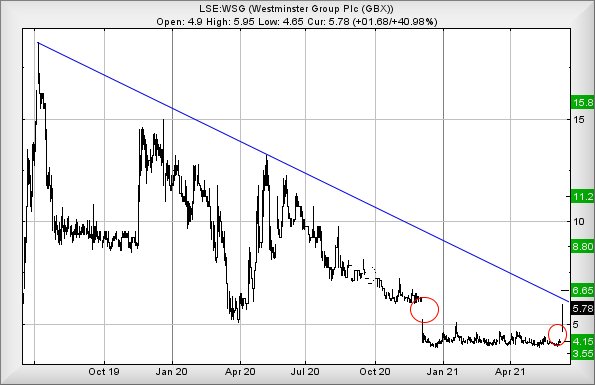

The company website certainly “talks a good game”, making us puzzle how a share which once traded up at 95p is now floundering down at the 5.58p level. While some research is probably merited, from our perspective we’re more than a little bit curious as to the relatively near future, thanks to the price enacting a Gap Down at the tail of 2020, followed by a Gap Up this week. Traditionally, when we see this sort of thing, it’s generally safe to anticipate a price getting ready to experience some irrational recovery.

It’s easy to believe market thinking was something along the lines of;

November 2020; “Westminster blotted their copybook. Punishment by forced the share price down”

June 2021; “Oops, looks like we overcooked the punishment. Best force the share price up to cover the error”

Despite 15th June presenting the market with a 41% gain at the end of the day, thanks to a large airport contract from The Congo in Africa, we’re not convinced the party has actually started! As the chart highlights, there is a very obvious downtrend which started nearly two years ago. Price movements on the 15th May certainly came close to the trend but even the high of the day at 5.78p failed to convince us happy days are ahead. In fact, we’ve a suspicion the share price shall require “gapped up” again. if the market is really serious about getting things moving.

The numbers are pretty complex against this, thanks to the gap (manipulation) movements throwing a spanner in our works. Immediately, there’s a demand price movement above 5.95 must almost certainly bring the share to an initial 6.65p. From our software perspective, we expect some hesitation at such a level unless the price is forced upward by a gap. Only above 7.3p dare we believe things shall become truly interesting, this being the trigger level which calculates with an initial 8.8p with secondary, if bettered, a longer term 11.25p.

In keeping with the Irish theme, if ever a share needed a 4 Leaf Clover for luck, Westminster are certainly in pole position. Their share price needs tumble below 4.95p to ring the first alarm bell, warning things may not be going as planned.

Our inclination is of hope for the future of Westminster Group.

As always, huge thanks to anyone who finds the adverts on this page worth visiting. We like our daily coffee!

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 11:11:35PM | BRENT | 73.85 | ‘cess | ||||||||

| 11:14:32PM | GOLD | 1859.47 | ‘cess | ||||||||

| 11:16:59PM | FTSE | 7183 | 7154 | 7144 | 7128 | 7184 | 7191 | 7216 | 7249 | 7153 | |

| 11:20:18PM | FRANCE | 6647 | Success | ||||||||

| 11:22:11PM | GERMANY | 15743 | |||||||||

| 11:23:35PM | US500 | 4248 | ‘cess | ||||||||

| 11:26:22PM | DOW | 34312 | |||||||||

| 11:28:14PM | NASDAQ | 14050 | 14010 | 13970 | 13907 | 14080 | 14159 | 14229 | 14273 | 13970 | |

| 11:30:44PM | JAPAN | 29332 | Success |

15/06/2021 FTSE Closed at 7172 points. Change of 0.36%. Total value traded through LSE was: £ 5,912,147,960 a change of 2.11%

14/06/2021 FTSE Closed at 7146 points. Change of 0.17%. Total value traded through LSE was: £ 5,789,732,909 a change of 12.95%

11/06/2021 FTSE Closed at 7134 points. Change of 0.65%. Total value traded through LSE was: £ 5,126,105,822 a change of 3.18%

10/06/2021 FTSE Closed at 7088 points. Change of 0.1%. Total value traded through LSE was: £ 4,968,352,767 a change of 1.13%

9/06/2021 FTSE Closed at 7081 points. Change of -0.2%. Total value traded through LSE was: £ 4,913,059,029 a change of 3.4%

8/06/2021 FTSE Closed at 7095 points. Change of 0.25%. Total value traded through LSE was: £ 4,751,728,118 a change of 8.88%

7/06/2021 FTSE Closed at 7077 points. Change of 0.11%. Total value traded through LSE was: £ 4,364,121,178 a change of 7.1%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BT.A British Telecom** **LSE:DGE Diageo** **LSE:EXPN Experian** **LSE:HUR Hurrican Energy** **LSE:IPF International Personal Finance** **LSE:OXIG Oxford Instruments** **LSE:PPC President Energy** **LSE:SPX Spirax** **LSE:VOD Vodafone** **

********

Updated charts published on : British Telecom, Diageo, Experian, Hurrican Energy, International Personal Finance, Oxford Instruments, President Energy, Spirax, Vodafone,

LSE:BT.A British Telecom. Close Mid-Price: 197.35 Percentage Change: + 2.87% Day High: 199.35 Day Low: 190.9

In the event of British Telecom enjoying further trades beyond 199.35, th ……..

</p

View Previous British Telecom & Big Picture ***

LSE:DGE Diageo. Close Mid-Price: 3478.5 Percentage Change: + 1.28% Day High: 3484 Day Low: 3449.5

In the event of Diageo enjoying further trades beyond 3484, the share sho ……..

</p

View Previous Diageo & Big Picture ***

LSE:EXPN Experian. Close Mid-Price: 2745 Percentage Change: + 1.48% Day High: 2754 Day Low: 2718

Now above 2754 should bring movement to an initial 2829 with secondary, if ……..

</p

View Previous Experian & Big Picture ***

LSE:HUR Hurrican Energy Close Mid-Price: 1.2 Percentage Change: -3.92% Day High: 1.35 Day Low: 1.15

Continued weakness against HUR taking the price below 1.15 calculates as ……..

</p

View Previous Hurrican Energy & Big Picture ***

LSE:IPF International Personal Finance. Close Mid-Price: 143 Percentage Change: + 12.60% Day High: 147.2 Day Low: 136

Target met. In the event of International Personal Finance enjoying furth ……..

</p

View Previous International Personal Finance & Big Picture ***

LSE:OXIG Oxford Instruments. Close Mid-Price: 2245 Percentage Change: + 3.46% Day High: 2245 Day Low: 2180

Further movement against Oxford Instruments ABOVE 2245 should improve acc ……..

</p

View Previous Oxford Instruments & Big Picture ***

LSE:PPC President Energy Close Mid-Price: 2.12 Percentage Change: -4.49% Day High: 2.25 Day Low: 2.12

A month has passed and it’s still the case President Energy needs mid-pric ……..

</p

View Previous President Energy & Big Picture ***

LSE:SPX Spirax. Close Mid-Price: 13470 Percentage Change: + 2.08% Day High: 13585 Day Low: 13215

Target met. Continued trades against SPX with a mid-price ABOVE 13585 sho ……..

</p

View Previous Spirax & Big Picture ***

LSE:VOD Vodafone. Close Mid-Price: 132 Percentage Change: + 1.54% Day High: 132.3 Day Low: 130.22

Apparently movement continuing beyond 132.3 should bring another rise to 1 ……..

</p

View Previous Vodafone & Big Picture ***