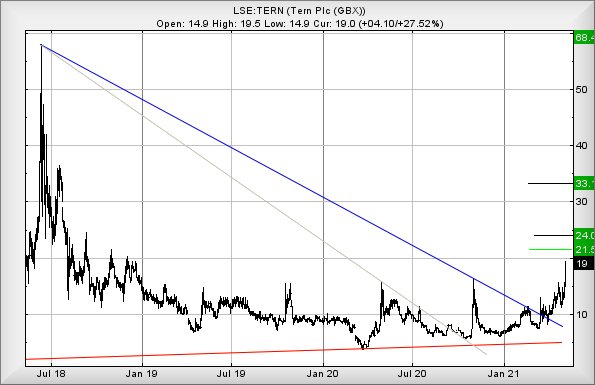

#Gold_Futures #Nasdaq We reviewed venture capital firm Tern a year ago, finishing our report (link here) with the words “For now, the share looks almost ready to fly“. Alas, with the dampening effect of a pandemic, the share price spent the year waffling around but now, this Tern appears to be attempting to leave the nest and head upward. Starting the week with a 27% upward surge, some considerable hope remains viable, especially as the share price closed at a level not seen since 2018.

Terns speciality is to invest in companies who’re involved in the “internet of things”. Wiki’s explanation is probably as succinct as it gets; ‘The Internet of Things describes a network of physical objects (aka things) which are embedded with sensors, software, and other tech for the purpose of connecting and exchanging data with other devices and systems over the Internet’. The minds eye pictures a smart kettle, telling a smart water tap it needs filled. The kettle will also count the tea bags used, automatically ordering replacements while it secretly plans world domination in the kitchen to resolve a never ending battle with a smart dishwasher which secretly is eating plates…

Perhaps the foregoing will not prove the most ideal scenario to pitch at Tern, if begging for funds. In reality, most of us are exposed to this sort of thing with our cars, everything constantly monitored with high end vehicles even communicating directly to the factory, if a serious fault occurs. The rest of us need to tolerate a mechanic plugging in a cable from a laptop, before making the traditional sharp intake of breath.

Returning to the share price, whatever has provoked the rise looks interesting and when we extrapolate price movements since the downtrend was broken in March, we can calculate further gains exceeding 19.5p should make an attempt at 21.5p. This scenario for a 2p rise is pretty tame, concealing something important. If the price manages exceed 21.5p, our view regarding price influences changes dramatically. We’re now projecting above 21.5 should attempt an initial 24p with secondary, if exceeded, a longer term 33p along with almost certain hesitation.

Another facet of this acceleration potential gives a long term calculation of 68p, something which shouldn’t be taken seriously unless the share price manages to close above 33p.

Visually, if it all intends go wrong, the price needs crash below 10p. This would be a really bad thing as we cannot calculate an ‘ultimate’ bottom.

We keep the adverts to a minimum, hopefully only letting through those which may be of interest. Today was a two latte thank you day!

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:48:38PM | BRENT | 68.21 | ‘cess | ||||||||

| 9:50:42PM | GOLD | 1837.37 | 1829 | 1825 | 1818 | 1839 | 1845 | 1850 | 1858 | 1836 | |

| 10:09:19PM | FTSE | 7078 | Shambles | ||||||||

| 10:11:23PM | FRANCE | 6342 | |||||||||

| 10:13:53PM | GERMANY | 15325 | |||||||||

| 10:16:47PM | US500 | 4183.72 | ‘cess | ||||||||

| 10:22:16PM | DOW | 34750 | Success | ||||||||

| 10:24:22PM | NASDAQ | 13343 | 13307 | 13210 | 13029 | 13603 | 13668 | 13701.5 | 13833 | 13514 | Success |

| 10:26:09PM | JAPAN | 29223 |

10/05/2021 FTSE Closed at 7123 points. Change of -0.08%. Total value traded through LSE was: £ 6,156,776,739 a change of 2.81%

7/05/2021 FTSE Closed at 7129 points. Change of 0.75%. Total value traded through LSE was: £ 5,988,474,650 a change of -25.26%

6/05/2021 FTSE Closed at 7076 points. Change of 0.53%. Total value traded through LSE was: £ 8,012,209,382 a change of 24%

5/05/2021 FTSE Closed at 7039 points. Change of 1.68%. Total value traded through LSE was: £ 6,461,512,143 a change of 1.02%

4/05/2021 FTSE Closed at 6923 points. Change of -0.66%. Total value traded through LSE was: £ 6,395,995,707 a change of -1.38%

30/04/2021 FTSE Closed at 6969 points. Change of 0.11%. Total value traded through LSE was: £ 6,485,673,817 a change of 11.9%

29/04/2021 FTSE Closed at 6961 points. Change of -100%. Total value traded through LSE was: £ 5,795,996,815 a change of 0%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BDEV Barrett Devs** **LSE:BP. BP PLC** **LSE:CAR Carclo** **LSE:CCL Carnival** **LSE:CEY Centamin** **LSE:DDDD 4D Pharma** **LSE:GENL Genel** **LSE:GLEN Glencore Xstra** **LSE:HL. Hargreaves Lansdown** **LSE:IAG British Airways** **LSE:IGAS Igas Energy** **LSE:LLOY Lloyds Grp.** **LSE:RR. Rolls Royce** **LSE:SBRY Sainsbury** **

********

Updated charts published on : Barrett Devs, BP PLC, Carclo, Carnival, Centamin, 4D Pharma, Genel, Glencore Xstra, Hargreaves Lansdown, British Airways, Igas Energy, Lloyds Grp., Rolls Royce, Sainsbury,

LSE:BDEV Barrett Devs. Close Mid-Price: 781.2 Percentage Change: + 0.08% Day High: 790.8 Day Low: 777

This is finally almost interesting, needing above 795p to build sufficient ……..

</p

View Previous Barrett Devs & Big Picture ***

LSE:BP. BP PLC. Close Mid-Price: 315.7 Percentage Change: + 0.69% Day High: 319.85 Day Low: 314.15

In the event of BP PLC enjoying further trades beyond 319.85, the share s ……..

</p

View Previous BP PLC & Big Picture ***

LSE:CAR Carclo. Close Mid-Price: 60.3 Percentage Change: + 9.64% Day High: 62 Day Low: 55

Target met. All Carclo needs are mid-price trades ABOVE 62 to improve acc ……..

</p

View Previous Carclo & Big Picture ***

LSE:CCL Carnival Close Mid-Price: 1608.4 Percentage Change: -1.09% Day High: 1640.4 Day Low: 1593.2

Noticing smoke coming from 3 cruise vessels stored across from me, I guess ……..

</p

View Previous Carnival & Big Picture ***

LSE:CEY Centamin. Close Mid-Price: 119.85 Percentage Change: + 0.67% Day High: 122.95 Day Low: 119.5

Continued trades against CEY with a mid-price ABOVE 122.95 should improve ……..

</p

View Previous Centamin & Big Picture ***

LSE:DDDD 4D Pharma Close Mid-Price: 98.3 Percentage Change: -4.19% Day High: 107.4 Day Low: 95

If 4D Pharma experiences continued weakness below 95, it will invariably ……..

</p

View Previous 4D Pharma & Big Picture ***

LSE:GENL Genel. Close Mid-Price: 179.2 Percentage Change: + 0.67% Day High: 185.4 Day Low: 177.6

Further movement against Genel ABOVE 185.4 should improve acceleration to ……..

</p

View Previous Genel & Big Picture ***

LSE:GLEN Glencore Xstra. Close Mid-Price: 331.25 Percentage Change: + 2.63% Day High: 331.8 Day Low: 323.3

In the event of Glencore Xstra enjoying further trades beyond 331.8, the ……..

</p

View Previous Glencore Xstra & Big Picture ***

LSE:HL. Hargreaves Lansdown. Close Mid-Price: 1772 Percentage Change: + 1.34% Day High: 1778 Day Low: 1742.5

Continued trades against HL. with a mid-price ABOVE 1778 should improve t ……..

</p

View Previous Hargreaves Lansdown & Big Picture ***

LSE:IAG British Airways Close Mid-Price: 209.85 Percentage Change: -1.57% Day High: 214.3 Day Low: 207.65

Further movement against British Airways ABOVE 214.3 should improve acce ……..

</p

View Previous British Airways & Big Picture ***

LSE:IGAS Igas Energy Close Mid-Price: 21.5 Percentage Change: -10.42% Day High: 23.1 Day Low: 21.5

Target met. If Igas Energy experiences continued weakness below 21.5, it ……..

</p

View Previous Igas Energy & Big Picture ***

LSE:LLOY Lloyds Grp.. Close Mid-Price: 47.85 Percentage Change: + 2.78% Day High: 47.93 Day Low: 46.79

All Lloyds Grp. needs are mid-price trades ABOVE 47.93 to improve acceler ……..

</p

View Previous Lloyds Grp. & Big Picture ***

LSE:RR. Rolls Royce. Close Mid-Price: 109.68 Percentage Change: + 2.75% Day High: 110.42 Day Low: 105.16

Continued trades against RR. with a mid-price ABOVE 110.42 should improve ……..

</p

View Previous Rolls Royce & Big Picture ***

LSE:SBRY Sainsbury. Close Mid-Price: 256.1 Percentage Change: + 1.95% Day High: 256.1 Day Low: 252.1

In the event of Sainsbury enjoying further trades beyond 256.1, the share ……..

</p

View Previous Sainsbury & Big Picture ***