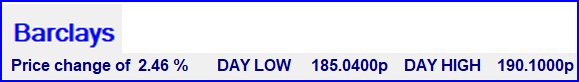

Barclays Plc (LSE:BARC) Optimism spring’s from funny places. In the case of Barclays, we’re now officially positive for the share price future, due to a movement of 4/100ths of a penny! The sensible part of the brain is firmly in favour of sanity, our software has quite different ideas, now opting to colour Barclays a cheerful Blue to indicate the price has achieved a Higher High after breaking a downtrend and, frankly, being pretty boring for the last 3 weeks.

It can be assumed our software is easily impressed but the surprising thing is, it’s rarely wrong with this sort of thing. Barclays breakout closing price High was 189.14p and the share managed to close the day on Friday at 189.18p. This tiny little change was sufficient to trigger the change shown below, a switch from non-committal black text to exciting blue text, a visual cue something truly unusual happened with a UK Retail Bank.

Warning: Technical Guff Ahead. By 4/100ths of a penny, we’re now tasked with providing an analysis which will have readers on the edge of their seats, positively drooling at the prospect of happy days ahead. Due to previous recovery models, built following movements in US and German markets, we’re actually inclined to take our software’s giddy behaviour seriously. We obviously wrote the software, it doesn’t have magical powers but currently employs several hundred formula against which each price movement is measured. For those who’ve ever fallen down Spreadsheet Macro wormholes, it’s effectively a rather complex “If THIS, then do THAT. Else if THAT, then do THIS” series of equations. For this particular moment of share price recovery, we’re forced to compare “what happened next” with the immediate situation at Barclays, then extrapolate forward the potentials for the future.

Please remember, this is due to a 4/100ths of a penny trigger movement. Perhaps the equivalent of that bloke on the Titanic bridge who saw a flake of snow and was told to ignore it! Had they paid attention, we’d be spared a terrible film and terrible soundtrack.

So, now we’ve run out of excuses to delay, optimism now suggests continued recovery above 191p for Barclays Plc faces share price movement to an initial 240p. With closure above 240p, our software tells us to expect a longer term 288p. We do have a little ‘sanity clause’ suggesting the long term trade potential can only be marked “safe”, once the share price is actually trading above 198p. This formula is one of these ‘belt & braces’ things, where we attempt to define the point beyond which something becomes inevitable. For it all to go wrong for Barclays, the share price needs founder below 140p, a concept which is visually unlikely but in todays world, who knows.

This certainly shall provide a wide and sane stop loss level for anyone trying a Long term position.

The date today is 19th April 2021 and will be remembered as; “On This Day In History, Trends & Targets Expressed Optimism About A UK Retail Bank!”

*** yet again, many thanks to those who find the adverts via Google sufficiently interesting to click on. Whoever you are, you’re keeping us in coffee! Which is nice.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 6:58:44PM | BRENT | 66.47 | 66.16 | 65.84 | 65.42 | 66.54 | 67.1 | 67.36 | 67.76 | 66.58 | ‘cess |

| 7:00:25PM | GOLD | 1777.26 | Success | ||||||||

| 7:05:01PM | FTSE | 7024.79 | Success | ||||||||

| 7:08:18PM | FRANCE | 6314.7 | Success | ||||||||

| 7:25:32PM | GERMANY | 15495 | Success | ||||||||

| 7:27:03PM | US500 | 4182.62 | 4160 | 4149.5 | 4136 | 4175 | 4188 | 4193 | 4201 | 4170 | Success |

| 7:37:18PM | DOW | 34187.7 | Success | ||||||||

| 7:39:11PM | NASDAQ | 14038 | |||||||||

| 7:40:47PM | JAPAN | 29794 | Success |

16/04/2021 FTSE Closed at 7019 points. Change of 0.52%. Total value traded through LSE was: £ 6,885,119,827 a change of 21.21%

15/04/2021 FTSE Closed at 6983 points. Change of 0.63%. Total value traded through LSE was: £ 5,680,355,568 a change of 19.55%

14/04/2021 FTSE Closed at 6939 points. Change of 0.71%. Total value traded through LSE was: £ 4,751,574,999 a change of -6.5%

13/04/2021 FTSE Closed at 6890 points. Change of 0.01%. Total value traded through LSE was: £ 5,082,010,354 a change of 5.4%

12/04/2021 FTSE Closed at 6889 points. Change of -0.38%. Total value traded through LSE was: £ 4,821,423,252 a change of -22.92%

9/04/2021 FTSE Closed at 6915 points. Change of -0.39%. Total value traded through LSE was: £ 6,255,086,151 a change of 4.29%

8/04/2021 FTSE Closed at 6942 points. Change of 0.83%. Total value traded through LSE was: £ 5,997,557,402 a change of 4.89%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

The Arrow icons refer to expected Big Picture direction. No Arrow, No clue!

Click Epic to jump to share: LSE:AFC AFC Energy** **LSE:BBY BALFOUR BEATTY** **LSE:CBX Cellular Goods** **LSE:CEY Centamin** **LSE:DGE Diageo** **LSE:EXPN Experian** **LSE:IGAS Igas Energy** **LSE:IPF International Personal Finance** **LSE:ITRK Intertek** **LSE:PMG Parkmead** **LSE:QFI Quadrise** **LSE:SBRY Sainsbury** **LSE:TW. Taylor Wimpey** **

********

Updated charts published on : AFC Energy, BALFOUR BEATTY, Cellular Goods, Centamin, Diageo, Experian, Igas Energy, International Personal Finance, Intertek, Parkmead, Quadrise, Sainsbury, Taylor Wimpey,

LSE:AFCLSE:AFC AFC Energy. Close Mid-Price: 72.4 Percentage Change: + 6.47% Day High: 72.9 Day Low: 66.1

Further movement against AFC Energy ABOVE 72.9 should improve acceleratio ……..

</p

View Previous AFC Energy & Big Picture ***

LSE:BBYLSE:BBY BALFOUR BEATTY. Close Mid-Price: 314.4 Percentage Change: + 1.29% Day High: 316 Day Low: 308

Target met. All BALFOUR BEATTY needs are mid-price trades ABOVE 316 to im ……..

</p

View Previous BALFOUR BEATTY & Big Picture ***

LSE:CBX Cellular Goods Close Mid-Price: 8.1 Percentage Change: -4.71% Day High: 8.57 Day Low: 7.88

Weakness on Cellular Goods below 7.88 will invariably lead to 7.7 with se ……..

</p

View Previous Cellular Goods & Big Picture ***

LSE:CEYLSE:CEY Centamin. Close Mid-Price: 113.95 Percentage Change: + 1.33% Day High: 114.85 Day Low: 112.7

Target met. Continued trades against CEY with a mid-price ABOVE 114.85 sh ……..

</p

View Previous Centamin & Big Picture ***

LSE:DGELSE:DGE Diageo. Close Mid-Price: 3230 Percentage Change: + 0.17% Day High: 3247.5 Day Low: 3222.5

In the event of Diageo enjoying further trades beyond 3247.5, the share s ……..

</p

View Previous Diageo & Big Picture ***

LSE:EXPNLSE:EXPN Experian. Close Mid-Price: 2716 Percentage Change: + 1.88% Day High: 2733 Day Low: 2690

Target met. Further movement against Experian ABOVE 2733 should improve a ……..

</p

View Previous Experian & Big Picture ***

LSE:IGASLSE:IGAS Igas Energy. Close Mid-Price: 23.5 Percentage Change: + 0.00% Day High: 24 Day Low: 23.2

Weakness on Igas Energy below 23.2 will invariably lead to 22 with second ……..

</p

View Previous Igas Energy & Big Picture ***

LSE:IPF International Personal Finance Close Mid-Price: 124.6 Percentage Change: -0.64% Day High: 128.2 Day Low: 123.2

Further movement against International Personal Finance ABOVE 128.2 shoul ……..

</p

View Previous International Personal Finance & Big Picture ***

LSE:ITRKLSE:ITRK Intertek. Close Mid-Price: 6098 Percentage Change: + 0.23% Day High: 6152 Day Low: 6080

In the event of Intertek enjoying further trades beyond 6152, the share s ……..

</p

View Previous Intertek & Big Picture ***

LSE:PMGLSE:PMG Parkmead. Close Mid-Price: 39.15 Percentage Change: + 1.42% Day High: 40 Day Low: 38.6

All Parkmead needs are mid-price trades ABOVE 40 to improve acceleration ……..

</p

View Previous Parkmead & Big Picture ***

LSE:QFILSE:QFI Quadrise. Close Mid-Price: 4.25 Percentage Change: + 10.53% Day High: 4.1 Day Low: 3.61

Target met. Continued trades against QFI with a mid-price ABOVE 4.1 shoul ……..

</p

View Previous Quadrise & Big Picture ***

LSE:SBRYLSE:SBRY Sainsbury. Close Mid-Price: 248.7 Percentage Change: + 1.72% Day High: 248.5 Day Low: 244

Further movement against Sainsbury ABOVE 248.5 should improve acceleratio ……..

</p

View Previous Sainsbury & Big Picture ***

LSE:TW. Taylor Wimpey Close Mid-Price: 190.95 Percentage Change: -0.39% Day High: 193.8 Day Low: 189.05

Target met. In the event of Taylor Wimpey enjoying further trades beyond ……..

</p

View Previous Taylor Wimpey & Big Picture ***