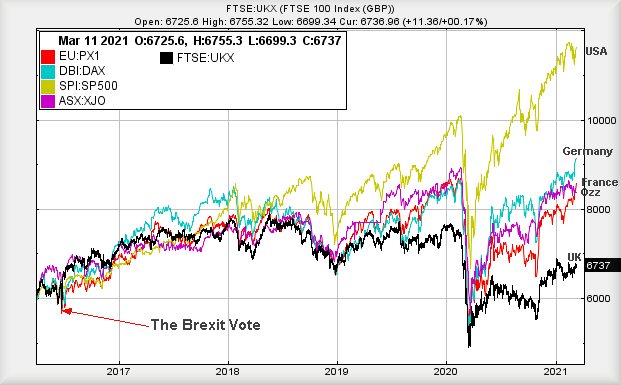

Once again, it’s time for our world famous #FTSE for Friday, along with an outpouring of misery for its prospects. For the last few years, we feel we constantly moan about how badly the FTSE is performing, when compared to its peers. We decided to take a snapshot of what’s been happening, if we use The Brexit Vote as an anchor, comparing “what happened next” with a few other key national index’ trends. The results proved quite sobering, more shocking when recovery from the Covid-19 drops are viewed.

Obviously, topping the chart is the USA with the example given, the S&P, now trading 20% higher than its level before Covid hit. Germany and the Dax is more modest, around 6% above the pre-Covid level with Australia and France nervously challenging their pre-Covid market levels right now. To be fair, we can easily calculate targets of 6,750 sometime in the future for France and somewhere around 7,900 for Australia. But only once they start achieving highs above their pre-pandemic levels. The funny thing, despite the S&P500 running ahead, we fear it shall run out of steam just before the 4,300 level.

It sometimes feels disloyal to our country, highlighting this sort of shambles but the harsh reality cannot be ignored. The FTSE needs grow 15%, just to draw level with the current position of France and Australia. Then, things get a little frightening as we’re currently calculating such a scenario with a potential high of 8,100 before trouble. Perhaps the UK Govt shouldn’t have caused the deaths of so many (in 2020, the worlds only open airports and ports policy?) and also, should perhaps be performing better when handling Brexit.

If ‘interesting’ is a simile for ‘worrying’, we live in interesting times!

FTSE for Friday Despite the last week proving somewhat boring, March as a whole is actually showing some interesting potentials and we should now be singing the praises of a potential rise toward 6,816 points, perhaps even 6,935 points if everything goes right. Unfortunately, the FTSE, perhaps due to lethargy and the reasons given above, is proving quite hesitant and we’re inclined to establish a “safe” trigger level at 6,757 points.

In the event the FTSE betters 6,757, we calculate an initial ambition of 6,816 points. we are nervous proposing a secondary at 6,935 points, suspecting a fearful UK market shall recoil if it matches the highs of January this year at 6,900 points.

For everything to (again) go wrong, the index needs trade below 6,690 as this risks triggering reversal toward an initial 6,645 with secondary, if broken, at 6,594 points.

Have a good weekend and remember, now only 2 weeks until the Formula1 season starts.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:55:50PM | BRENT | 69.38 | 67.62 | 66.865 | 69.1 | 69.58 | 70.51 | 68.15 | ‘cess | ||

| 9:57:16PM | GOLD | 1722 | 1719 | 1715 | 1726 | 1739 | 1746 | 1731 | ‘cess | ||

| 10:09:25PM | FTSE | 6722 | 6699 | 6680 | 6737 | 6749 | 6780.5 | 6719 | ‘cess | ||

| 10:10:54PM | FRANCE | 6028.7 | 5980 | 5971.5 | 6014 | 6039 | 6050 | 5981 | |||

| 10:12:43PM | GERMANY | 14547 | 14514 | 14489 | 14554 | 14596 | 14631 | 14538 | |||

| 10:14:41PM | US500 | 3935.92 | 3910 | 3896.5 | 3931 | 3961 | 3975.75 | 3909 | Success | ||

| 10:17:24PM | DOW | 32502 | 32273 | 32179 | 32460 | 32665 | 32748 | 32333 | ‘cess | ||

| 10:20:09PM | NASDAQ | 13050 | 12899 | 12808.5 | 13012 | 13125 | 13194.5 | 12926 | ‘cess | ||

| 10:22:21PM | JAPAN | 29284 | 29119 | 29086.5 | 29256 | 29378 | 29433 | 29077 | ‘cess |

11/03/2021 FTSE Closed at 6736 points. Change of 0.16%. Total value traded through LSE was: £ 5,972,975,685 a change of -1.35%

10/03/2021 FTSE Closed at 6725 points. Change of -0.07%. Total value traded through LSE was: £ 6,055,011,331 a change of -12.01%

9/03/2021 FTSE Closed at 6730 points. Change of 0.16%. Total value traded through LSE was: £ 6,881,664,141 a change of 1.69%

8/03/2021 FTSE Closed at 6719 points. Change of 1.34%. Total value traded through LSE was: £ 6,767,361,334 a change of -3.17%

5/03/2021 FTSE Closed at 6630 points. Change of -0.3%. Total value traded through LSE was: £ 6,989,244,582 a change of -1.26%

4/03/2021 FTSE Closed at 6650 points. Change of -0.37%. Total value traded through LSE was: £ 7,078,677,923 a change of 10.48%

3/03/2021 FTSE Closed at 6675 points. Change of 0.94%. Total value traded through LSE was: £ 6,407,091,178 a change of -5.86%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

The Arrow icons refer to expected Big Picture direction. No Arrow, No clue!

Click Epic to jump to share: LSE:AVCT Avacta** **LSE:HL. Hargreaves Lansdown** **LSE:IGG IG Group** **LSE:IQE IQE** **LSE:MRW Morrisons** **LSE:RMG Royal Mail** **LSE:TW. Taylor Wimpey** **LSE:VOD Vodafone** **

********

Updated charts published on : Avacta, Hargreaves Lansdown, IG Group, IQE, Morrisons, Royal Mail, Taylor Wimpey, Vodafone,

LSE:AVCT Avacta Close Mid-Price: 244 Percentage Change: -2.40% Day High: 255.5 Day Low: 242.5

All Avacta needs are mid-price trades ABOVE 255.5 to improve acceleration ……..

</p

View Previous Avacta & Big Picture ***

LSE:HL. Hargreaves Lansdown Close Mid-Price: 1521.5 Percentage Change: -0.16% Day High: 1544 Day Low: 1522

This is getting to be a concern as below 1510 suggests coming weakness to ……..

</p

View Previous Hargreaves Lansdown & Big Picture ***

LSE:IGGLSE:IGG IG Group. Close Mid-Price: 850.5 Percentage Change: + 4.87% Day High: 863 Day Low: 834

Above 863 suggests travel to an initial 890p with secondary, if bettered, ……..

</p

View Previous IG Group & Big Picture ***

LSE:IQELSE:IQE IQE. Close Mid-Price: 73.95 Percentage Change: + 4.15% Day High: 74.5 Day Low: 70.35

This is a bit of a puzzle as it’s supposed to be heading up. Only it’s doi ……..

</p

View Previous IQE & Big Picture ***

LSE:MRW Morrisons Close Mid-Price: 175.25 Percentage Change: -0.99% Day High: 178.45 Day Low: 171.9

Even above 179 should now give slight hope, permitting an initial 185 with ……..

</p

View Previous Morrisons & Big Picture ***

LSE:RMGLSE:RMG Royal Mail. Close Mid-Price: 495.5 Percentage Change: + 1.00% Day High: 500 Day Low: 485.7

All Royal Mail needs are mid-price trades ABOVE 500 to improve accelerati ……..

</p

View Previous Royal Mail & Big Picture ***

LSE:TW. Taylor Wimpey Close Mid-Price: 181.65 Percentage Change: -0.14% Day High: 182.9 Day Low: 178.4

Further movement against Taylor Wimpey ABOVE 182.9 should improve acceler ……..

</p

View Previous Taylor Wimpey & Big Picture ***

LSE:VODLSE:VOD Vodafone. Close Mid-Price: 131.78 Percentage Change: + 1.90% Day High: 132.34 Day Low: 129.26

Near term, above 133 is supposed to bring movement to a significant 137. S ……..

</p

View Previous Vodafone & Big Picture ***