#FTSE #FRANCE Everything is now well in the world. Glencore, reinstating their dividend despite a $1.9bn loss, now enjoy a share price where we find it easy to calculate the price more than doubling in the longer term. Obviously, there are one or two minor hurdles to consider first but we suspect, thanks to the March 2020 Covid-19 drop, the stock markets are going to find many shares in a similar position. Essentially, once the strength of downward volatility is reversed, any bounce is liable to be flamboyant.

To illustrate, imagine dropping a ball and finding it bounces higher than the level it dropped from. Physics says this is impossible, assuming no additional energy is given to the ball but as traders know, share prices rarely follow the rules of physics. Or even common sense! But from a visual perspective, record losses are being ignored by the market and instead, the prospect of a dividend now makes Glencore an exciting share for the future.

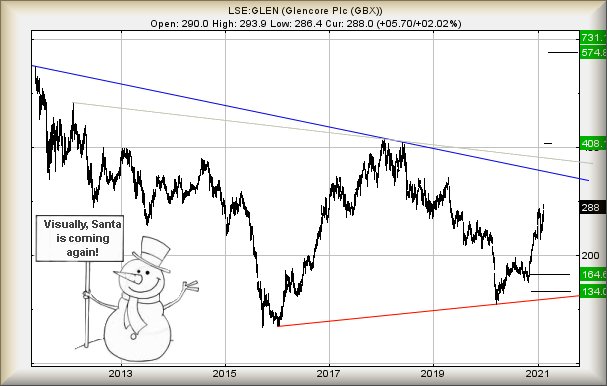

To dwell on the chart, the immediate scenario suggests movement above 295p should next impart sufficient bounce for the share price to reach 408p. Visually, the 4 quid level makes a lot of sense and without a doubt, a glass ceiling since 2013 awaits at such a point. There’s also the problem of the downtrend since 2011, presently enacting a barrier around the 357p level. Amazingly, this is also extremely capable of matching the Feb 2020 Pre-Covid high level of 345p, giving two distinct excuses for some hesitation on the way up. Undoubtedly, there will be those trapped at the 345p level, potentially since 2018. Bailing at Break Even (BABE) is a very real event, one perfectly capable of provoking price hesitation. The Blue downtrend since 2011 is another and should both events occur at the same time, an assumption will grow of the downtrend being a “real” barrier to price growth.

Who knows, it make even be right!

We suspect this shall not prove to be the case, instead tending to speculate the 408p level is liable to provide sufficient long term excuse for hesitation. Goodness knows how long the scenario will take to unfold but from a Big Picture perspective, it makes perfect sense.

Only with closure above 408p shall we dare become breathless with anticipation, thanks to the Big Picture indicating an all time high of 731p becomes possible.

At time of writing, this FTSE 100 component is trading at 288p. The price needs below 210p to spoil our optimism.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:11:20PM | BRENT | 63.14 | |||||||||

| 10:13:01PM | GOLD | 1794.68 | Success | ||||||||

| 10:16:34PM | FTSE | 6748.77 | 6731 | 6706.5 | 6676 | 6774 | 6799 | 6813 | 6862 | 6733 | |

| 10:18:10PM | FRANCE | 5784.5 | 5766 | 5760.5 | 5748 | 5794 | 5798 | 5808 | 5822 | 5776 | |

| 10:20:58PM | GERMANY | 14054.26 | ‘cess | ||||||||

| 10:38:27PM | US500 | 3932 | Success | ||||||||

| 10:40:48PM | DOW | 31545 | ‘cess | ||||||||

| 10:42:20PM | NASDAQ | 13761 | |||||||||

| 10:44:08PM | JAPAN | 30439 | Success |