#Gold #SP500 Will Florida be cheaper for an Easter Break or February skiing in Colorado? Or even, is it worth holding off buying a Gulfstream to escape the UK? These questions, and more, have not been asked of us (yet) despite Sterling started to exhibit strength against the US Dollar. With British tourists as welcome internationally as an unwrapped Mars Bar floating in a swimming pool, the UK currency could be expected to behave oddly. It has certainly obliged.

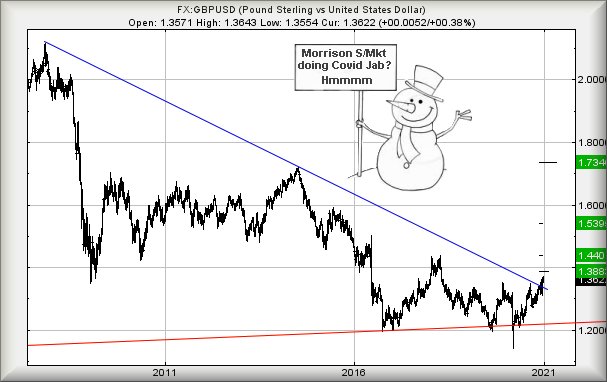

With the Sterling/US Dollar pairing trading above the critical 1.35 level, some real hope is possible for the future for those folk planning on taking their kids to the hell which is Disney Florida. Doubtless, ongoing travel bans contribute to the utter lack of folk emailing to ask about the US Dollar. The January eruption of holiday adverts of TV invariably promotes questions about buying the dollar now or holding off for a while.

We suspect, this year, the relationship should continue to firm up. Strength anytime soon above 1.37 looks pretty capable of bringing 1.388 with secondary, if exceeded, a rather more attractive 1.440. Visually, the secondary is fairly interesting, taking the pair to the same level as 2018’s high and suggesting the presence of a Glass Ceiling, along with inevitable hesitation in a rise. What REALLY surprises us for the longer term is a calculation (if any of this scenario plays out) which gives 1.734 as a viable Big Picture ambition sometime in the presumably distant future. This would suggest the idea of a future return to the level which ruled from 2009 through to 2014, a pleasant concept as it again promises a level where some turbulence can be expected.

If it all intends go wrong, the pairing needs reverse below 1.310. Maybe the rest of the world shall not prove keen on “UK Mutant Covid-19” proving our most successful export… assuming such a thing even exists and isn’t a figment in the rabid imagination of a journalist.

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:04:03PM | BRENT | 53.56 | ‘cess | ||||||||

| 10:05:34PM | GOLD | 1950.37 | 1936 | 1930.5 | 1923 | 1946 | 1953 | 1954.5 | 1960 | 1943 | |

| 10:07:35PM | FTSE | 6628 | Shambles | ||||||||

| 10:10:11PM | FRANCE | 5581.4 | Ditto | ||||||||

| 10:12:30PM | GERMANY | 13695.3 | as above | ||||||||

| 10:14:49PM | US500 | 3726.07 | 3681 | 3673 | 3651 | 3713 | 3734 | 3740 | 3767 | 3695 | Success |

| 10:17:18PM | DOW | 30403 | Success | ||||||||

| 10:30:24PM | NASDAQ | 12816 | ‘cess | ||||||||

| 10:32:35PM | JAPAN | 27132 |