#Brent #CAC40 Obviously, for this Xmas, the driving subject was Cat Pee. Our dining room, usually only opened for dinner between 8pm and 9pm (or so), had been open thanks to innumerable grandchildren (just 2 of them) treating it as a rehearsal studio, dressing room, or adult free space. It’s one of these peculiar rooms which is prized and mostly unused except for an evening meal. Except one of our unwanted cats decided it can now be used as a toilet.

Christmas day started by shampooing the dining room carpet, the shampoo mixed with peppermint. The internet claims cats dislike peppermint, giving a vague hope of avoiding a repeat performance. Amazingly, the cat stink revealed something hitherto unknown in the household. Four, out of FOUR, females could not smell the abhorrent stink. Perhaps they were exhibiting early signs of Covid-19, perhaps they were avoiding shampooing the carpet.

The above rant has quite a lot to do with the stock market. Amongst market analysts, there appears quite a bit of optimism for 2021, based on reliance for “The Vaccine”. This reliance is generating an assumption soon, everything shall return to the way it was before Covid-19 hit. Who knows, perhaps things shall be even better!

Goodness knows, of course we all want things to return to normal but, like the female nose and cat pee, market analysts seem to be missing something quite important. (I should point out, my own sense of smell is such that I cannot exist in the same room as strong perfume or potpourri)

During 2020, very many businesses failed to trade at normal levels. Instead, there has been chaotic disruption of income levels, giving an expectation many companies shall cough politely and announce reduced dividend payments in 2021. This sort of thing generally justifies some hysterics with share prices but there’s a greater issue, one being glossed over currently.

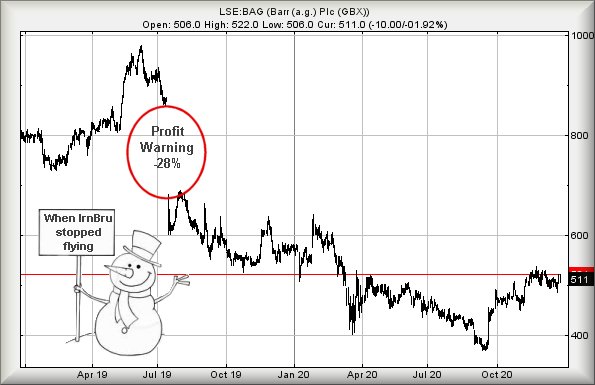

“Profit Warnings” tend produce quite nasty share price movements, on average a drop of 21% in the share price on the day the warning was issued. The majority of Profit Warnings are generated, due to shortfalls in sales and the worst share price drops come from companies who previously issued a warning.

The big thing about Profit Warnings is the time of year they are issued. Historically, the majority occur in Q1, the first trading quarter of the year. Q2 will generally host a slightly lesser bunch. And with the example of A G Barr below, bad news can emerge in Q3 too.

If we are to experience a bunch a Profit Warnings, bursting the bubble of optimism produced by the Covid-19 vaccine, when is it liable to occur and how bad could it be for the FTSE?

Our suspicion demands a critical mass of trouble, causing a loss of confidence as traders wonder which company shall be next to announce sales plunged during 2020. Perhaps by the end of March, perhaps during May and if we adhere to average drop philosophy, a market reversal above 21% is expected. If current levels of optimism are maintained, ‘maybe’ the FTSE shall experience a bottom around 5,200 points but our own software keeps suggesting an eventual bottom around 4,400 points.

Something worth remembering, if a Tsunami of bad news provokes market reversals, the rebound is liable to be strong, hopefully occurring in an environment where all the bad news is finally out of the way, people are getting immunized, business is indeed returning to normal, and of course, summer will be coming and folk cheer up. More importantly, there will be a strong possibility those market sectors currently floundering shall be ones experiencing stronger recovery. The banking sector immediately springs to mind but equally food and drink retail should not be ignored.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop |

| 9:22:31PM | BRENT | 50.99 | 50.6 | 49.975 | 49.28 | 51.78 | 51.64 | 52.095 | 53.05 | 50.6 |

| 9:26:08PM | GOLD | 1873.73 | 1881 | |||||||

| 9:28:07PM | FTSE | 6548 | 6502 | |||||||

| 9:29:57PM | FRANCE | 5580 | 5546 | 5527.5 | 5503 | 5590 | 5600 | 5612.75 | 5658 | 5571 |

| 9:34:40PM | GERMANY | 13786 | 13655 | |||||||

| 9:36:17PM | US500 | 3739 | 3722 | |||||||

| 9:38:29PM | DOW | 30376 | 30337 | |||||||

| 9:40:04PM | NASDAQ | 12846 | 12733 | |||||||

| 9:43:31PM | JAPAN | 26943 | 26848 |