#FTSE #GOLD When we last glanced at the AIM nearly a month ago, we’d speculated on the coming potential of a rise cycle of around 20%. It’s rather pleasing to report things have kicked off, the junior UK market now comfortably trading at its highest level of the year, cheerfully leaving pre-Covid drop levels behind, along with the highs of last year too! Optimism is the name of the game it seems, certainly for the AIM market. (Code: FTSE:AXX)

It’s a real pity retailer GAME has delisted as news they are releasing a Super Mario themed perfume (Eau De Plumber) would normally justify an optimistic analysis. Or maybe not…

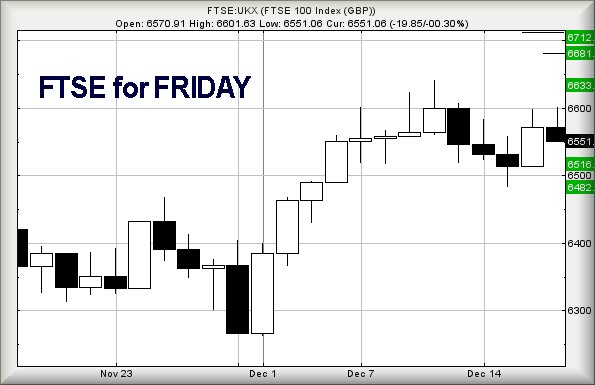

The FTSE is difficult, the index proving incredibly lethargic in recent weeks, gloriously failing in any attempt to follow the path taken by many other markets worldwide, thanks to introduction of virus medication. To be quite clear, if the FTSE were following examples set by the US or Europe, we’d currently be singing the praises of 8,070 as a logical target for London. Instead, about the best we dare hope for, even if a “Santa Rally” runs amok, is for a market gain toward 7,000 points. There’s a distinct feeling of dismay attached to FTSE behaviour, the index feeling like it’s primed for the release of bad news, simply going through the motions in the meantime.

Obviously, it’s easy to assume this is Brexit related uncertainty, especially as no-one seems confident predicting what’s going to happen. Someone once said something along the lines of “Civilisation is only ever 3 square meals away from utter collapse!” and with supermarkets apparently stockpiling food and the Financial Times reporting the UK’s Covid death toll is around 70,000, some nerves are understandable.

Near term, the FTSE needs exceed 6,602 points to ideally provoke growth to an initial 6,633 points. If bettered, secondary calculates at a longer term 6,681 points with a 3rd target level of 6,712 almost certain to provide a point of real hesitation. The tightest stop looks like a rather generous 6,550 points.

In the even 6,550 breaks, there’s a risk of reversal commencing to 6,516 with secondary, if broken, down at 6,482.

Hopefully this, the last Friday trading before Xmas, proves kind to traders.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:39:36PM | BRENT | 51.61 | 51.07 | 50.915 | 51.6 | 51.86 | 52.045 | 51.23 | ‘cess | ||

| 10:41:42PM | GOLD | 1885.89 | 1870 | 1863 | 1889 | 1896 | 1903.75 | 1871 | Success | ||

| 10:46:29PM | FTSE | 6556 | 6542 | 6532.5 | 6580 | 6601 | 6614 | 6556 | |||

| 10:48:07PM | FRANCE | 5541.2 | 5535 | 5514 | 5561 | 5593 | 5627 | 5536 | |||

| 10:50:25PM | GERMANY | 13682 | 13556 | 13519 | 13653 | 13733 | 13755.5 | 13646 | Success | ||

| 10:53:04PM | US500 | 3722 | 3704 | 3700 | 3722 | 3725 | 3752 | 3708 | ‘cess | ||

| 10:55:52PM | DOW | 30307.6 | 30220 | 30197.5 | 30316 | 30332 | 30448 | 30220 | |||

| 10:58:17PM | NASDAQ | 12751 | 12663 | 12636.5 | 12736 | 12768 | 12797.75 | 12675 | ‘cess | ||

| 11:00:10PM | JAPAN | 26776 | 26717 | 26692 | 26812 | 26851 | 26879.5 | 26761 | ‘cess |