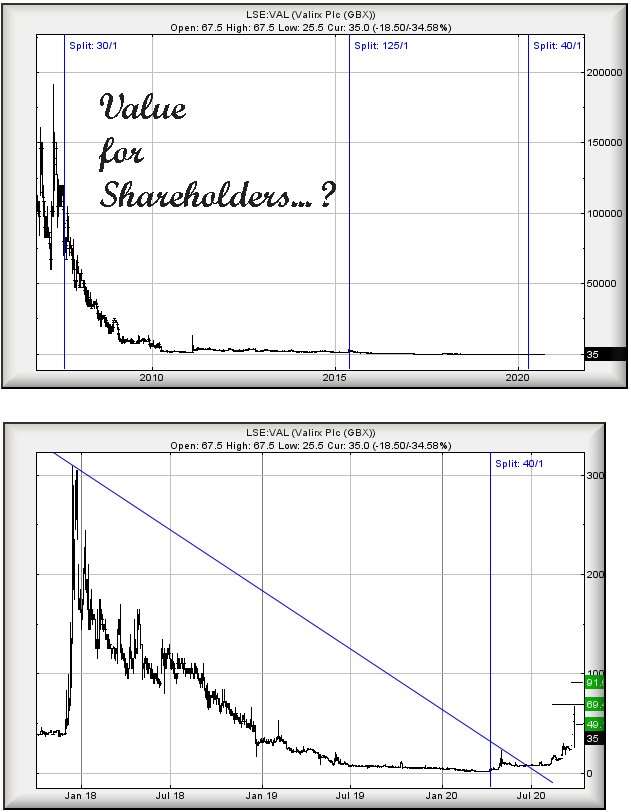

#Gold #Nasdaq Every now and then, a share features in our emails which provokes an instant dislike. Valirx starts the week, waving an enormous red flag thanks to its price behaviour over the years. We’ve written previously about our dislike for “Share Splits”, a method by which the market manipulates a price to make a share sound more respectable. In the case of LSE:VAL, they cottoned onto this wheeze initially in 2007, magically making a 0.2p into a 6p share with a 30:1 share split.

Did it help?

Nope, not in the slightest. By May 2015, another attempt at “respectability” saw the share enter Harry Potter land, a wave of a wand bringing the price from 0.1p to 12.5p, thanks to a 125:1 share split.

Finally, in April of this year, yet another “Share Split” of 40:1 (ie; for every 40 shares you have, we shall now call it 1 share) brought the price to 4p. This time, thanks to a pandemic along with a market eager to find a company in the medical field successfully active in the Covid-19 arena, Valirx price has finally shown some movement which looks genuine. Unfortunately, this repeated consolidation of shares has created a situation where the price will need achieve £2,000 per share just to allow the suckers from 13 years ago to break even.

Equally, £30 per share will allow folk from 5 years ago to break even!

But this year has been different, so far anyway.

The immediate situation is not ideal as weakness next below 25p calculates with the risk of reversal to 20p and hopefully a rebound. The implication, should 20p break, is of travel yet again to the realms below 1p (at best) as we cannot reliably calculate an ultimate bottom.

However, price movement since their most recent share split has broken the mould and despite an absolutely foul start to this week, we shall be interested if the price manages above 39p anytime soon as this is supposed to provoke recovery to an initial 49p. It’s above this level where things get useful as 69p calculates as possible. Beyond such a level is liable to prove equally useful. Ideally we shall need run the numbers again but currently, a longer term attraction comes from 91p.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:33:40PM | BRENT | 42.89 | |||||||||

| 10:36:23PM | GOLD | 1881.8 | 1848 | 1840.5 | 1826 | 1867 | 1884 | 1891.5 | 1906 | 1864 | Shambles |

| 10:38:24PM | FTSE | 5947.81 | ‘cess | ||||||||

| 10:40:33PM | FRANCE | 4837 | Success | ||||||||

| 10:44:42PM | GERMANY | 12900 | Success | ||||||||

| 10:46:37PM | US500 | 3357.97 | Success | ||||||||

| 10:49:57PM | DOW | 27644.4 | Success | ||||||||

| 10:51:52PM | NASDAQ | 11402.52 | 11179 | 11148 | 11058 | 11302 | 11418 | 11458.5 | 11718 | 11238 | Success |

| 10:54:16PM | JAPAN | 23509 | ‘cess |