#Gold #SP500 #Synairgen, by following Stock Market rules, ensured we received a pile of emails regard their wild price movements. The company were obliged to report preliminary results of a Covid-19 trial and there is no doubt genuine reason for excitement was given. Obviously, the usual caveats apply as their work has not been “peer reviewed” nor, obviously, has all the data been made available. But a glance at the figures certainly promotes encouragement.

It’s important to remember the caveats. Many folk will retain painful memories of the “Desire Petroleum” clause; on a Monday, they announced discovery of oil but by Wednesday, conceded initial test results were wrong and it was, in fact, water! Needless to say, the share price never recovered from this little whoops.

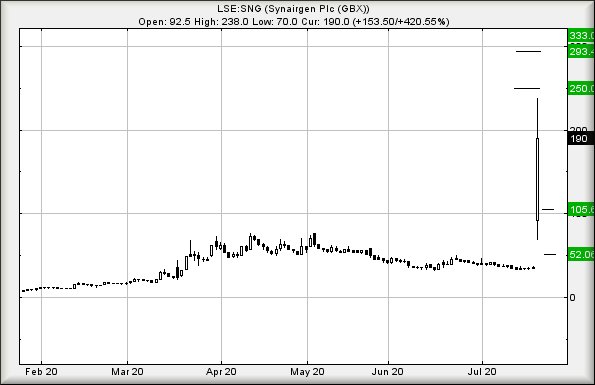

With Synairgen closing the session 153% up, a glance at their news tended confirm solid reasons for market optimism. With 101 folk involved, half the participants were given the treatment across 9 different hospitals. The other half were given a placebo and police are wanting to question the scientist who dissected the spare person into two! Kidding aside, reading the results certainly gives hope for the future and Synairgen CEO was quoted as saying, “We couldn’t have expected much better results than these”

Personally speaking, the idea of a treatment which deals with the asthmatic terror of ‘cannot catch my next breath’ aspect of coughing fits is to be welcomed and doubtless explains some bias when reading their news.

On the basis the hype is completely genuine, we can calculate some fairly useful potentials for their share price. Movement next exceeding 238p (doubtless possible as the company featured on major evening news bulletins) looks very capable of reaching an initial lame 250p. If exceeded, secondary calculates at 293p but to be realistic, the price could runaway higher to 333p without too much difficulty. There’s absolutely no rule stopping the price bettering 333p, aside from the fact we cannot presently count any higher.

If it’s all going wrong, we’d be concerned if the price found an excuse to relax below 138p as this permits relaxation to 105 initially with secondary, if broken, at 52p.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:08:45PM | BRENT | 43.38 | ‘cess | ||||||||

| 10:10:26PM | GOLD | 1817.89 | 1805 | 1800 | 1793 | 1813 | 1821 | 1824 | 1828 | 1811 | ‘cess |

| 10:12:02PM | FTSE | 6267.53 | Sorry | ||||||||

| 10:44:10PM | FRANCE | 5093.7 | ‘cess | ||||||||

| 10:46:37PM | GERMANY | 13085 | Shambles | ||||||||

| 10:48:28PM | US500 | 3252.52 | 3211 | 3191 | 3169 | 3238 | 3259 | 3265.25 | 3275 | 3231 | Success |

| 10:50:18PM | DOW | 26739 | Success | ||||||||

| 10:52:29PM | NASDAQ | 10957 | Success | ||||||||

| 10:58:19PM | JAPAN | 22787 | ‘cess |