#France #SP500 Our January review of B&Q owner, Kingfisher PLC, finished with the paragraph below. Obviously this was before “it hit the fan” but proved prescient, the share price eventually closing at 132p. We now see an important bounce fuelled by similar enthusiasm to those who’d been desperate for the stores to reopen, predominantly “blokes”.

There’s a degree of personal favouritism for B&Q, thanks to our choices here in Argyll, Scotland, limited to a few builders merchants who really prefer serving folk who drive white Transits, grudgingly supplying a single sheet of plasterboard and mainly stocking wood which comes in 4.8 metre lengths. As a result, any trip to the mainland will often include some sort of excuse for a B&Q visit to pick up bits and pieces. So yes, B&Q opening again was a pretty big deal and now seems to be reflected in their surprising share price movements.

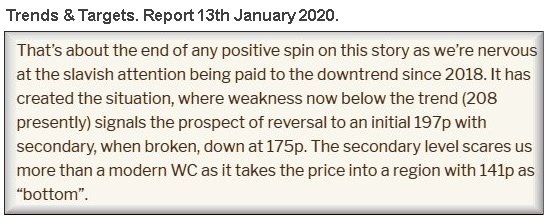

This is actually quite a big deal as very few share prices have yet bettered the level attained before the Covid drop but Kingfisher has achieved this miracle. If we regard the Covid-19 reversal as commencing at 221p on February 20th, the price is now at 225p and marginally in ‘safe’ territory for future recovery.

Price movements next exceeding 230p should prove capable of a lunge toward an initial 241p with secondary, if exceeded, calculating at a more enthusiastic 277p. Perhaps more importantly, with price closure above 241p, we shall regard the longer term influence as coming from 355p. Visually, this makes quite a lot of sense as there’s some sort of Glass Ceiling awaiting at such a level, a flat trend which has formed since 2015…

However, we’re in uncertain times and we’d be foolish if we refused to look for danger levels. Against Kingfisher, the Red uptrend since 2009 certainly supplies pause for thought, suggesting weakness below 193p could be problematic as it allows reversal to an initial 160p. If broken, our secondary calculation provides for a bottom at 102p, a price level we’d normally regard as absurd were it not for the intraday opening second plunge on March 20th.

This time around, our final paragraph on Kingfisher looks pretty unlikely as it feels the market wants this share price to recover.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 9:55:50PM | BRENT | 42.92 | Sorry | ||||||||

| 9:57:36PM | GOLD | 1795.13 | ‘cess | ||||||||

| 10:07:21PM | FTSE | 6163.19 | Success | ||||||||

| 10:14:43PM | FRANCE | 5006.1 | 5003 | 4994 | 4973 | 5037 | 5057 | 5079.5 | 5105 | 5015 | Success |

| 10:16:51PM | GERMANY | 12529 | ‘cess | ||||||||

| 10:18:24PM | US500 | 3146.6 | 3142 | 3126.5 | 3104 | 3177 | 3184 | 3190 | 3206 | 3158 | Success |

| 10:20:48PM | DOW | 25914 | ‘cess | ||||||||

| 10:22:40PM | NASDAQ | 10540 | Success | ||||||||

| 10:24:26PM | JAPAN | 22442 |