#FTSE #DOW There are times when the market is kind enough to confirm where a trend is. Perhaps all these folk who visited England’s South Coast beaches made the FTSE pause for thought, displaying warning of trouble ahead. Needless to say, I’m being a little hypocritical, visiting a beach locally in 28c temperatures at 4pm. But in defence, there were only 9 other people (and their dogs) in evidence, making social distancing easy on 2+ miles of sand. Scotland remains in lockdown.

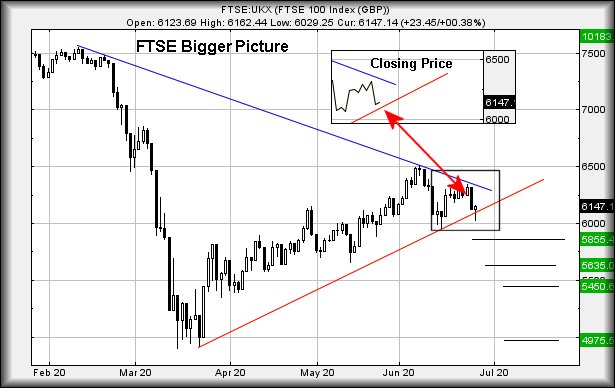

The warning signal, along with the market trend, is shown on the chart below. Visually the FTSE broke the Red uptrend during the session but was carefully recovered above the trend. As the inset highlights, care was taken to ensure the market closed the day in “safe” territory. This level of attention is often fascinating, usually telling us the market is perfectly aware of a trend, proving it can be broken, choosing to present the case of a closing price languishing in the land of sanity.

From our perspective, the next signal shall be weakness below 6029 points as this gives an official “lower low” which tends to confirm a trend has changed. In the case of the FTSE, weakness next below 6029 points brings the risk of reversal to an initial 5855 points with secondary, if broken, at 5635 points. And hopefully a rebound. We’ve opted to display the implications, should 5635 break and wonder if the market was “girding its loins” in fear of all those folk at Brighton provoking a theoretical second wave of Covid-19?

Presently we’ve absolutely no idea the real reason behind the trend break as it happened at 08:15am, long before the media started self righteous salivating over events on the South Coast but one important detail was revealed. The uptrend since the Covid-19 drop can be broken and now, this uptrend risks proving fragile.

As for the near(er) term, we shall be fascinated if the FTSE stumbles above 6155 points as this risks triggering recovery to an initial 6191 points with secondary, if bettered, a confident looking 6245 points. This certainly sounds like a nice scenario and according to the chart, shall keep the market trapped in limbo land between the Blue downtrend and Red uptrend.

The alternate near term scenario is of weakness below 6092 points as this risks producing reversal to an initial 6050 with secondary, if broken, calculating at 5944 points.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:00:37PM | BRENT | 41.5 | 39.71 | 39.51 | 42.7 | 41.68 | 42.035 | 40.4 | Shambles | ||

| 10:09:04PM | GOLD | 1764.16 | 1755 | 1750 | 1766 | 1768 | 1773 | 1756 | ‘cess | ||

| 10:16:15PM | FTSE | 6212 | 6027 | 5962 | 6153 | 6229 | 6252.75 | 6135 | Success | ||

| 10:26:37PM | FRANCE | 4982.5 | 4925 | 4906 | 4959 | 4983 | 5014.5 | 4928 | |||

| 10:28:46PM | GERMANY | 12331.89 | 12077 | 12061.5 | 12172 | 12357 | 12376.5 | 12160 | |||

| 10:30:34PM | US500 | 3084.1 | 3034 | 3019.5 | 3063 | 3086 | 3093 | 3067 | ‘cess | ||

| 10:32:43PM | DOW | 25698 | 25335 | 25200.5 | 25560 | 25796 | 25822.5 | 25572 | ‘cess | ||

| 10:34:57PM | NASDAQ | 10100 | 10039 | 10034.5 | 10092 | 10119 | 10142 | 10063 | Shambles | ||

| 10:37:40PM | JAPAN | 22502 | 22054 | 21939 | 22324 | 22537 | 22606 | 22303 | ‘cess |