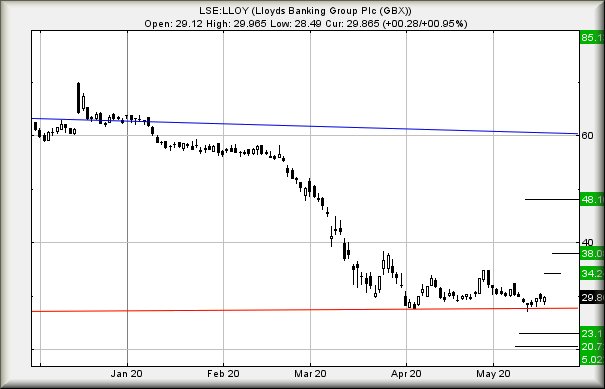

#SP500 #Japan Many shares are showing early signs of “coming off the bottom”. Needless to say, the Retail Bank Sector is not yet part of this grouping and #Lloyds remains resolutely trapped in the gutter. When last reviewed, we suggested Lloyds needed only exceed 35p to give hope, something the price carefully avoided!

Rather worse, in keeping clear of our 35p ‘early warning’ trigger level, Lloyds managed to briefly stumble below 27.7p. This movement risks real danger as weakness next below 27p risks further reversal toward 23p as a hopeful rebound level. And if broken, it almost must bounce by 20.7p, thanks to the only calculation below such a level indicating the price faces a final bottom down at just 5p.

We wonder if Lloyds share price shall face a Price Consolidation next in an attempt to make this FTSE100 component look more respectable. Eight years ago, RBS suffered a 10:1 split, thanks to the share price spending the previous 12 months trading in the 20p range. As it’s now trading around 100p (10p in real money) the effort didn’t really work, other than to propel the share price away from ‘penny share’ territory. We’re obviously just thinking aloud as there’s absolutely nothing to indicate a price split is planned, nothing aside from the painful detail Lloyds share price isn’t showing early signs for recovery yet.

The share STILL needs movement above 35p to give hope for the future. If there’s to be early warning of a movement to this early warning trigger (yup, we’re reduced to absurd levels of logic), next above 30.6p is supposed to deliver 31.5p. If bettered, our secondary calculation presents a confident looking 34.25p. While the visuals still suggest a Glass Ceiling awaits at the 35p level, we suspect closure above 34.25p shall deliver sufficient strength to allow a longer term ambition of 38p and beyond.

For now, Lloyds is quite troubling and we’re quite concerned regarding last weeks breach of 27.7p.

FUTURES

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

9:56:07PM |

BRENT |

36.03 |

‘cess |

||||||||

|

9:57:30PM |

GOLD |

1748.13 |

|||||||||

|

9:59:23PM |

FTSE |

6074.07 |

|||||||||

|

10:01:08PM |

FRANCE |

4484.2 |

Shambles |

||||||||

|

10:04:21PM |

GERMANY |

11228.8 |

‘cess |

||||||||

|

10:07:32PM |

US500 |

2977 |

2946 |

2936 |

2921 |

2975 |

2981 |

2988.5 |

3006 |

2958 |

|

|

10:10:02PM |

DOW |

24607.7 |

|||||||||

|

10:11:43PM |

NASDAQ |

9501.99 |

Success |

||||||||

|

10:13:12PM |

JAPAN |

20710 |

20532 |

20427 |

20300 |

20737 |

20808 |

20860.5 |

21037 |

20558 |

Success |

20/05/2020 FTSE Closed at 6067 points. Change of 1.08%. Total value traded through LSE was: £ 5,947,398,391 a change of 10.61%

19/05/2020 FTSE Closed at 6002 points. Change of -0.76%. Total value traded through LSE was: £ 5,376,891,155 a change of -9.59%

18/05/2020 FTSE Closed at 6048 points. Change of 4.29%. Total value traded through LSE was: £ 5,947,351,021 a change of 14.48%

15/05/2020 FTSE Closed at 5799 points. Change of 1.01%. Total value traded through LSE was: £ 5,195,107,449 a change of -15.28%

14/05/2020 FTSE Closed at 5741 points. Change of -2.76%. Total value traded through LSE was: £ 6,132,234,871 a change of 5.73%

13/05/2020 FTSE Closed at 5904 points. Change of -1.5%. Total value traded through LSE was: £ 5,799,712,485 a change of 7.88%

12/05/2020 FTSE Closed at 5994 points. Change of -100%. Total value traded through LSE was: £ 5,375,886,438 a change of 0%