#GOLD #SP500 It’s not often one gets shamed by a fairy but a niece accomplished provided a dose of humiliation. For over a year, we’ve been threatening to produce a “Podcast” and nothing had been done. A niece runs “Princess Parties”, a niche market which has vanished for Covid-19 reasons. Over the weekend, she decided, ‘okay, I’ll do Princess Story Time’, producing an amazingly professional video which is available free on YouTube, completely dressed in character, where she reads children’s stories.

Meanwhile, despite being surrounded by some professional recording studio equipment, the ambition of doing a market podcast had been successfully avoided. In defense, while stories about Princesses and Dragons may entrance children, we’ve always felt a dialogue about future market potentials could prove as interesting as The Shipping Forecast. However, an attempt has been made and our first 10-minute effort – covering Wall St, The FTSE, Gold, and GBPUSD is available at the link below. If it proves popular, we’ll continue them.

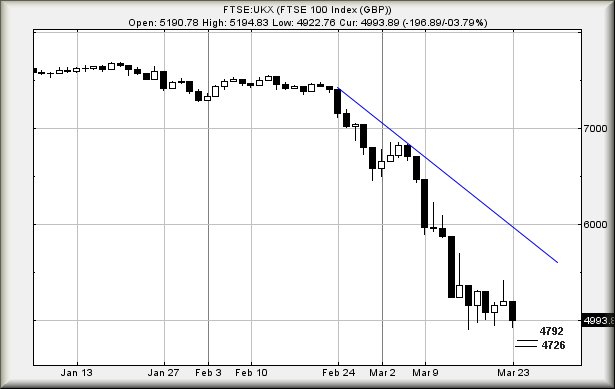

As for the FTSE, Monday proved pretty chaotic. The index was (as usual) forced down at the open, hitting 4940 within the first 4 minutes. Unusually, some surprise recovery was enacted and by noon, the market ignited the rockets. Needless to say, it all fell apart after 30 minutes with the day ending nearly 4% down. The wild swings are proving frustrating, giving sensible Stop Loss Levels for various index scenarios now an almost impossible task. As fairly simple “for instance” comes with the current market position. There’s a heck of an argument favouring reversal to around 4,000 points next. At time of writing, the FTSE is trading at 4993 points, so we’re postulating nearly 1,000 points of drop. But the trend line (Blue) which delineates the current drop cycle is presently at 5995 points. This suggests a nearly (and impossible) 1,000 point width of stop loss.

It’s almost as if the market knows this. Gone are the days of a 1% day being fairly vibrant for the FTSE. Instead, we are starting to regard 4 & 5 percent days as the norm!

Near term, it feels like weakness below yesterday’s 4922 risks reversal down to 4792 points. If broken, secondary calculates down at 4726 points. The tightest stop works out at 5,110 points. It’s going to be worth remembering, this scenario risks taking the FTSE below the critical 4,900 level. If you want to know what that means, listen to the podcast…

Please, do remember we are speculating on the FTSE during trading hours, not before – or after – hours futures.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:02:15PM | BRENT | 29.16 | ‘cess | ||||||||

| 10:04:30PM | GOLD | 1556 | 1520 | 1509.5 | 1492 | 1543 | 1562 | 1574 | 1591 | 1520 | Success |

| 10:37:16PM | FTSE | 5095 | Sorry | ||||||||

| 10:49:21PM | FRANCE | 3920 | Success | ||||||||

| 10:52:11PM | GERMANY | 8990 | Success | ||||||||

| 10:53:49PM | US500 | 2267.64 | 2184 | 2124 | 2034 | 2296 | 2394 | 2441 | 2528 | 2227 | |

| 10:57:29PM | DOW | 18915 | Success | ||||||||

| 11:03:20PM | NASDAQ | 7112 | Success | ||||||||

| 11:06:16PM | JAPAN | 17718 |

23/03/2020 FTSE Closed at 4993 points. Change of -3.8%. Total value traded through LSE was: £ 9,333,810,024 a change of -32.33%

20/03/2020 FTSE Closed at 5190 points. Change of 0.76%. Total value traded through LSE was: £ 13,793,008,167 a change of 30.09%

19/03/2020 FTSE Closed at 5151 points. Change of 1.4%. Total value traded through LSE was: £ 10,602,721,602 a change of 9.14%

18/03/2020 FTSE Closed at 5080 points. Change of -4.04%. Total value traded through LSE was: £ 9,714,451,101 a change of 6.42%

17/03/2020 FTSE Closed at 5294 points. Change of 2.78%. Total value traded through LSE was: £ 9,128,689,221 a change of -13.38%

16/03/2020 FTSE Closed at 5151 points. Change of -4.01%. Total value traded through LSE was: £ 10,538,775,450 a change of -6.31%

13/03/2020 FTSE Closed at 5366 points. Change of 2.46%. Total value traded through LSE was: £ 11,248,883,463 a change of 60.84%