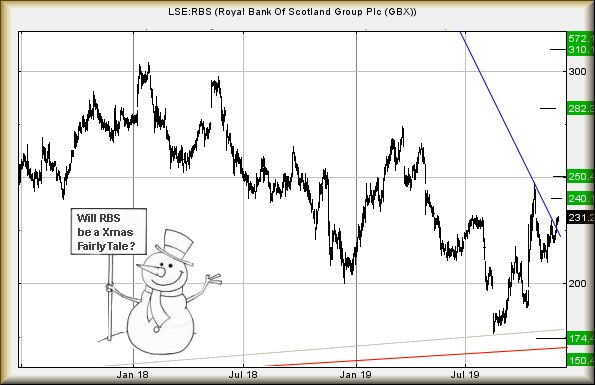

#DAX #FTSE We’re starting to wonder whether the slight, very slight, optimism present against the retail banks may be due to expectations against next months election result in the UK. If this is indeed the case, Royal Bank of Scotland PLC are carefully sticking their tartan bonnet above the parapet at present.

The immediate situation is pretty straightforward as moves above 232p look capable of achieving a near term 240p. In itself, a pretty useless movement but greater interest is aroused, if the price somehow betters 240p. A movement like this will be a solid nod in the right direction, calculating with a secondary target of 250p.

In a ‘back to school’ moment, achieving 250p shall prove important taking the price above the last point the downtrend (Blue from 2009) was defined and thus, officially creating a Higher High. Stumbling into such territory risks truly stirring the pot, from a Big Picture perspective. In fact, we’d strongly suggest shelving celebrations until the share actually closes around the 250p point. A miracle like this will tend promise 282p and beyond for the longer term.

Of course, there’s a reasonable chance this optimism could be dashed, if politicians (or voters) do something exquisitely stupid. In the case of RBS, anything capable of driving the price below 210p is liable to have dire consequences, transporting the price back into a region where 174p is yet again calculating as a probable drop location. Secondary, if broken, remains at 150p.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

9:44:46PM |

BRENT |

63.1 |

‘cess | ||||||||

|

9:47:02PM |

GOLD |

1454.64 | |||||||||

|

9:50:07PM |

FTSE |

7430.8 |

7407 |

7401 |

7386 |

7444 |

7448 |

7456 |

7472 |

7417 |

‘cess |

|

9:51:49PM |

FRANCE |

5928.7 |

Shambles | ||||||||

|

9:54:59PM |

GERMANY |

13307.72 |

13217 |

13202 |

13120 |

13267 |

13316 |

13324 |

13368 |

13262 |

Success |

|

9:57:51PM |

US500 |

3155.52 |

Success | ||||||||

|

9:59:41PM |

DOW |

28179.5 | |||||||||

|

10:03:46PM |

NASDAQ |

8453.24 |

Success | ||||||||

|

10:06:28PM |

JAPAN |

23584 |