#DAX #Nasdaq When reading a FT journalist comment about UK Politics never being so chaotic ‘since time began’, a brief memory of the 1970’s/80’s surfaced. Lots of General Elections, power cuts, food panics, fuel ration books, inflation, a mindset eventually leading to the widely known (rarely reported) ‘secret’ UK soldiers deployed, dressed as civilian policemen to “fight” striking miners in the earlier 1980’s. Somehow, our current shambles just isn’t the same!

The 70’s and early 80’s were “interesting times” with some real brinksmanship, unlike today, where we appear to be led by folk without gravitas or statesman like quality. But we do have a media, determined to pretend things have never been so bad as they are now. The purveyors of panic in the media must be experiencing a frisson of delight, if only due to the FTSE being DOWN 0.6% on a day the DOW was UP 1.6%.

In the last few days, the UK market has been challenging. But on Wednesday evening, we threw the toys from the pram and lied to ourselves with what was perhaps the most stupid logic available. The problem was, Thursday calculated as being an UP day on the FTSE. Everything pointed to this being possible. As a result, we adopted the stance of expecting a DOWN day! Our thinking was fairly basic, if UK market seems to be holding itself in place, neither accelerating upward nor downward. The logic by which upward travel was supposed to happen presented a scenario with continued growth possible to the 7700’s. Surely, a market which was awaiting guidance, would avoid this scenario and instead head downward.

It did.

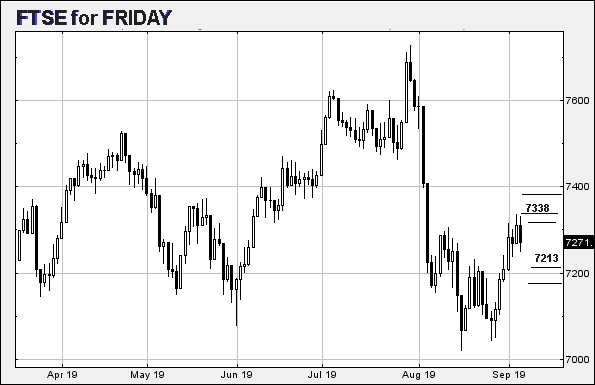

Closing Thursday at 7265, there is now a problem if the FTSE makes its way below 7240. We can calculate travel down to an initial 7213 points with secondary, if broken, at 7174 points. Visually this appears not terribly traumatic and thus, there’s a reasonable chance of it happening.

However, if the market opts to remain marching on the spot, above 7289 is supposed to bring an initial 7313 points with secondary, if bettered, at 7338 points. As the chart below highlights, neither target level challenges the hiatus which has been the first few days of September. As a result, we suspect this shall be the route taken.

Above 7338 should prove interesting, breaking from trend and expecting 7390 points. We doubt it.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

10:11:06PM |

BRENT |

60.57 |

Success | ||||||||

|

10:12:57PM |

GOLD |

1519.7 |

Success | ||||||||

|

10:16:11PM |

FTSE |

7248.68 |

Shambles | ||||||||

|

10:19:13PM |

FRANCE |

5584 |

Success | ||||||||

|

10:22:17PM |

GERMANY |

12110 |

12066 |

12040 |

11999 |

12135 |

12140 |

12177.25 |

12284 |

12076 |

Success |

|

10:24:38PM |

US500 |

2969.72 |

Success | ||||||||

|

10:29:09PM |

DOW |

26686 |

Success | ||||||||

|

10:40:03PM |

NASDAQ |

7847 |

7730 |

7652.5 |

7576 |

7833 |

7882 |

7904 |

7915 |

7760 |

Success |

|

10:43:31PM |

JAPAN |

21131 |

Success |