BRENT CRUDE Big Picture. We’d friends round for dinner on Saturday. Okay, we had Chinese takeaway containers on the table, plates, cutlery, several bags of chips, and the inevitable bag of prawn crackers for the animals. And wine, lots of wine. Mrs T&T, despite proper chef credentials, likes relaxing with friends rather than cooking for ’em.

During the course of the evening, it became clear there was an almost ridiculous notion the market analyst in the room would know, with complete certainty, what was going to happen in the future as a result of Brexit. The shock, when it was admitted I don’t have a clue, should not have been a surprise. But at present, there are many indications of share prices being placed in fairly tight ranges until the current chaos – if it is chaos – can be resolved. Personally speaking, it’s difficult to trust anything written or broadcast, thanks to the level of agenda’ being promoted.

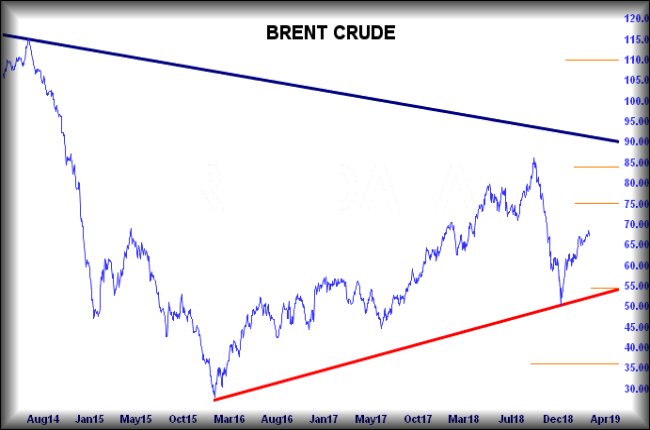

During the last week, there has been further evidence of share prices being stalled into a range with some interesting movements against the retail banks. Surprisingly, even Brent Crude (an international benchmark price) seems to be showing the potential of it being trapped for a while.

The immediate situation against Brent seems fairly simple.

Movement now above 69 should promote further growth to an initial 75. If exceeded, secondary is at 84 dollars. Visually, neither ambition is particularly helpful as it appears the market intends match the high of last year but certainly, no higher without some volatility first. More probable, if our suspicion about “parking” proves correct, shall be weakness now below 64 proving capable of reversal toward 55 and a bonk against the uptrend since 2015. A more severe (but visually unlikely) issue occurs, should the price manage below the RED uptrend as future weakness to 35 becomes possible.

For now, we favour the visuals which tend suggest a repeat of last years performance shall prove viable. As a result, it will hopefully be worth watching for similar dance steps enacted by oil related share prices.

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 5:49:08PM | BRENT | 66.75 | 65.98 | 65.595 | 64.62 | 66.83 | 67.8 | 67.97 | 68.63 | 66.57 | Success |

| 5:56:25PM | GOLD | 1314.25 | |||||||||

| 5:58:44PM | FTSE | 7189.49 | Success | ||||||||

| 6:33:39PM | FRANCE | 5264 | Success | ||||||||

| 6:36:20PM | GERMANY | 11322 | 11310 | 11239 | 11113 | 11515 | 11516 | 11570 | 11657 | 11449 | Success |

| 6:40:25PM | US500 | 2802.57 | Success | ||||||||

| 6:43:17PM | DOW | 25519 | |||||||||

| 6:51:51PM | NASDAQ | 7331.24 | Success | ||||||||

| 6:54:01PM | JAPAN | 21130 | Success |