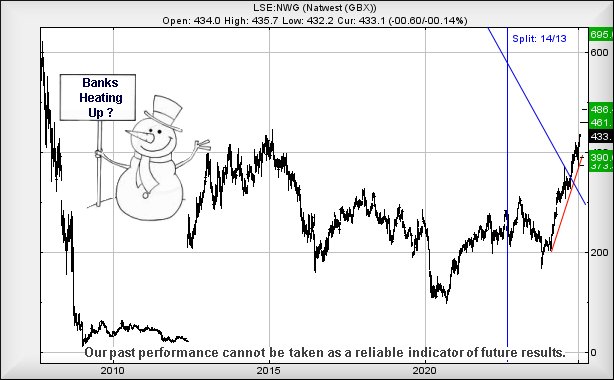

Natwest (LSE:NWG) #Brent #GOLD In the three weeks since we previously reviewed Natwest, the company brought, quite pleasantly, a series of pretty exact movements to our target level of 434p. In fact, when the share price closed at 435p on the first surge to our target level, it ticked an important first box for longer term growth. Of course, this was only a “first box” by our own bespoke inhouse criteria, a series of arguments fuelling a balance of probabilities.

Currently bumbling around our target level, we shall not be aghast if the share suffers an artificial relaxation, and an excuse to visit the 350 level shall make a lot of visual sense. Already, and argument is developing for reversal to an initial 390 with secondary, if broken, at 373p. Moves below 405 look to be capable of triggering such reversal.

However, on the positive side of the fence, above 437p could now easily trigger gains toward an initial 451p with our secondary, if beaten, at 486p and some hesitation. Overall, we shall regard the share price as dwelling in a zone where a longer term 695p has becomes possible.

Could we be witnessing the birth of a resurgence of the retail banks?

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop |

| 10:49:05PM | BRENT | 7632.2 | 7490 | 7302 | 6993 | 7665 | 7658 | 7700 | 7769 | 7570 |

| 10:51:20PM | GOLD | 2797.82 | 2790 | 2779 | 2766 | 2809 | 2818 | 2827 | 2859 | 2804 |

| 10:53:44PM | FTSE | 8636.3 | 8630 | 8621 | 8597 | 8650 | 8680 | 8694 | 8732 | 8660 |

| 10:56:24PM | STOX50 | 5258.8 | 5250 | 5243 | 5219 | 5270 | 5310 | 5328 | 5354 | 5290 |

| 10:58:57PM | GERMANY | 21629.3 | 21606 | 21558 | 21476 | 21726 | 21804 | 21852 | 21934 | 21688 |

| 11:02:21PM | US500 | 5930 | 5920 | 5913 | 5844 | 6016 | 6120 | 6148 | 6225 | 6086 |

| 11:05:08PM | DOW | 44026.5 | 43960 | 43560 | 43056 | 44281 | 44284 | 44494 | 44716 | 44030 |

| 11:07:16PM | NASDAQ | 20912 | 20824 | 20541 | 20103 | 21068 | 21300 | 21387 | 21637 | 20969 |

| 11:12:01PM | JAPAN | 38684 | 38544 | 37750 | 36792 | 39055 | 39830 | 40378 | 40977 | 39442 |

31/01/2025 FTSE Closed at 8673 points. Change of 0.31%. Total value traded through LSE was: £ 7,830,859,911 a change of 58.83%

30/01/2025 FTSE Closed at 8646 points. Change of 1.04%. Total value traded through LSE was: £ 4,930,240,161 a change of -10.24%

29/01/2025 FTSE Closed at 8557 points. Change of 0.28%. Total value traded through LSE was: £ 5,492,931,897 a change of 11.31%

28/01/2025 FTSE Closed at 8533 points. Change of 0.35%. Total value traded through LSE was: £ 4,934,936,161 a change of 3.9%

27/01/2025 FTSE Closed at 8503 points. Change of 0.01%. Total value traded through LSE was: £ 4,749,731,761 a change of -19.91%

24/01/2025 FTSE Closed at 8502 points. Change of -0.74%. Total value traded through LSE was: £ 5,930,778,515 a change of -10.73%

23/01/2025 FTSE Closed at 8565 points. Change of 0.23%. Total value traded through LSE was: £ 6,643,702,165 a change of 25.9%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:CCL Carnival** **LSE:EXPN Experian** **LSE:GKP Gulf Keystone** **LSE:HIK Hikma** **LSE:HSBA HSBC** **LSE:IAG British Airways** **LSE:IHG Intercontinental Hotels Group** **LSE:SMT Scottish Mortgage Investment Trust** **LSE:STAN Standard Chartered** **LSE:TLW Tullow** **

********

Updated charts published on : Carnival, Experian, Gulf Keystone, Hikma, HSBC, British Airways, Intercontinental Hotels Group, Scottish Mortgage Investment Trust, Standard Chartered, Tullow,

LSE:CCL Carnival Close Mid-Price: 2050 Percentage Change: -0.34% Day High: 2095 Day Low: 2046

Target met. All Carnival needs are mid-price trades ABOVE 2095 to improve ……..

</p

View Previous Carnival & Big Picture ***

LSE:EXPN Experian. Close Mid-Price: 4007 Percentage Change: + 0.55% Day High: 4021 Day Low: 3968

Target met. Continued trades against EXPN with a mid-price ABOVE 4021 sho ……..

</p

View Previous Experian & Big Picture ***

LSE:GKP Gulf Keystone. Close Mid-Price: 170.6 Percentage Change: + 2.46% Day High: 172.3 Day Low: 166.9

Continued trades against GKP with a mid-price ABOVE 172.3 should improve ……..

</p

View Previous Gulf Keystone & Big Picture ***

LSE:HIK Hikma. Close Mid-Price: 2292 Percentage Change: + 0.53% Day High: 2296 Day Low: 2256

Continued trades against HIK with a mid-price ABOVE 2296 should improve t ……..

</p

View Previous Hikma & Big Picture ***

LSE:HSBA HSBC. Close Mid-Price: 845.7 Percentage Change: + 0.65% Day High: 849.8 Day Low: 841.5

Target met. Further movement against HSBC ABOVE 849.8 should improve acce ……..

</p

View Previous HSBC & Big Picture ***

LSE:IAG British Airways. Close Mid-Price: 337.9 Percentage Change: + 0.93% Day High: 340.5 Day Low: 334.2

Further movement against British Airways ABOVE 340.5 should improve acce ……..

</p

View Previous British Airways & Big Picture ***

LSE:IHG Intercontinental Hotels Group. Close Mid-Price: 10820 Percentage Change: + 0.28% Day High: 10910 Day Low: 10735

Continued trades against IHG with a mid-price ABOVE 10910 should improve ……..

</p

View Previous Intercontinental Hotels Group & Big Picture ***

LSE:SMT Scottish Mortgage Investment Trust. Close Mid-Price: 1085.5 Percentage Change: + 1.26% Day High: 1088 Day Low: 1080

All Scottish Mortgage Investment Trust needs are mid-price trades ABOVE 1 ……..

</p

View Previous Scottish Mortgage Investment Trust & Big Picture ***

LSE:STAN Standard Chartered. Close Mid-Price: 1092 Percentage Change: + 0.55% Day High: 1097 Day Low: 1082.5

Continued trades against STAN with a mid-price ABOVE 1097 should improve ……..

</p

View Previous Standard Chartered & Big Picture ***

LSE:TLW Tullow Close Mid-Price: 18 Percentage Change: -5.31% Day High: 19 Day Low: 18.22

Continued weakness against TLW taking the price below 18.22 calculates as ……..

</p

View Previous Tullow & Big Picture ***