#Brent #US500 It felt like the last week was spent commenting on the whimsical nature of living in Argyll. On Saturday, during monsoon conditions, giving in and doing a dog walk brought the perfect end to a strange week. Out of nowhere, a bloke trundled passed, confidently riding a unicycle and unfortunately not juggling fish to confirm the weather conditions. From looking at the effort involved, it was easy to suspect he’d fallen foul of a clickbait article to tackle belly flab as it was easy to imagine how tightly he was holding his stomach muscles. It certainly made a pleasant change from the plethora of wee fat blokes riding mountain bikes who tend appear during the summer months.

Another event from the weekend, a shooting competition with a grand-daughter was able to take place during a dry period on Sunday. The 11 year old won quite conclusively with 85 points to my score of 47, winning the right to set up the target range next time around. To be fair to the little monster, she is a substantially better shot, opting to start the competition by successfully hitting the furthest two targets 150 feet downrange. However, I can beat her at chess which is a slight saving grace.

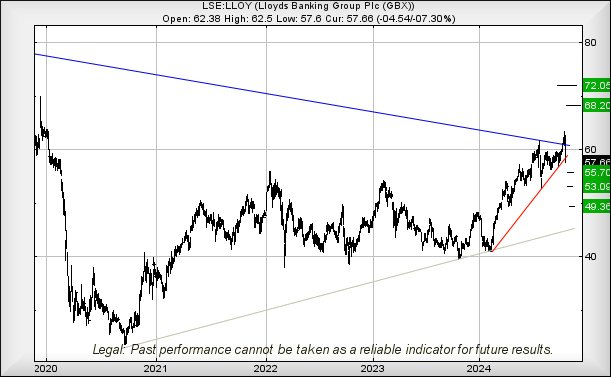

As for Lloyds, their share price has fallen apart on us. When we reviewed it three weeks ago, the share was supposed to exceed 61.338p to signal happy times ahead, a feat achieved from October 17th. But everything fell apart on Friday 25th with news of Lloyds exposure to the car finance court ruling, exposing them to a 3bn pound hit. It’s all quite messy, doubtless about to spawn an entire industry of “car finance claim” companies similar to the absurd number of leaches which appeared, when the Payment Protection thing hit the fan.

The 7% reversal for Lloyds on Friday has dumped the share into some quite nasty territory, suggesting traffic below 56.92p risks a visit to an initial 55.7p with our secondary, if broken, at 53p and hopefully a proper bounce, capable of starting the entire recovery process again. Given the court verdict on Friday is expected to be appealed to the UK Supreme Court, there shall doubtless be plenty of time until all the lawyers decide they’ve clocked up sufficient hours to absorb any successful litigation awards. We’re obviously a bit cynical but with this sort of class action, the legal profession always appear to flourish.

Should Lloyds intend any sort of surprise, it’s now the case where above 61.33 should bring a visit to 68.2p next with our secondary, if beaten, at 72p and some possible hesitation. Unfortunately, for now we expect to see Lloyds pay homage to the 53p level.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop |

| 11:21:46PM | BRENT | 7555 | 7470 | 7430 | 7381 | 7569 | 7576 | 7621 | 7706 | 7502 |

| 11:25:16PM | GOLD | 2747.07 | 2734 | |||||||

| 2:07:12AM | FTSE | 8235.5 | 8257 | |||||||

| 2:14:51AM | STOX50 | 4927 | 4938 | |||||||

| 2:24:30AM | GERMANY | 19411 | 19412 | |||||||

| 2:29:01AM | US500 | 5804.7 | 5799 | 5777 | 5748 | 5823 | 5833 | 5881 | 5898 | 5807 |

| 2:41:33AM | DOW | 42082 | 42350 | |||||||

| 2:57:30AM | NASDAQ | 20330.4 | 20341 | |||||||

| 3:11:40AM | JAPAN | 38036 | 38022 |

25/10/2024 FTSE Closed at 8148 points. Change of -1.46%. Total value traded through LSE was: £ 4,737,422,038 a change of -5.81%

24/10/2024 FTSE Closed at 8269 points. Change of 0.13%. Total value traded through LSE was: £ 5,029,789,282 a change of 1.28%

23/10/2024 FTSE Closed at 8258 points. Change of -0.58%. Total value traded through LSE was: £ 4,966,414,850 a change of 16.11%

22/10/2024 FTSE Closed at 8306 points. Change of -0.14%. Total value traded through LSE was: £ 4,277,437,819 a change of 11.53%

21/10/2024 FTSE Closed at 8318 points. Change of -0.48%. Total value traded through LSE was: £ 3,835,225,981 a change of -24.37%

18/10/2024 FTSE Closed at 8358 points. Change of -0.32%. Total value traded through LSE was: £ 5,071,129,740 a change of -4.53%

17/10/2024 FTSE Closed at 8385 points. Change of 0.67%. Total value traded through LSE was: £ 5,311,482,750 a change of -18.88%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BME B & M** **LSE:ITM ITM Power** **LSE:NWG Natwest** **LSE:SPT Spirent Comms** **LSE:STAN Standard Chartered** **

********

Updated charts published on : B & M, ITM Power, Natwest, Spirent Comms, Standard Chartered,

LSE:BME B & M. Close Mid-Price: 402.1 Percentage Change: + 0.25% Day High: 404.6 Day Low: 397.4

If B & M experiences continued weakness below 397.4, it will invariably l ……..

</p

View Previous B & M & Big Picture ***

LSE:ITM ITM Power. Close Mid-Price: 40.06 Percentage Change: + 0.15% Day High: 40.8 Day Low: 39.72

Target met. Continued weakness against ITM taking the price below 39.72 c ……..

</p

View Previous ITM Power & Big Picture ***

LSE:NWG Natwest. Close Mid-Price: 363.9 Percentage Change: + 0.58% Day High: 381.5 Day Low: 364.1

Target met. Further movement against Natwest ABOVE 381.5 should improve a ……..

</p

View Previous Natwest & Big Picture ***

LSE:SPT Spirent Comms Close Mid-Price: 170.1 Percentage Change: -1.10% Day High: 171.2 Day Low: 167.3

Continued weakness against SPT taking the price below 167.3 calculates as ……..

</p

View Previous Spirent Comms & Big Picture ***

LSE:STAN Standard Chartered Close Mid-Price: 853 Percentage Change: -0.70% Day High: 865.6 Day Low: 850.2

All Standard Chartered needs are mid-price trades ABOVE 865.6 to improve ……..

</p

View Previous Standard Chartered & Big Picture ***