#DAX #Brent Driving home in the dark evenings has become reminiscent of ones first view of “The Strip” in Las Vegas, the USA’s homage to all things tacky. Thankfully, the vast majority of Xmas lights locally appear to be on timers. It results in an amusing situation of rushing out for milk just before 10pm, overawed by the sheer volume of LCD lights. But when returning home, houses lose their electric smile and revert to standard Scottish Highland gloom.

Admittedly, this reverence to imaginative light displays (due, usually, to the imminent appearance of grandchildren) doubtless goes unnoticed by the National Grid. The type of lighting favoured is cheap to buy and usually cheaper to operate than a mobile phone charger. But yes, locally, there are some really tacky displays.

This subject brings us neatly to JD Sports, purveyors of expensive tacky clothing, designed for folk who think it a great idea to pay premium prices to advertise the fact they’d paid a premium price. It’s a concept which eludes completely, perhaps indicative of a life spent avoiding herd mentality. Equally, there has always been a suspicion this particular drive in fashion may suddenly change, if the “herd” become sentient? This would surely impact negatively on companies who regard sport as a fashion opportunity!

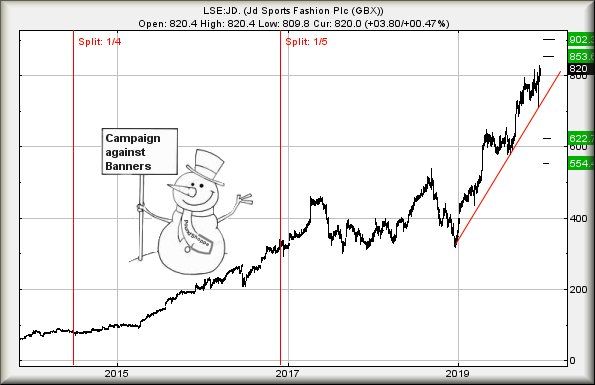

All kidding aside, JD Sports have experienced a truly impressive rise in share price since 2014 and normally we’d be concerned about the recent hiatus in climbing potentials. There are early signs this hesitation is about to ease as movement now above 830p calculate with the potential of an initial 853p. If exceeded, our secondary works out at a longer term 902p. We cannot calculate higher than 902p but would stress, especially in the case of JD’s, this historically means little and it shall be worth keeping an eye out for the market gapping the share price UP anytime now. This will tend suggest 902p as proving extremely valid, perhaps a point where some hesitation may occur, but we’d need take another hard look at the tea leaves at such a level.

Presently trading around 820p, the price needs go below 720p before alarm is justified as this will indicate the immediate uptrend has failed. Additionally, it allows future reversal to commence down to 622p initially with secondary, if broken, at 554p and hopefully a proper rebound.

For now, it appears optimism shall be justified.

|

Time Issued |

Market |

Price At Issue |

Short Entry |

Fast Exit |

Slow Exit |

Stop |

Long Entry |

Fast Exit |

Slow Exit |

Stop |

Prior |

|

6:47:16PM |

BRENT |

65.44 |

65.1 |

64.695 |

64.21 |

65.95 |

66.04 |

66.36 |

66.78 |

64.98 |

‘cess |

|

6:49:06PM |

GOLD |

1478.98 | |||||||||

|

6:51:46PM |

FTSE |

7570 | |||||||||

|

7:08:45PM |

FRANCE |

6014.5 |

Success | ||||||||

|

7:10:53PM |

GERMANY |

13298 |

13268 |

13245 |

13219 |

13316 |

13323 |

13334.75 |

13363 |

13293 |

‘cess |

|

7:13:43PM |

US500 |

3221.55 |

‘cess | ||||||||

|

7:16:01PM |

DOW |

28460 |

‘cess | ||||||||

|

7:18:32PM |

NASDAQ |

8677.25 |

‘cess | ||||||||

|

7:20:17PM |

JAPAN |

23858 |