Trailers or vehicles with loads sticking out a bit, usually have a rag tied to signify the pointy bit, this item flapping around wildly as it moved through the air. We’d a cat blessed with similar elegance, always capable of walking into a room and showing clear signs she’d no idea why she was there. Sometimes, she’d go to the water bowl and sit, staring at the liquid, trying to remember what to do with it. The thing did remain true to a couple of traits. It would exhibit affection to my wife, our daughter, our grand-daughters, happily joining any of them for a cuddle or nap. Not once did it ever sit down beside me nor acknowledge me in any way, treating me exactly the way it treated our dogs, best to pretend we didn’t exist.

Long story short, at 22 or 24 years old, the vet informed my wife it “was time” due to an attempt at a routine blood test failing with the need to knock the cat out to try and take blood. The vet felt, quite strongly, the cat wouldn’t wake up again and given she’d stopped eating and was as light as a cliche, it was best to end things as she was probably in pain.

And so, still inhabited by a stinking cold, I was detailed to dig a grave for the cat at the top of the lawn. The morning provided atmosphere, wet and windy, and our garden crows were fascinated as I struggled to dig a three foot hole with manual tools. I’ve kept threatening to buy a digger attachment for the little tractor but thankfully, we’ve only had two cats providing justification, each many years apart. Our dogs get cremated.

Anyway, eventually a sufficient cavern was created and I carried the weightless body (wrapped in a light towel) to the waiting grave. My wife, understandably upset, left the burial to me which meant I’d a choice of music to play on my phone, while I filled the grave in. Which is why, the Mud tune called “Tiger Feet” echoed across the garden, the cat actually being called Tiger. It was either that or the perfect “Year of The Cat” by local boy Al Stewart, far too good a tune to spoil in such a way. To be fair, “Tiger Feet” was played to satisfy my sense of the ridiculous in having a cat funeral which the single mourner and also grave digger, didn’t want to be at. Pretty sure the cat didn’t want to be there either!

Thus, 2/3rds through January and life in Argyll maintains its steady stream of ridiculous, the tune “Tiger Feet” unfortunately is stuck in my head now.

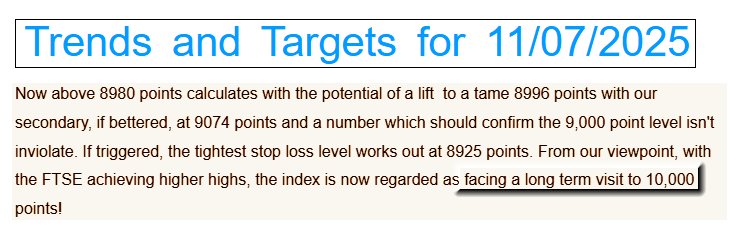

Unfortunately, the FTSE has also been indulging in its own sense of the ridiculous, the UK (and all other markets) pretending to believe the US was planning an invasion of Greenland, quite forgetting President Trump’s initial silly rhetoric is always simply setting out a negotiating position. (Source: The Art of the Deal, Donald R Trump) Common sense continues to suggest Greenland shall end up a “protectorate” of the USA, such as Panama was until full sovereignty was assigned to the country with everything going downhill in the period since. Perhaps a similar lesson to the UK, Brexit removing itself from the governance of Europe and returning as a country with “rulers” completely untrained in the concept of running a nation. This would certainly explain the stream of incompetent politicians since Brexit, people who would normally fight to be elected as town councillors, finding running a country substantially above their level of ability.

Index movements since the start of 2026 brought a new rule for us to observe, something which makes little sense yet proved to be exquisitely correct. As always, our reasoning can verge on the absurd but one of our “things” has been a reliable argument which relates to Glass Ceilings. We’ve now got a rule which arguments accurately on the drop potentials, when a glass ceiling is exceeded and a new high achieved. To most folk, this isn’t a big deal but for us, our rule book just expanded from 189 to 190 concepts of what may happen, following a price movement. Our software is emphatically NOT AI, just a series of “IF” statements designed to avoid logic loops occurring and sometimes toss out correct answers.

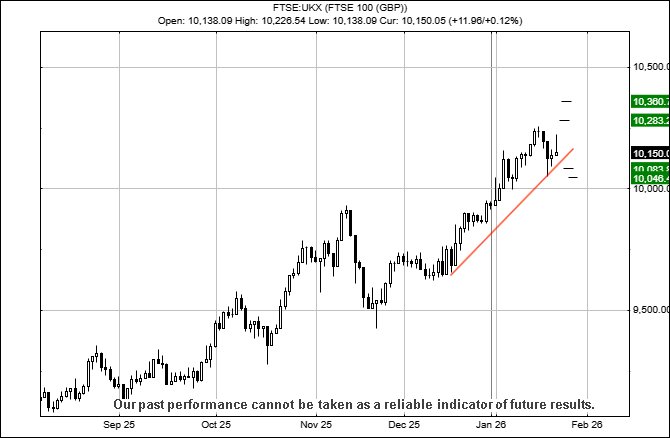

Currently, below 10,134 points indicates the potential of weakness to an initial 10,083 points with our secondary, if broken, at 10,046 points. If triggered, the tightest stop loss level looks like a fairly acceptable 10,170 points. Oddly, we suspect this game plan will probably fail as it’s almost too obvious.

Instead, above 10,196 should become of special interest, giving an initial target level at 10,283 points with our secondary, if beaten, at 10,360 points.

Have a good weekend, we’re going to sit back and hope the FTSE experiences some gains and the cat doesn’t claw its way out of a grave… Didn’t Mud have another tune called “The Cat Crept In”?

FUTURES

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 11:15:50PM | BRENT | 6374.9 | 6300 | 6245 | 6355 | 6401 | 6420 | 6353 | |||

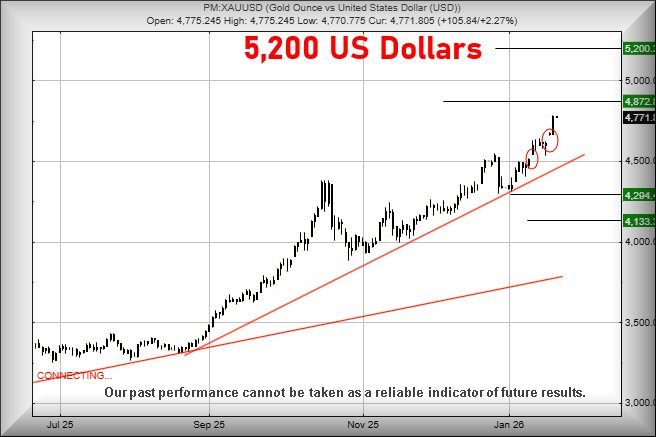

| 11:18:55PM | GOLD | 4949 | 4813 | 4746 | 4839 | 4961 | 4973 | 4901 | Success | ||

| 11:24:50PM | FTSE | 10150.1 | 10138 | 10128 | 10158 | 10210 | 10220 | 10155 | |||

| 11:28:48PM | GERMANY | 24829.7 | 24777 | 24768 | 24863 | 24942 | 25034 | 24852 | |||

| 11:33:54PM | US500 | 6922.5 | 6878 | 6863 | 6898 | 6935 | 6954 | 6900 | ‘cess | ||

| 11:41:58PM | DOW | 49413 | 49082 | 48882 | 49305 | 49618 | 49894 | 49318 | ‘cess | ||

| 11:45:15PM | NASDAQ | 25534 | 25345 | 25282 | 25465 | 25600 | 25905 | 25395 | |||

| 11:47:54PM | JAPAN | 53819 | 53563 | 53484 | 53855 | 54129 | 54526 | 53896 | Success |

22/01/2026 FTSE Closed at 10150 points. Change of 0.12%. Total value traded through LSE was: £ 7,429,608,745 a change of -10.7%

21/01/2026 FTSE Closed at 10138 points. Change of 0.12%. Total value traded through LSE was: £ 8,319,716,543 a change of -14.69%

20/01/2026 FTSE Closed at 10126 points. Change of -0.68%. Total value traded through LSE was: £ 9,752,396,465 a change of 107.45%

19/01/2026 FTSE Closed at 10195 points. Change of -0.39%. Total value traded through LSE was: £ 4,701,087,965 a change of -48.92%

16/01/2026 FTSE Closed at 10235 points. Change of -0.03%. Total value traded through LSE was: £ 9,203,782,063 a change of 3.12%

15/01/2026 FTSE Closed at 10238 points. Change of 0.53%. Total value traded through LSE was: £ 8,925,069,676 a change of 39.46%

14/01/2026 FTSE Closed at 10184 points. Change of 0.46%. Total value traded through LSE was: £ 6,399,572,065 a change of -4.73%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AAL Anglo American** **LSE:BME B & M** **LSE:CNA Centrica** **LSE:FRES Fresnillo** **LSE:HSBA HSBC** **LSE:IGG IG Group** **LSE:LLOY Lloyds Grp.** **LSE:NG. National Glib** **LSE:ONT Oxford Nanopore Tech** **LSE:SRP Serco** **

********

Updated charts published on : Anglo American, B & M, Centrica, Fresnillo, HSBC, IG Group, Lloyds Grp., National Glib, Oxford Nanopore Tech, Serco,

LSE:AAL Anglo American Close Mid-Price: 3342 Percentage Change: -1.73% Day High: 3451 Day Low: 3298

All Anglo American needs are mid-price trades ABOVE 3451 to improve accel ……..

</p

View Previous Anglo American & Big Picture ***

LSE:BME B & M. Close Mid-Price: 174.1 Percentage Change: + 0.58% Day High: 178.4 Day Low: 164.35

Further movement against B & M ABOVE 178.4 should improve acceleration to ……..

</p

View Previous B & M & Big Picture ***

LSE:CNA Centrica Close Mid-Price: 181.65 Percentage Change: -0.95% Day High: 185.25 Day Low: 180.1

Target met. Further movement against Centrica ABOVE 186p should improve a ……..

</p

View Previous Centrica & Big Picture ***

LSE:FRES Fresnillo. Close Mid-Price: 4084 Percentage Change: + 0.84% Day High: 4092 Day Low: 3908

Continued trades against FRES with a mid-price ABOVE 4092 should improve ……..

</p

View Previous Fresnillo & Big Picture ***

LSE:HSBA HSBC. Close Mid-Price: 1244.2 Percentage Change: + 1.07% Day High: 1254 Day Low: 1239.2

Further movement against HSBC ABOVE 1254 should improve acceleration towa ……..

</p

View Previous HSBC & Big Picture ***

LSE:IGG IG Group. Close Mid-Price: 1356 Percentage Change: + 0.67% Day High: 1363 Day Low: 1347

Target met. Continued trades against IGG with a mid-price ABOVE 1363 shou ……..

</p

View Previous IG Group & Big Picture ***

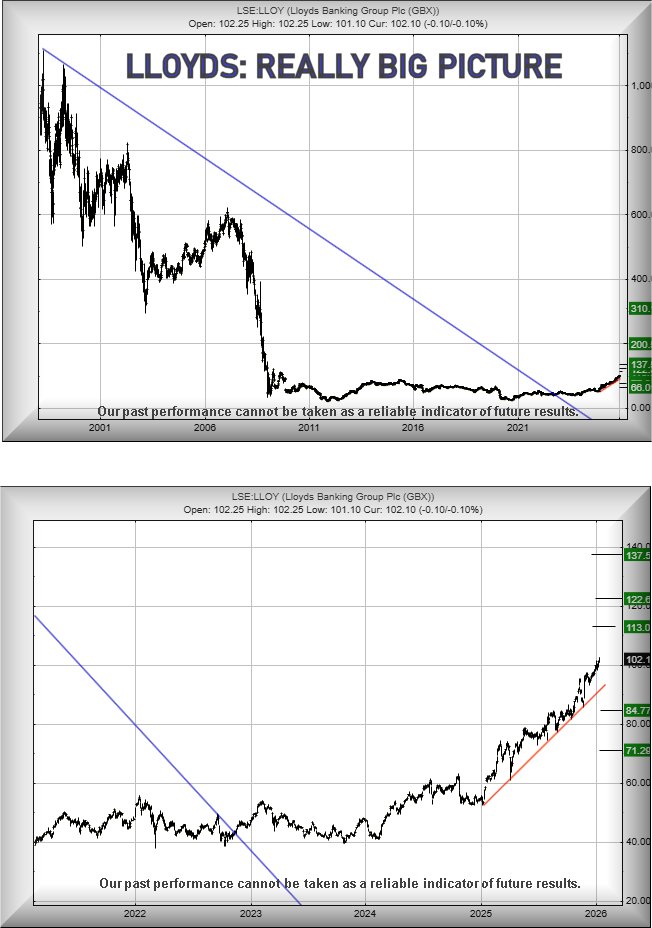

LSE:LLOY Lloyds Grp.. Close Mid-Price: 101.9 Percentage Change: + 0.49% Day High: 103.5 Day Low: 100.5

Continued trades against LLOY with a mid-price ABOVE 103.5 should improve ……..

</p

View Previous Lloyds Grp. & Big Picture ***

LSE:NG. National Glib Close Mid-Price: 1186.5 Percentage Change: -0.34% Day High: 1208 Day Low: 1182.5

Continued trades against NG. with a mid-price ABOVE 1208 should improve t ……..

</p

View Previous National Glib & Big Picture ***

LSE:ONT Oxford Nanopore Tech. Close Mid-Price: 172.9 Percentage Change: + 7.46% Day High: 174.5 Day Low: 160

Target met. Further movement against Oxford Nanopore Tech ABOVE 174.5 sho ……..

</p

View Previous Oxford Nanopore Tech & Big Picture ***

LSE:SRP Serco. Close Mid-Price: 304.4 Percentage Change: + 0.26% Day High: 310.8 Day Low: 303.6

Target met. All Serco needs are mid-price trades ABOVE 310.8 to improve a ……..

</p

View Previous Serco & Big Picture ***