#FTSE #Doomed

The final Friday of 2022, a year which shall not be missed. The Conservatives displayed why Scotland’s failed to vote for the party since 1955 (yes, really) with multiple leadership fumbles and the legal scent of wider corruption. Russia did Russian stuff and The FTSE did something truly unusual in the grand scheme of things. It didn’t collapse!

In fact, we need to visit Brazil to discover an index which has behaved quite as resiliently as the FTSE.

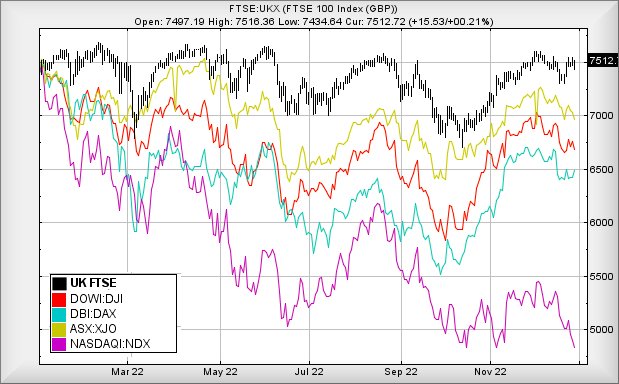

As the chart below highlights, the FTSE achieved levels of stability missing from popular indices elsewhere with only Australia (yellow) coming close to matching the UK’s stubborn refusal to diminish, remaining around the level it started the year at.

Rather worrying, glancing at the Nasdaq (magenta) tends suggest the US markets face a bit of a thrashing in 2023 but perhaps it should be remembered the Nasdaq also outperformed everything else in the pandemic recovery phase, therefore finding itself best placed to suffer extreme levels of reversal. In plain English, a bottom is expected around 9250 points, giving the Nasdaq a further 1,700 points of pain from the current 10,950 points.

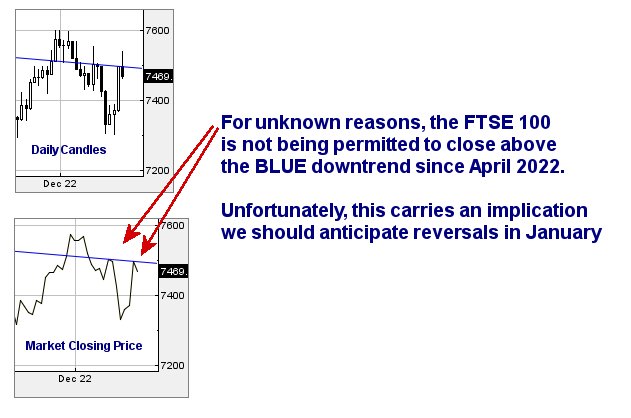

What we’re trying to say, the words literally catching in our throat, is ridiculous but if we apply our dodgy logic “if it ain’t goin’ down, it’s goin’ up”, the FTSE is best placed to outperform other markets by displaying surprise strength next year. Okay, maybe not next week, but visually, the UK index appears to be finishing 2022 in a fairly solid position with hope for the future. With 2022 being a year of so many false dawns, maybe this will finally be the FTSE’s turn. We’re not risking speculating who the next PM shall be, but notice the policeman on guard at the door of No 10 looks increasingly nervous, every time a camera rests on his face.

We shall return on Wednesday 4th January, thanks to Scottish statutory holidays. For now, our final FTSE for Friday ends the year with mild optimism. It was a year which started at 7384 points, meaning it’s not a big ask to expect the FTSE to close above such a level. Finishing Thursday at 7508 points added fuel to the bonfire of misguided loyalty against the UK’s leading index.

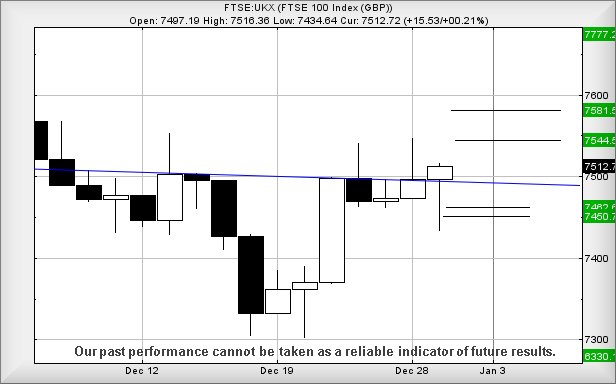

Above just 7517 points calculates with the potential of a lift to 7544 with secondary, if exceeded, working out at 7581 points. Visually, both targets make some sense but we’re inclined to caution around the 7544 level, given it matches a few recent highs. The very tightest stop loss level looks like 7490 points.

Our converse scenario questions what happens, should the FTSE wander below 7480 points? We’re looking for reversal to a tame 7462 with secondary, if broken, at 7450 points. Visually, we shall not be aghast if either target makes an appears and provokes a bounce. But then again, it’s only a half day, and very little activity is expected.

Finally, our thanks for the emails from around the world. It remains a surprise a few folk on Reunion Island in the Pacific visit every Friday, displaying similar loyalty to substantial numbers in Hong Kong & Beijing who choose to visit. Surprisingly, the city of Columbus, Ohio, somehow also generates an average of 16 visitors every Friday!

Here’s hoping for a great New Year. We all deserve it.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 11:02:34PM | BRENT | 83.76 | 82.4 | 82.15 | 81.61 | 83.23 | 84.1 | 84.78 | 85.8 | 83.28 | ‘cess |

| 11:04:35PM | GOLD | 1815.15 | 1804 | 1799 | 1792 | 1812 | 1820 | 1823 | 1826 | 1812 | ‘cess |

| 11:06:48PM | FTSE | 7508 | 7475 | 7467 | 7448 | 7499 | 7525 | 7537 | 7552 | 7495 | Shambles |

| 11:08:54PM | STOX50 | 3846 | 3812 | 3799 | 3780 | 3831 | 3856 | 3869 | 3896 | 3827 | |

| 11:11:00PM | GERMANY | 14044 | 13940 | 13912 | 13854 | 14026 | 14084 | 14100 | 14180 | 14000 | ‘cess |

| 11:13:28PM | US500 | 3843.62 | 3807 | 3802 | 3786 | 3825 | 3857 | 3884 | 3919 | 3827 | |

| 11:17:23PM | DOW | 33183 | 32906 | 32863 | 32720 | 33107 | 33292 | 33309 | 33470 | 33138 | |

| 11:19:12PM | NASDAQ | 10940 | 10740 | 10690 | 10593 | 10812 | 10982 | 11014 | 11122 | 10914 | |

| 11:21:18PM | JAPAN | 26263 | 26230 | 26215 | 26171 | 26311 | 26347 | 26389 | 26550 | 26227 |

29/12/2022 FTSE Closed at 7512 points. Change of 0.2%. Total value traded through LSE was: £ 2,614,666,454 a change of -34.95%

28/12/2022 FTSE Closed at 7497 points. Change of 0.32%. Total value traded through LSE was: £ 4,019,239,763 a change of 100.17%

23/12/2022 FTSE Closed at 7473 points. Change of 0.05%. Total value traded through LSE was: £ 2,007,879,926 a change of -54.01%

22/12/2022 FTSE Closed at 7469 points. Change of -0.37%. Total value traded through LSE was: £ 4,366,369,327 a change of -6.1%

21/12/2022 FTSE Closed at 7497 points. Change of 1.72%. Total value traded through LSE was: £ 4,650,253,463 a change of -20.61%

20/12/2022 FTSE Closed at 7370 points. Change of -100%. Total value traded through LSE was: £ 5,857,237,056 a change of 0%

19/12/2022 FTSE Closed at 7361 points. Change of 0%. Total value traded through LSE was: £ 3,719,802,637 a change of 0%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:AGM Applied Graphene** **LSE:CBX Cellular Goods** **LSE:CCL Carnival** **LSE:DARK Darktrace Plc** **LSE:EZJ EasyJet** **LSE:HIK Hikma** **LSE:OXIG Oxford Instruments** **LSE:RKH Rockhopper** **LSE:SMT Scottish Mortgage Investment Trust** **

********

Updated charts published on : Applied Graphene, Cellular Goods, Carnival, Darktrace Plc, EasyJet, Hikma, Oxford Instruments, Rockhopper, Scottish Mortgage Investment Trust,

LSE:AGM Applied Graphene. Close Mid-Price: 7.25 Percentage Change: + 34.26% Day High: 7.65 Day Low: 5.4

Further movement against Applied Graphene ABOVE 7.65 should improve accel ……..

</p

View Previous Applied Graphene & Big Picture ***

LSE:CBX Cellular Goods Close Mid-Price: 0.62 Percentage Change: -1.60% Day High: 0.65 Day Low: 0.52

Weakness on Cellular Goods below 0.52 will invariably lead to 0.44 with s ……..

</p

View Previous Cellular Goods & Big Picture ***

LSE:CCL Carnival. Close Mid-Price: 585.6 Percentage Change: + 3.43% Day High: 583.2 Day Low: 555

Continued weakness against CCL taking the price below 555 calculates as l ……..

</p

View Previous Carnival & Big Picture ***

LSE:DARK Darktrace Plc. Close Mid-Price: 263.7 Percentage Change: + 3.09% Day High: 266.1 Day Low: 254.3

If Darktrace Plc experiences continued weakness below 254.3, it will inva ……..

</p

View Previous Darktrace Plc & Big Picture ***

LSE:EZJ EasyJet Close Mid-Price: 332.3 Percentage Change: -0.15% Day High: 330.3 Day Low: 321

Target met. Weakness on EasyJet below 321 will invariably lead to 296 wit ……..

</p

View Previous EasyJet & Big Picture ***

LSE:HIK Hikma. Close Mid-Price: 1575 Percentage Change: + 0.96% Day High: 1584.5 Day Low: 1556

All Hikma needs are mid-price trades ABOVE 1584.5 to improve acceleration ……..

</p

View Previous Hikma & Big Picture ***

LSE:OXIG Oxford Instruments. Close Mid-Price: 2215 Percentage Change: + 1.14% Day High: 2280 Day Low: 2155

Continued trades against OXIG with a mid-price ABOVE 2280 should improve ……..

</p

View Previous Oxford Instruments & Big Picture ***

LSE:RKH Rockhopper Close Mid-Price: 8.82 Percentage Change: -1.45% Day High: 8.9 Day Low: 8.62

If Rockhopper experiences continued weakness below 8.62, it will invariab ……..

</p

View Previous Rockhopper & Big Picture ***

LSE:SMT Scottish Mortgage Investment Trust. Close Mid-Price: 715.8 Percentage Change: + 3.74% Day High: 715.4 Day Low: 691.8

Weakness on Scottish Mortgage Investment Trust below 691.8 will invariabl ……..

</p

View Previous Scottish Mortgage Investment Trust & Big Picture ***