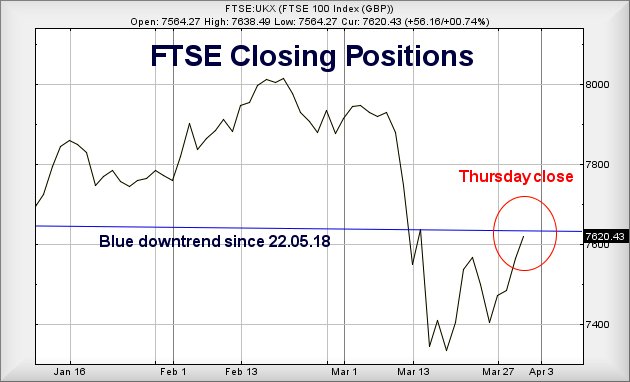

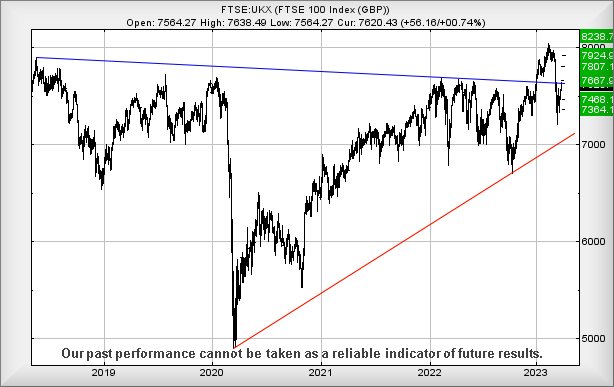

#FTSE #WallSt We’re probably spending far too long, glaring at a line on a chart in utter frustration. Once again, the culprit is the FTSE 100 downtrend since May 2018, along with the current demand the index CLOSE a session above Blue to suggest happy days are coming. On Thursday, this wretched trend line asked that the market close the day above just 7621.406 points.

The day closed at 7620.43 points, turning an optimists Thursday into a session of disappointment, making us wonder what awaits on Friday 31st March, last day of the month and quarter. From our usual perspective, we’d be quite happy to suspect Friday should experience some gains, the market clearly closing in a “higher high” position. But missing breaking above a 5 year trend by a single point bothers us quite a bit, the market doubtless having its own private reasons for believing this historical downtrend is important.

If we pretend the above chart doesn’t bother us, instead choosing to ooze confidence for the coming day, the immediate situation suggests above Thursdays high of 7638 points should trigger a fairly unimpressive movement to 7667 points next. If exceeded, our secondary is a bit more cheerful, lying in wait at 7807 points. Unfortunately, historically the end of a quarter generally provides sufficient excuse for a bunch of short term sell-offs, provoking a pretty foul day which will doubtless become a distant memory within the next few sessions. Once all these things are married together, we lack confidence for Friday. The tightest stop loss position is around 7607 points, fairly reasonable when considering the level of risk/reward in this scenario.

Of course, perhaps we’re being grumpy due to grand-daughters visiting for the whole week from this Sunday.

From an immediate perspective for the FTSE, below 7574 points is liable to prove worrisome, calculating with the risk of reversal to an initial 7468 points with our secondary, if broken, working out at a silly looking 7364 points. The absolutely crazy this about this negative perspective is the position of a potential stop loss level at 7584 points, an almost free gift in the risk/reward stakes.

In fact, as the market looks like it intends make it harder to experience gains, common sense suggests we should abandon our negative thoughts and expect happy days…

Finally, it’s the Australia Grand Prix, hopefully a race which shall be worth watching. Have a good weekend.

FUTURES

| Time Issued | Market | Price At Issue | Short Entry | Fast Exit | Slow Exit | Stop | Long Entry | Fast Exit | Slow Exit | Stop | Prior |

| 10:07:41PM | BRENT | 78.55 | 77 | 76.245 | 77.95 | 78.84 | 79.01 | 77.37 | |||

| 10:09:50PM | GOLD | 1980.84 | 1963 | 1960 | 1975 | 1985 | 1990 | 1977 | Success | ||

| 10:13:48PM | FTSE | 7624.08 | 7554 | 7526 | 7580 | 7637 | 7673 | 7602 | Success | ||

| 10:16:21PM | STOX50 | 4291.2 | 4231 | 4211 | 4261 | 4295 | 4331 | 4265 | ‘cess | ||

| 10:33:15PM | GERMANY | 15544 | 15341 | 15292 | 15425 | 15563 | 15584 | 15492 | ‘cess | ||

| 10:35:47PM | US500 | 4054.62 | 4024 | 4018 | 4040 | 4062 | 4083 | 4034 | ‘cess | ||

| 10:41:41PM | DOW | 32870 | 32676 | 32643 | 32795 | 32937 | 32997 | 32810 | Success | ||

| 10:44:22PM | NASDAQ | 12970.47 | 12857 | 12828 | 12936 | 12988 | 13005 | 12900 | ‘cess | ||

| 10:47:12PM | JAPAN | 27938 | 27713 | 27638 | 27802 | 27975 | 27989 | 27849 |

30/03/2023 FTSE Closed at 7620 points. Change of 0.74%. Total value traded through LSE was: £ 4,859,647,247 a change of 17.38%

29/03/2023 FTSE Closed at 7564 points. Change of 1.07%. Total value traded through LSE was: £ 4,139,938,147 a change of -38.03%

28/03/2023 FTSE Closed at 7484 points. Change of 0.17%. Total value traded through LSE was: £ 6,680,856,903 a change of 37.06%

27/03/2023 FTSE Closed at 7471 points. Change of 0.89%. Total value traded through LSE was: £ 4,874,298,034 a change of -13.9%

24/03/2023 FTSE Closed at 7405 points. Change of -1.25%. Total value traded through LSE was: £ 5,661,322,709 a change of -17%

23/03/2023 FTSE Closed at 7499 points. Change of -0.89%. Total value traded through LSE was: £ 6,821,003,257 a change of 31.84%

22/03/2023 FTSE Closed at 7566 points. Change of 0.4%. Total value traded through LSE was: £ 5,173,752,790 a change of 1.87%

SUCCESS above means both FAST & SLOW targets were met. ‘CESS means just the FAST target met and probably the next time it is exceeded, movement to the SLOW target shall commence.

Our commentary is in two sections. Immediately below are today’s updated comments. If our commentary remains valid, the share can be found in the bottom section which has a RED heading. Hopefully, this will mean you no longer need to flip back through previous reports. HYPERLINKS DISABLED IN THIS VERSION

Please remember, all prices are mid-price (halfway between the Buy and Sell). When we refer to a price CLOSING above a specific level, we are viewing the point where we can regard a trend as changing. Otherwise, we are simply speculating on near term trading targets. Our website is www.trendsandtargets.com.

UPDATE. We often give an initial and a secondary price. If the initial is exceeded, we still expect it to fall back but the next time the initial is bettered, the price should continue to the secondary. The converse it true with price drops.

We can be contacted at info@trendsandtargets.com. Spam filters set to maximum so only legit emails get through…

Section One – Outlook Updated Today. Click here for Section Two – Outlook Remains Valid shares

Click Epic to jump to share: LSE:BBY BALFOUR BEATTY** **LSE:BLOE Block Energy PLC** **LSE:BLVN Bowleven** **LSE:BP. BP PLC** **LSE:CASP Caspian** **LSE:IAG British Airways** **LSE:SBRY Sainsbury** **LSE:TERN Tern Plc** **LSE:TSCO Tesco** **

********

Updated charts published on : BALFOUR BEATTY, Block Energy PLC, Bowleven, BP PLC, Caspian, British Airways, Sainsbury, Tern Plc, Tesco,

LSE:BBY BALFOUR BEATTY. Close Mid-Price: 377.2 Percentage Change: + 1.02% Day High: 380 Day Low: 374.4

In the event of BALFOUR BEATTY enjoying further trades beyond 380, the sh ……..

</p

View Previous BALFOUR BEATTY & Big Picture ***

LSE:BLOE Block Energy PLC Close Mid-Price: 0.92 Percentage Change: -2.63% Day High: 1 Day Low: 0.92

In the event Block Energy PLC experiences weakness below 0.92 it calculat ……..

</p

View Previous Block Energy PLC & Big Picture ***

LSE:BLVN Bowleven. Close Mid-Price: 1.3 Percentage Change: + 4.00% Day High: 1.3 Day Low: 0.85

Target met. In the event Bowleven experiences weakness below 0.85 it calc ……..

</p

View Previous Bowleven & Big Picture ***

LSE:BP. BP PLC. Close Mid-Price: 513.2 Percentage Change: + 0.53% Day High: 518.1 Day Low: 506.8

All BP PLC needs are mid-price trades ABOVE 518.1 to improve acceleration ……..

</p

View Previous BP PLC & Big Picture ***

LSE:CASP Caspian Close Mid-Price: 5.85 Percentage Change: -4.88% Day High: 6.15 Day Low: 5.65

If Caspian experiences continued weakness below 5.65, it will invariably ……..

</p

View Previous Caspian & Big Picture ***

LSE:IAG British Airways. Close Mid-Price: 148.6 Percentage Change: + 3.86% Day High: 149.26 Day Low: 144.72

In the event of British Airways enjoying further trades beyond 149.26, t ……..

</p

View Previous British Airways & Big Picture ***

LSE:SBRY Sainsbury. Close Mid-Price: 275.7 Percentage Change: + 2.95% Day High: 277.1 Day Low: 268.2

All Sainsbury needs are mid-price trades ABOVE 277.1 to improve accelerat ……..

</p

View Previous Sainsbury & Big Picture ***

LSE:TERN Tern Plc Close Mid-Price: 6.25 Percentage Change: -10.71% Day High: 7 Day Low: 6

Weakness on Tern Plc below 6 will invariably lead to 5.3 with secondary ( ……..

</p

View Previous Tern Plc & Big Picture ***

LSE:TSCO Tesco. Close Mid-Price: 264.9 Percentage Change: + 0.91% Day High: 265.2 Day Low: 260.6

Further movement against Tesco ABOVE 265.2 should improve acceleration to ……..

</p

View Previous Tesco & Big Picture ***